The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Andean Precious Metals Corp. (CVE:APM) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Andean Precious Metals

What Is Andean Precious Metals's Debt?

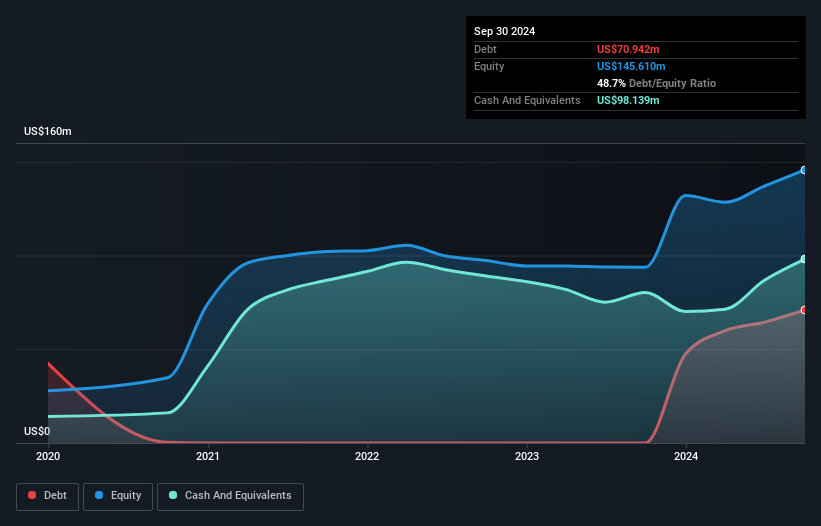

As you can see below, at the end of September 2024, Andean Precious Metals had US$70.9m of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has US$98.1m in cash, leading to a US$27.2m net cash position.

How Strong Is Andean Precious Metals' Balance Sheet?

The latest balance sheet data shows that Andean Precious Metals had liabilities of US$58.3m due within a year, and liabilities of US$113.7m falling due after that. Offsetting this, it had US$98.1m in cash and US$5.65m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$68.2m.

Andean Precious Metals has a market capitalization of US$143.3m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Andean Precious Metals also has more cash than debt, so we're pretty confident it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, Andean Precious Metals turned things around in the last 12 months, delivering and EBIT of US$31m. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Andean Precious Metals's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Andean Precious Metals has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent year, Andean Precious Metals recorded free cash flow worth 59% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

Although Andean Precious Metals's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$27.2m. So we are not troubled with Andean Precious Metals's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Andean Precious Metals has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:APM

Andean Precious Metals

Engages in the acquisition, exploration, development, and processing of mineral resource properties in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives