- Canada

- /

- Oil and Gas

- /

- TSX:BIR

Undiscovered Gems in Canada for November 2025

Reviewed by Simply Wall St

As the Canadian market continues to navigate near-record highs, investors are eyeing opportunities amid a backdrop of easing trade tensions and cautious monetary policies from major central banks. In this environment, discovering small-cap stocks with strong fundamentals and growth potential can provide valuable diversification and resilience against market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Total Energy Services | 17.20% | 20.44% | 57.34% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Senvest Capital | 63.10% | -24.28% | -25.94% | ★★★★★★ |

| Auxly Cannabis Group | 35.65% | 21.33% | 26.00% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of CA$1.79 billion.

Operations: The company's primary revenue stream comes from its oil and gas exploration and production segment, generating CA$648.22 million.

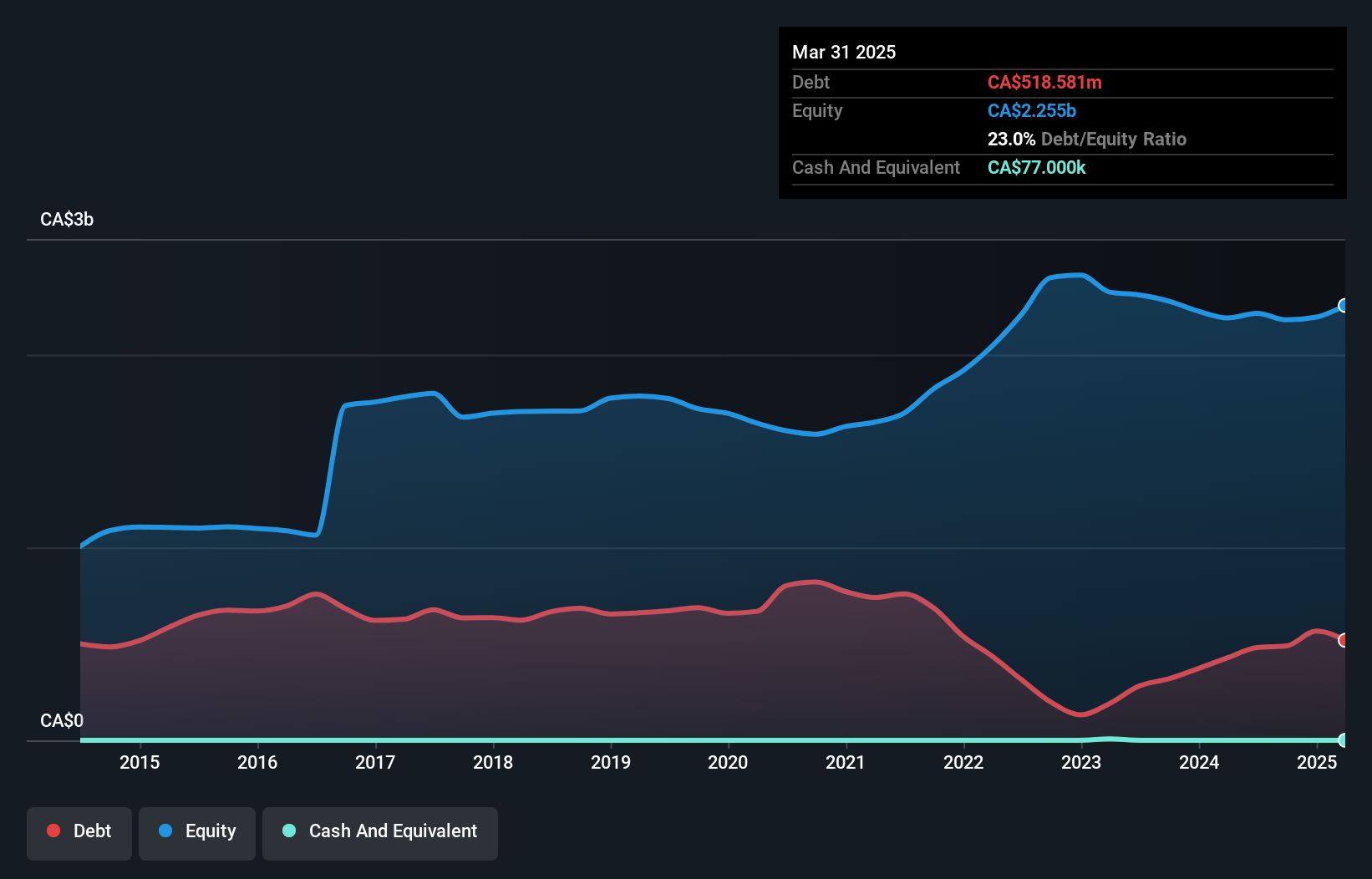

Birchcliff Energy, a nimble player in Canada's energy sector, showcases robust financial health with earnings growth of 87% over the past year, surpassing the industry average of 8%. Its net debt to equity ratio has impressively shrunk from 50% to a satisfactory 23.6% over five years. Despite recent quarterly revenue dipping to CAD 135 million from CAD 222 million year-on-year, Birchcliff remains profitable and free cash flow positive. The company recently announced a private placement raising CAD 860,000 and reaffirmed its production guidance for up to 79,000 boe/d for the year.

- Unlock comprehensive insights into our analysis of Birchcliff Energy stock in this health report.

Evaluate Birchcliff Energy's historical performance by accessing our past performance report.

Orezone Gold (TSX:ORE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orezone Gold Corporation focuses on the mining, exploration, and development of gold properties with a market capitalization of CA$837.04 million.

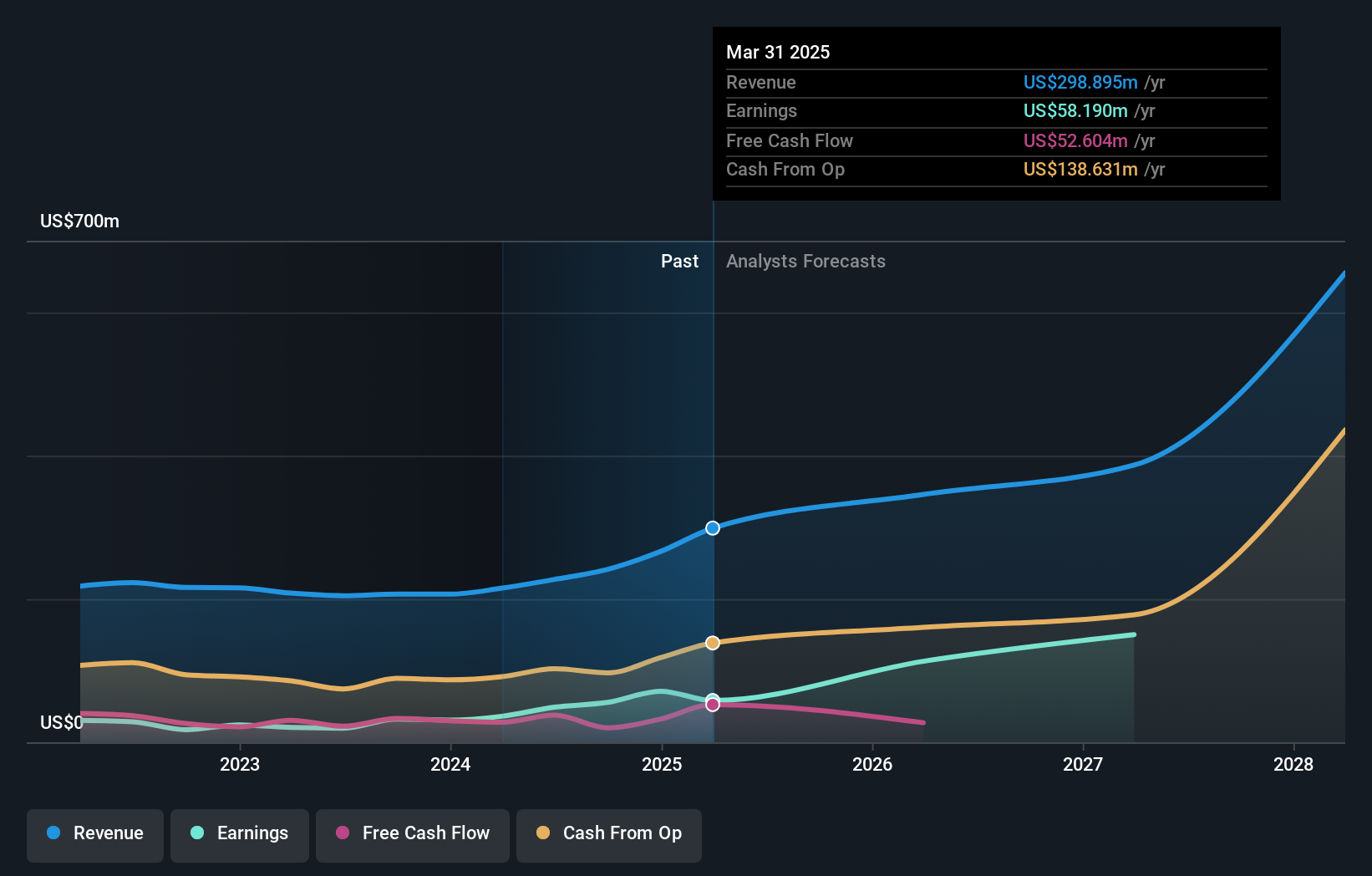

Operations: Orezone Gold generates revenue primarily from the acquisition, exploration, and potential development of precious metal properties, amounting to $337.72 million.

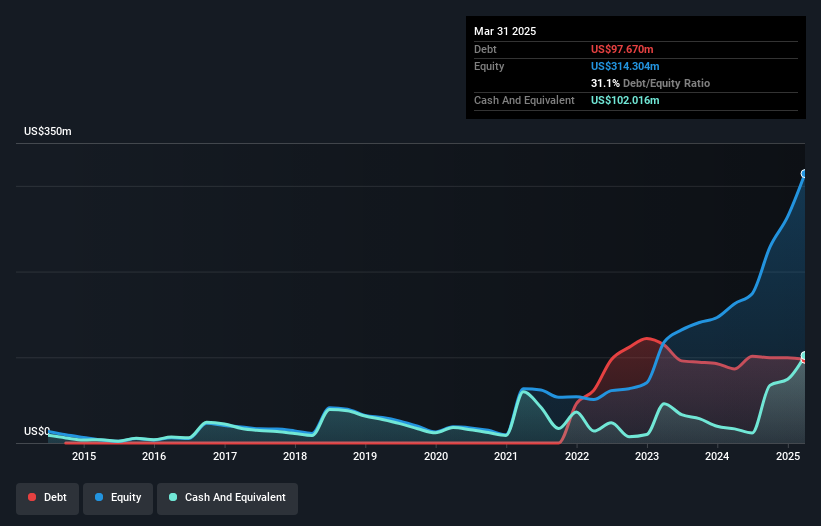

Orezone Gold, a promising player in the mining sector, has shown impressive financial growth with earnings surging 124% over the past year. The company's debt to equity ratio stands at 29.2%, reflecting its strategic leverage use for expansion. Recent production figures highlight Orezone's operational strength, with gold sales reaching 20,350 ounces at $3,375 per ounce in Q3 2025, generating $68.7 million in revenue. Despite shareholder dilution and reliance on a single asset, Orezone's inclusion in major indices and robust exploration results position it well for future growth amidst rising global gold demand.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Silvercorp Metals Inc. is a company that, along with its subsidiaries, focuses on acquiring, exploring, developing, and mining mineral properties in China with a market cap of CA$1.99 billion.

Operations: Silvercorp generates revenue primarily from its operations in China, with the Ying Mining District contributing significantly at $274.11 million and the GC Mine adding $33.95 million.

Silvercorp Metals, a notable player in the metals and mining sector, has seen its earnings grow at 8.6% annually over the past five years, with a forecasted growth of 25.78% per year moving forward. The company processes significant quantities of ore, reporting 341,251 tonnes for Q2 2025 compared to 297,205 tonnes the previous year. With a debt-to-equity ratio rising to 12.9% from zero over five years and trading at approximately CA$7.05—62.5% below estimated fair value—the company presents an intriguing opportunity despite challenges like regulatory scrutiny in China and Ecuador and rising production costs impacting future earnings stability.

Key Takeaways

- Gain an insight into the universe of 45 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Birchcliff Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BIR

Birchcliff Energy

An intermediate oil and natural gas company, engages in the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives