A Fresh Look at 5N Plus (TSX:VNP) Valuation Following Planned CEO Succession Announcement

Reviewed by Simply Wall St

5N Plus (TSX:VNP) announced a planned CEO succession, with current CFO Richard Perron set to take over as President this November and as CEO by next May. The leadership change is drawing fresh investor attention and questions about the future strategic path.

See our latest analysis for 5N Plus.

Shares of 5N Plus have caught fire lately, with a 1-month share price return of 20.6% and a remarkable 153% gain year-to-date. That momentum reflects not just optimism around the upcoming CEO transition, but also a market reassessment of 5N Plus's long-term growth prospects. This is evident in the outstanding 1-year total shareholder return of 183% and a staggering 729% over three years. Investors seem convinced management changes and solid execution may keep propelling the story forward.

If this turnaround has you curious about what else is attracting attention, now is the perfect chance to discover fast growing stocks with high insider ownership

But with shares rallying hard and optimism running high, the key question is whether the current price still offers value. Alternatively, the recent run may mean the market has already factored in all the good news and future growth.

Most Popular Narrative: 6.6% Undervalued

5N Plus’s most followed narrative sees a fair value estimate of CA$21.47, signaling a modest upside from the recent closing price of CA$20.06. With valuation climbing slightly ahead of the latest share surge, the current market seems to be weighing the extent of future earnings strength.

The expansion of the long-term supply agreement with First Solar positions 5N Plus as a critical U.S.-based supplier to the leading American solar panel manufacturer. This aligns with accelerating clean energy adoption and North American supply chain security. The agreement is set to drive sustained and step-wise increases in semiconductor compound volumes (33% in 2025-26, with another 25% lift in 2027-28) and support multi-year revenue and earnings growth, with minimal additional capital investment required.

Want to know the driver behind that price target? The narrative banks on lasting demand from a huge U.S. customer, plus expansion into new tech and margin gains. Curious which future assumptions really push the fair value higher? Discover the full growth blueprint behind this standout story.

Result: Fair Value of $21.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that regulatory headwinds or a sudden shift in solar technology adoption could challenge these upbeat forecasts for 5N Plus.

Find out about the key risks to this 5N Plus narrative.

Another View: What Do Market Multiples Say?

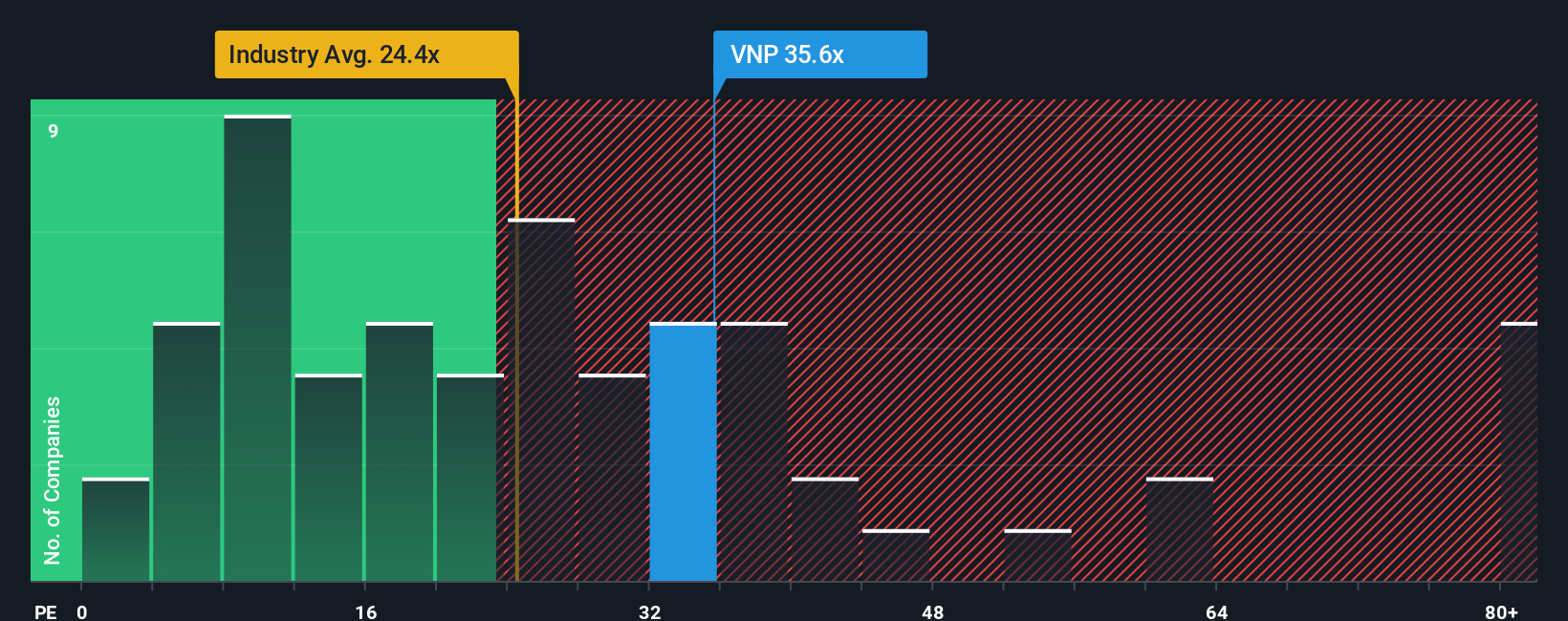

While the most-watched narrative points to 5N Plus being undervalued, looking at its price-to-earnings ratio raises some caution. The current ratio of 39.6 is well above industry peers at 23.4, and nearly double the fair ratio of 19.9. This sizable premium suggests the market is already pricing in a lot of future growth, leaving less room for error if performance falters. Are investors risking too much optimism here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 5N Plus Narrative

If you have a different take or want to dig into the numbers on your own terms, you can shape your personal 5N Plus story in just minutes. Do it your way.

A great starting point for your 5N Plus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t get left behind. Level up your research today by tapping into new trends and return opportunities using the Simply Wall Street Screener. Here’s where to start:

- Uncover potential growth stories before the crowd by starting with these 3580 penny stocks with strong financials that combine strong fundamentals with attractive valuations.

- Jump on the AI revolution and uncover tomorrow’s market leaders with these 26 AI penny stocks that are fueling breakthroughs in automation and machine learning.

- Secure dependable income for your portfolio by checking out these 22 dividend stocks with yields > 3% boasting yields over 3% and robust dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty semiconductors and performance materials in the Americas, Europe, Asia, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives