- Canada

- /

- Metals and Mining

- /

- TSX:TKO

Even though Taseko Mines (TSE:TKO) has lost CA$106m market cap in last 7 days, shareholders are still up 391% over 5 years

Taseko Mines Limited (TSE:TKO) shareholders might be concerned after seeing the share price drop 19% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. In that time, the share price has soared some 391% higher! So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

Although Taseko Mines has shed CA$106m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Taseko Mines

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

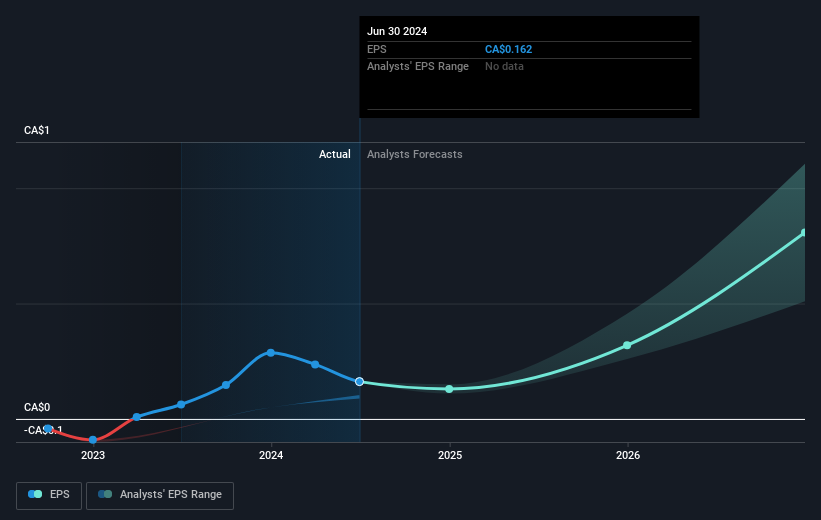

During the five years of share price growth, Taseko Mines moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the Taseko Mines share price has gained 12% in three years. Meanwhile, EPS is up 69% per year. This EPS growth is higher than the 4% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Taseko Mines' earnings, revenue and cash flow.

A Different Perspective

It's good to see that Taseko Mines has rewarded shareholders with a total shareholder return of 44% in the last twelve months. That gain is better than the annual TSR over five years, which is 37%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Taseko Mines (1 doesn't sit too well with us) that you should be aware of.

Taseko Mines is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Taseko Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TKO

Taseko Mines

A mining company, acquires, develops, and operates mineral properties.

Undervalued with high growth potential.