- Canada

- /

- Paper and Forestry Products

- /

- TSX:WFG

How Investors May Respond To West Fraser Timber (TSX:WFG) CFO's Significant Insider Share Purchase

Reviewed by Sasha Jovanovic

- On November 20th, 2025, West Fraser Timber's CFO Christopher Virostek purchased 1,250 common shares, increasing his direct holdings by 24.3%.

- This insider buying reflects a strong personal commitment by a top executive, which many investors interpret as a signal of confidence in the company's future.

- We'll examine how the CFO's recent insider share purchase may influence the overall investment narrative for West Fraser Timber.

Find companies with promising cash flow potential yet trading below their fair value.

West Fraser Timber Investment Narrative Recap

Shareholders in West Fraser Timber are generally betting on a rebound in global demand for wood products, as well as the company’s focus on sustainable building materials and improved capital efficiency. The CFO’s recent insider share purchase may be viewed as a show of confidence, but it does not meaningfully alter the immediate picture, persistent weak North American lumber pricing and supply chain pressures remain the dominant short-term catalyst and risk, respectively.

The announced permanent closure of the Augusta and 100 Mile House mills earlier this month is particularly relevant, as it underscores ongoing timber supply challenges and efforts to optimize mill utilization. These operational adjustments reflect management’s response to cost pressures, but near-term earnings visibility remains sensitive to shifts in demand and input costs.

However, investors should also be aware that ongoing trade uncertainties continue to present a risk that could...

Read the full narrative on West Fraser Timber (it's free!)

West Fraser Timber's outlook anticipates $6.7 billion in revenue and $653.7 million in earnings by 2028. This is based on a 4.9% annual revenue growth rate and an $779.7 million increase in earnings from the current -$126.0 million.

Uncover how West Fraser Timber's forecasts yield a CA$113.12 fair value, a 35% upside to its current price.

Exploring Other Perspectives

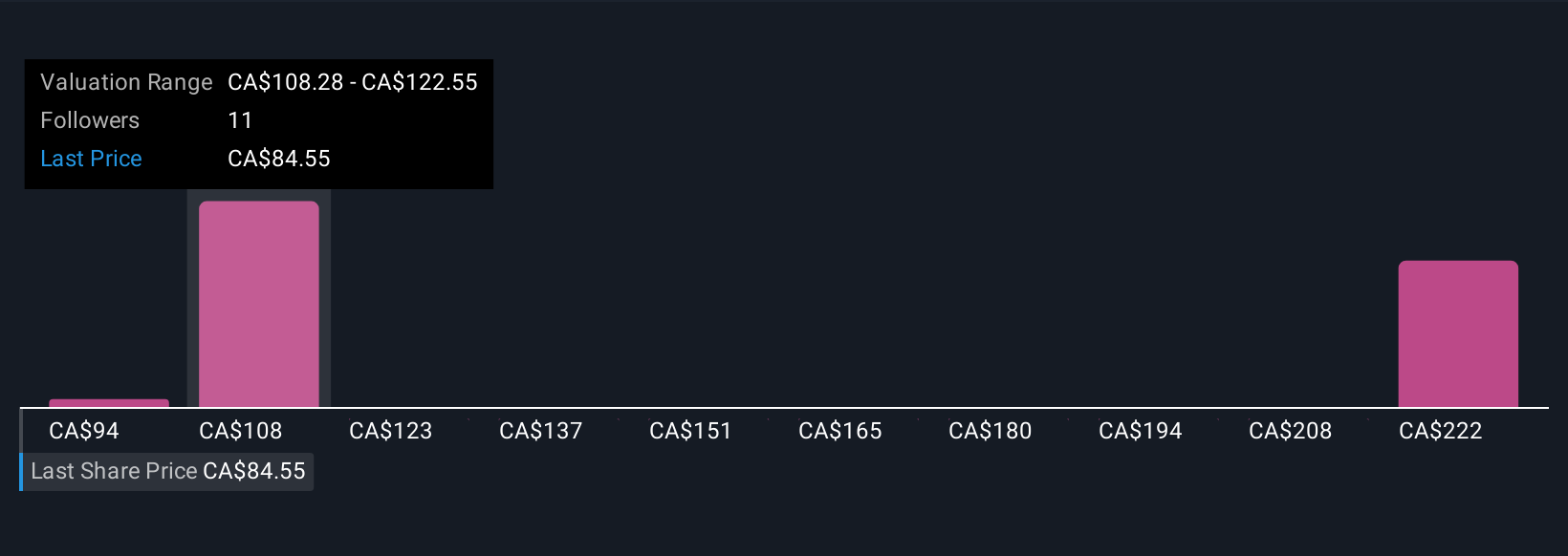

Community opinions on West Fraser Timber’s fair value range widely, from CA$94 to CA$236.94 across four analyses on Simply Wall St. While optimism surrounds long-term demand for renewable wood products, persistent margin pressure due to weak lumber pricing remains a key concern for many.

Explore 4 other fair value estimates on West Fraser Timber - why the stock might be worth just CA$94.00!

Build Your Own West Fraser Timber Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Fraser Timber research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free West Fraser Timber research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Fraser Timber's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Fraser Timber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WFG

West Fraser Timber

A diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives