- Canada

- /

- Metals and Mining

- /

- TSX:TECK.B

Teck Resources (TSX:TECK.B): Revisiting Valuation After Copper Guidance Cut and Critical Minerals Pivot

Reviewed by Kshitija Bhandaru

Teck Resources (TSX:TECK.B) recently updated its outlook for the next several years, lowering annual copper production guidance after a downgrade at its Chilean copper operations. At the same time, the company has initiated negotiations with U.S. and Canadian governments about supplying critical minerals such as germanium, antimony, and gallium.

See our latest analysis for Teck Resources.

Despite the trimmed copper production outlook and Chilean headwinds, Teck Resources has stayed resilient. Its share price has climbed over 17% in the past 90 days. While the 1-year total shareholder return remains negative, strong long-term returns indicate that momentum is starting to build again as the company pivots toward critical minerals.

If Teck’s evolving strategy has you watching the broader market, now is a great moment to expand your search and discover fast growing stocks with high insider ownership

With revised guidance and a new focus on critical minerals, is Teck Resources trading at a discount as the market digests these changes? Or have investors already priced in the company’s growth plans and turnaround? Is this a buying opportunity, or has the market moved ahead of fundamentals?

Most Popular Narrative: 2% Overvalued

Teck Resources’ most widely followed valuation narrative sees fair value just slightly below the current market price. This suggests investors are weighing ambitious earnings and margin growth against merger volatility.

Teck is progressing lower-risk, high-return copper growth projects (Zafranal, San Nicolas) that are well-advanced in permitting and construction readiness. These offer near-term expansion opportunities in stable jurisdictions and position the company to capture outsized volume growth and improved net margins versus industry peers.

Want to know the financial engine behind this lofty price? The story hinges on robust revenue growth projections and a remarkable margin leap. What bold numbers push this narrative close to market highs? Click to uncover the full playbook and see the key figures analysts are betting on.

Result: Fair Value of $60.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent project delays or declines in copper prices could quickly dampen the outlook. This may put pressure on both earnings growth and investor sentiment in the near term.

Find out about the key risks to this Teck Resources narrative.

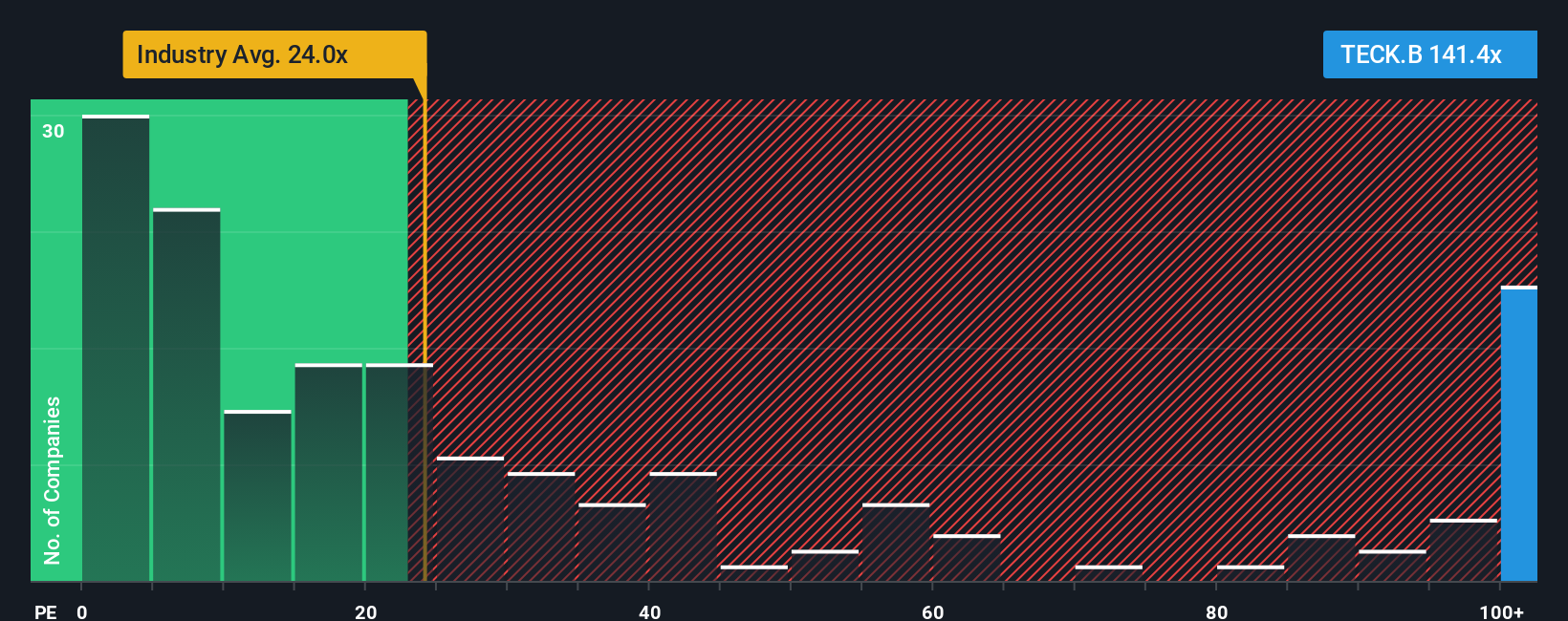

Another View: Multiples Suggest Elevated Valuation Risk

Looking at Teck Resources’ price-to-earnings ratio offers a sharp contrast. The company trades at 144.3x earnings, much higher than the Canadian Metals and Mining industry average of 23.7x and its fair ratio benchmark of 27.5x. This wide gap signals that if sentiment shifts, there could be a valuation reset. Are investors factoring in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Teck Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Teck Resources Narrative

If you see the story differently or want to dive deeper into the numbers, it's easy to craft your own take in minutes. Do it your way

A great starting point for your Teck Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead means not just watching Teck Resources, but actively searching for tomorrow’s winners. Use these powerful tools to find the stocks poised for real momentum.

- Turbocharge your portfolio with the top earners by checking out these 18 dividend stocks with yields > 3% for companies delivering robust income above the market average.

- Spot undervalued gems before the crowd by exploring these 874 undervalued stocks based on cash flows packed with stocks trading below intrinsic value based on strong cash flows.

- Capitalize on powerful trends in technology by targeting these 24 AI penny stocks where AI-driven pioneers are turning innovation into profit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teck Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TECK.B

Teck Resources

Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives