- Canada

- /

- Metals and Mining

- /

- TSX:USA

A Look at Americas Gold and Silver (TSX:USA) Valuation Following Surge in Silver and Antimony Production

Reviewed by Simply Wall St

Americas Gold and Silver (TSX:USA) has announced a surge in silver production, up 98% year-over-year, driven by operational efficiencies and higher ore grades at key sites. The company also emphasized unique progress in antimony output after acquiring full ownership of the Galena Complex.

See our latest analysis for Americas Gold and Silver.

This burst in production has helped fuel remarkable market momentum, with Americas Gold and Silver delivering a 277% year-to-date share price return and an impressive 261% total shareholder return over the past year. While shares have seen some short-term volatility, the strategic push into antimony and full control of the Galena Complex have shifted risk perceptions and added to the sense that long-term prospects are strengthening.

If strong metals output and turnaround stories interest you, it is a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

This rapid turnaround and powerful rally now raise a key question for investors: Is Americas Gold and Silver still undervalued at current levels, or has the market already priced in its future growth story?

Most Popular Narrative: 57% Undervalued

According to Agricola, the narrative suggests Americas Gold and Silver’s fair value is dramatically higher than its latest close of CA$5.28. This sets up a bold case that future cash flows and metals prices could drive the stock far above current levels.

“Total Annual Revenue: ~$793 million by 2027. Operating cash flow: $557.5 million/year by 2027. Free Cash Flow (FCF): ~$530.5 million/year by 2027.”

Curious what math powers this valuation? The narrative hinges on surging revenue, robust free cash flow, and ambitious production targets. But what’s fueling these aggressive projections? Uncover the drivers behind this remarkable price thesis by diving into the full analysis.

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ambitious forecasts rely on high metal prices and flawless execution. Setbacks in ramping up new production could quickly shift investor sentiment.

Find out about the key risks to this Americas Gold and Silver narrative.

Another View: What Do Market Ratios Say?

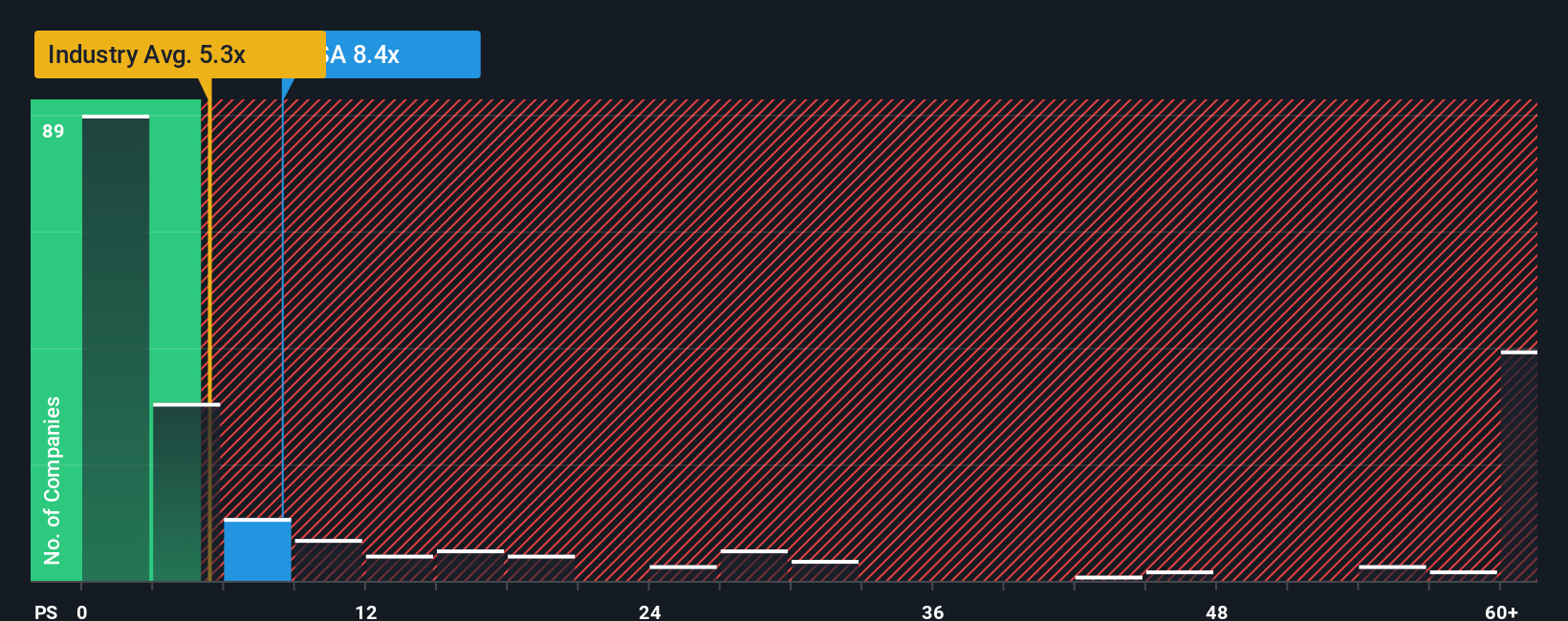

Looking at the company through the lens of the price-to-sales ratio paints a more cautious picture. Americas Gold and Silver trades at 10.5 times sales, which is higher than the Canadian Metals and Mining average of 5.5 and well above its fair ratio of 1.7. That sizable gap suggests the stock carries premium expectations and less room for error than raw growth forecasts imply.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you see the numbers differently or want to test your own assumptions, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Americas Gold and Silver research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Opportunities are not waiting around. Make your next move and expand your investing edge with handpicked stock ideas designed for different strategies and market trends.

- Supercharge your portfolio returns by checking out these 848 undervalued stocks based on cash flows, thriving on undervalued cash flows and compelling fundamentals.

- Optimize for passive income by scoping out these 20 dividend stocks with yields > 3% with attractive yields above 3% and stable financial profiles.

- Get ahead of the next digital breakthrough by reviewing these 26 AI penny stocks, led by innovators at the intersection of artificial intelligence and business transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

Exceptional growth potential and good value.

Market Insights

Community Narratives