- Canada

- /

- Metals and Mining

- /

- TSX:TMQ

Trilogy Metals (TSX:TMQ) Jumps After US Government Invests in Alaska Critical Minerals Project

Reviewed by Sasha Jovanovic

- The White House announced that the U.S. Department of War will invest US$35.6 million to acquire a 10% stake in Trilogy Metals, along with warrants for an additional 7.5%, and will support the construction of the Ambler Road to Alaska's Ambler Mining District.

- This rare federal investment provides Trilogy Metals with a key government partnership and advances U.S. efforts to secure access to critical minerals domestically.

- We'll explore how this government backing and infrastructure approval shape Trilogy Metals' investment narrative, especially as the company focuses on U.S. mineral independence.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Trilogy Metals' Investment Narrative?

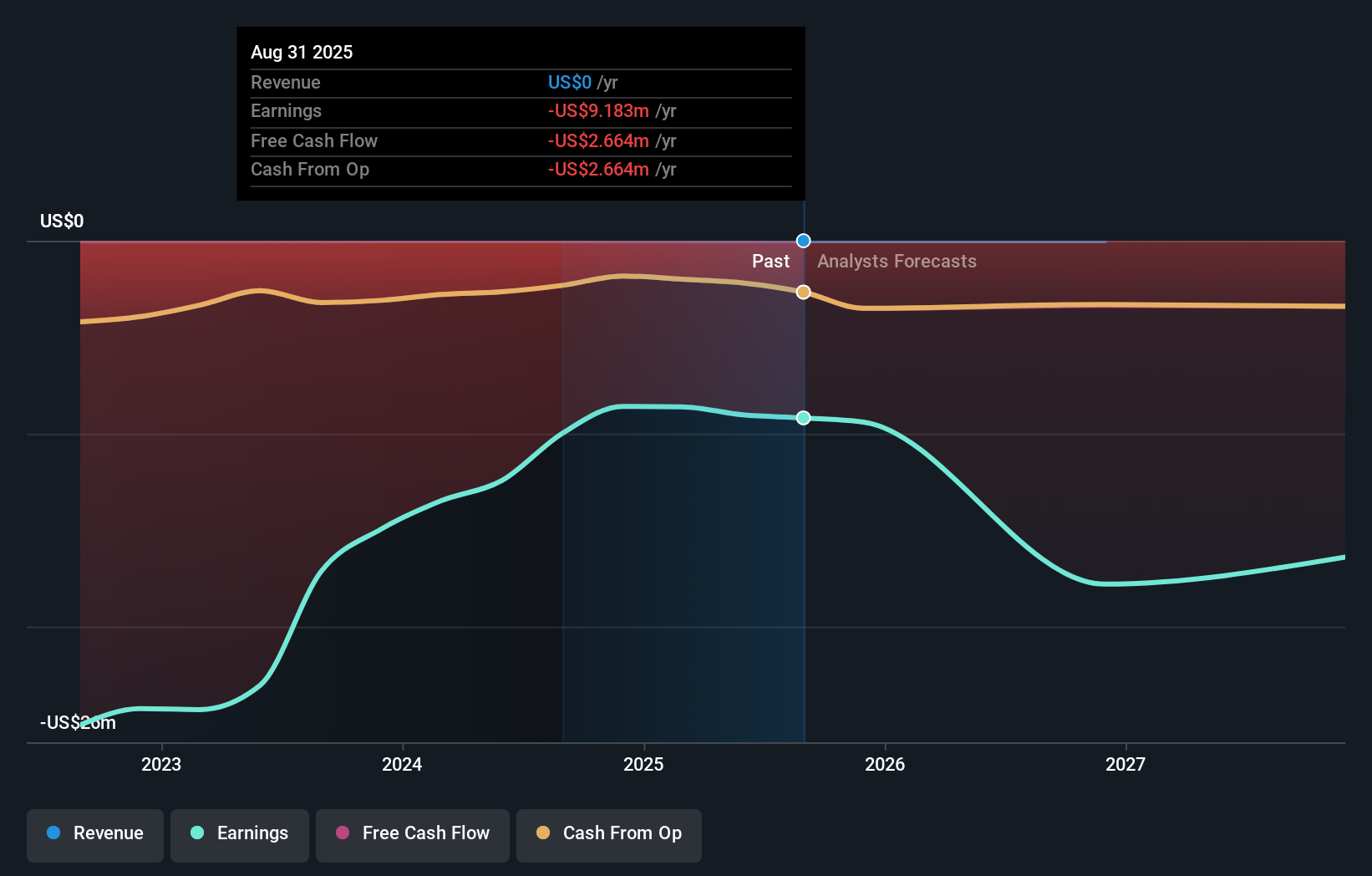

For anyone considering Trilogy Metals today, the big-picture thesis hinges on the company’s role in unlocking US copper and critical minerals supply from Alaska, an ambition that has so far been constrained by infrastructure and permitting challenges. The recent, rare direct investment from the US Department of War, coupled with executive support for the Ambler Road, shifts the risk-reward profile quite significantly. This partnership provides not just funding, but also a government stakeholder and potential expedited regulatory momentum, addressing what many saw as the biggest overhang for Trilogy: access and political support. Short-term catalysts now pivot from fundraising and permitting hurdles to tangible milestones around project execution, potential board changes, and securing full regulatory approval for the deal. Despite surging stock prices reflecting renewed optimism, the company remains pre-revenue and unprofitable, leaving operational execution and future financing as central risks. For shareholders, everything pivots on translating this government backing into progress, without it, the longer-term risks around funding and project delays persist.

But despite this influx of government capital, operational execution risk remains high for Trilogy Metals. The analysis detailed in our Trilogy Metals valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Trilogy Metals - why the stock might be worth as much as CA$6.36!

Build Your Own Trilogy Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trilogy Metals research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Trilogy Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trilogy Metals' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trilogy Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TMQ

Trilogy Metals

Engages in the exploration and development of mineral properties in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success