- Canada

- /

- Metals and Mining

- /

- TSX:VZLA

Is Vizsla Silver Still a Bargain After 156% Rally and Exploration Progress in 2025?

Reviewed by Bailey Pemberton

- Curious whether Vizsla Silver is a bargain or already priced for perfection? You are not alone, as many investors are watching this stock for its valuation story.

- While Vizsla Silver’s 1-week and 1-month returns show slight dips at -1.1% and -0.2%, the stock is up a staggering 156.6% year-to-date and has climbed 153.7% over the past year.

- Momentum has been building around Vizsla Silver, with recent headlines highlighting positive exploration results and progress at key mining projects. These developments have fueled optimism about future production growth and put the company more firmly on investors’ radar.

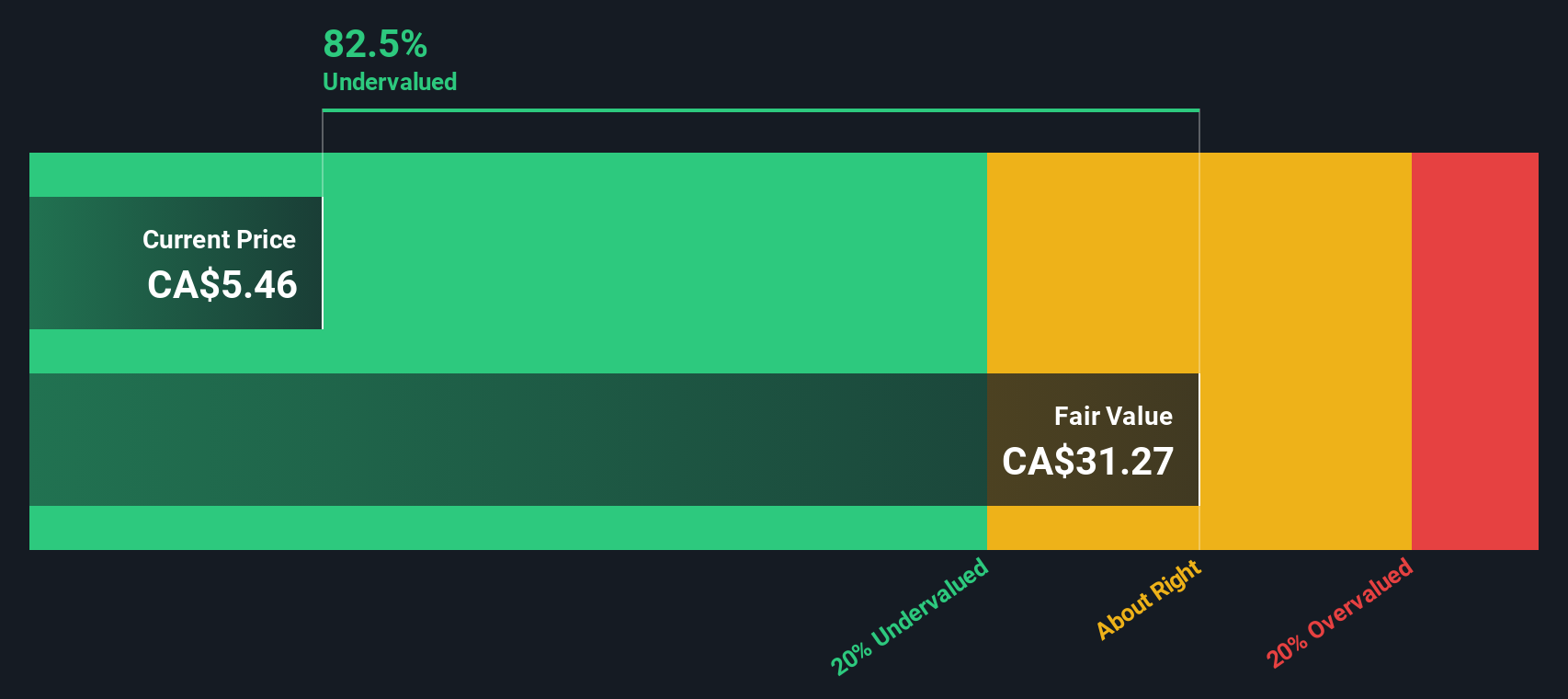

- Our latest valuation checks show Vizsla Silver scores a 4 out of 6. This suggests there may still be value here. We will break down the details of each approach next and reveal a smarter way to size up the stock’s true worth by the end of this article.

Approach 1: Vizsla Silver Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today to reflect the risk and time value of money. For Vizsla Silver, this involves forecasting how much cash the business can generate over several years and then translating that into a present value in CA$.

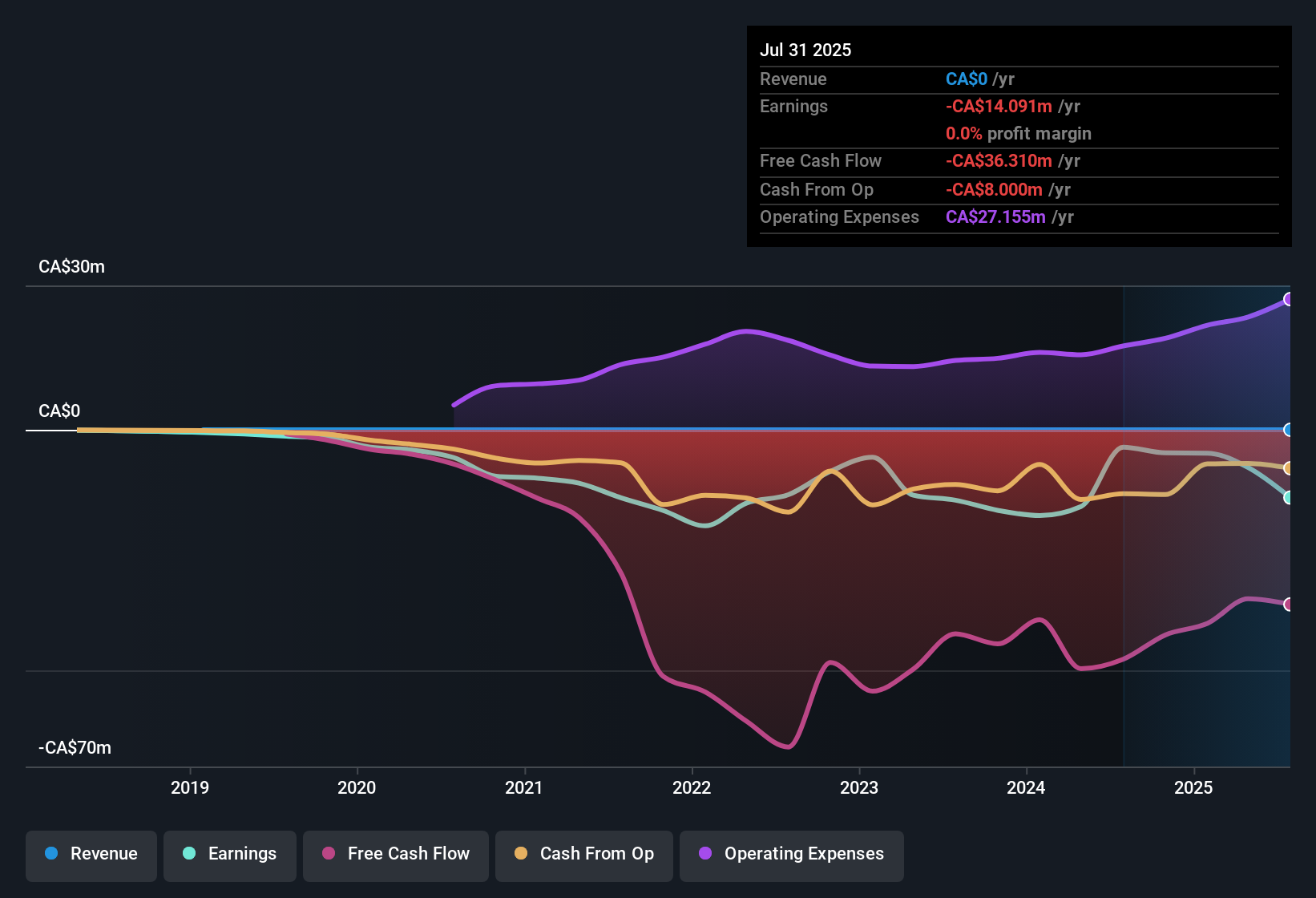

Currently, Vizsla Silver’s Free Cash Flow (FCF) stands at a negative CA$36.3 Million. Analyst projections suggest a turnaround is expected, with FCF moving into positive territory as soon as 2027, where estimates indicate CA$142.8 Million. By 2030, projections reach CA$620 Million in FCF. It is important to note that forecasts beyond five years are extrapolated rather than analyst-driven.

Based on the two-stage DCF analysis, Vizsla Silver's intrinsic value is calculated at CA$25.68 per share. Comparing this figure to the current market price suggests the stock is 74.4% undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vizsla Silver is undervalued by 74.4%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Vizsla Silver Price vs Book

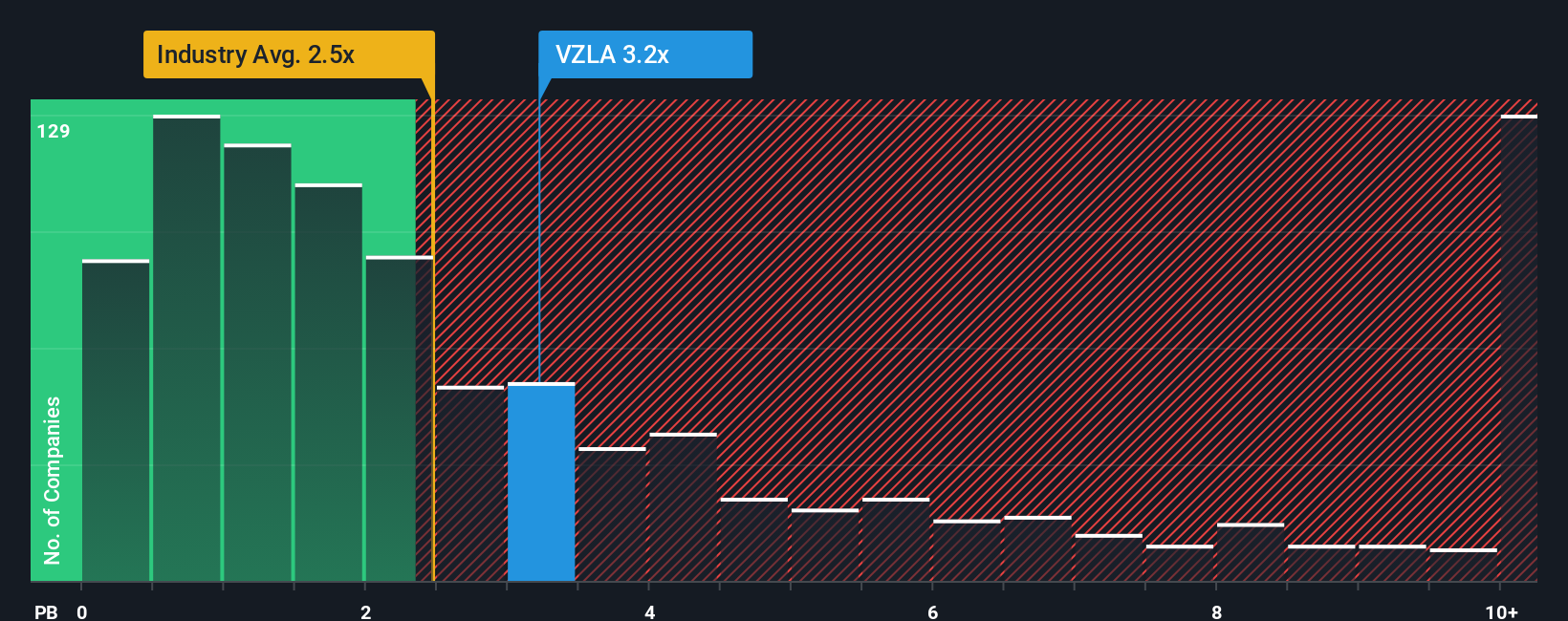

The Price-to-Book (P/B) ratio is a valuable valuation tool, especially for companies in asset-heavy industries like metals and mining. Since profits can fluctuate significantly for mining stocks as projects develop, book value provides a more stable anchor for comparison. The P/B ratio tells investors how much they are paying for a company’s net assets, making it practical for firms with inconsistent or negative earnings.

Expectations of future growth and the perceived risks facing a business influence what market participants consider a “normal” or “fair” P/B ratio. Higher growth prospects or strong asset quality may justify a richer multiple, while higher risks or declining asset values could put pressure on the valuation.

Vizsla Silver currently trades at a P/B ratio of 3.76x. This sits below its peer average of 4.77x, yet notably above the metals and mining industry average of 2.56x. Traditionally, investors might benchmark the company directly against these figures; however, this overlooks important nuances in its growth outlook, risk profile, and profitability.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary measure that tailors the ideal multiple for Vizsla Silver by factoring in its future earnings growth, industry dynamics, profit margins, company size, and risk factors. Unlike a straight peer or sector comparison, the Fair Ratio offers a more holistic and company-specific view of intrinsic value.

With all elements considered, Vizsla Silver’s actual P/B ratio of 3.76x is about in line with the Fair Ratio calculated for the company. This suggests that, using this approach, the stock price closely reflects its asset-based worth as determined by fundamentals and outlook.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vizsla Silver Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, intuitive approach where you create a story for Vizsla Silver by outlining your assumptions for its future revenue growth, earnings, and margins, and then see how these expectations translate into a fair value for the company. This connects your perspective on the business to actual forecasts, linking the company's story to its financial future and the price you believe it is worth.

Available directly on Simply Wall St’s Community page, Narratives are used by millions of investors as an easy tool to inform buy or sell decisions by comparing the calculated Fair Value to the current market Price. What sets Narratives apart is their dynamic nature. Every time fresh news or earnings are released, all Narratives update so you always have the most current insights. For example, when looking at Vizsla Silver, one investor might see a Fair Value of CA$35 per share based on a bullish production outlook, while another might land at CA$15 per share based on more conservative forecasts. Narratives let you explore these perspectives in context, making it easier to make confident and timely investment decisions.

Do you think there's more to the story for Vizsla Silver? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VZLA

Vizsla Silver

Engages in the acquisition, exploration, and development of mineral resource properties in Canada and Mexico.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives