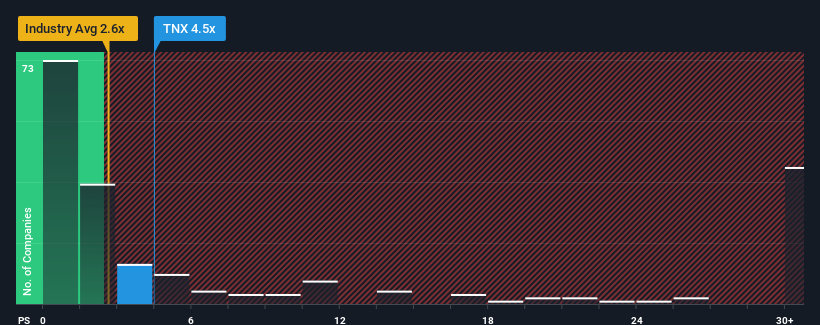

When you see that almost half of the companies in the Metals and Mining industry in Canada have price-to-sales ratios (or "P/S") below 2.6x, TRX Gold Corporation (TSE:TNX) looks to be giving off some sell signals with its 4.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for TRX Gold

How Has TRX Gold Performed Recently?

TRX Gold certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think TRX Gold's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, TRX Gold would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 78% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 21%, which is noticeably less attractive.

With this in mind, it's not hard to understand why TRX Gold's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that TRX Gold maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Metals and Mining industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 2 warning signs for TRX Gold (of which 1 is a bit concerning!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TRX Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TRX

TRX Gold

A junior gold mining company, engages in the exploration, development, and production of mineral property in Tanzania.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives