- Canada

- /

- Metals and Mining

- /

- TSX:SSRM

TSX's Electrovaya And 2 Stocks That Could Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the Canadian market navigates through economic uncertainties and global disruptions, investors remain focused on potential opportunities amid fluctuating interest rates and employment trends. In this environment, identifying stocks that may be trading below their estimated value can provide a strategic advantage, as these equities often hold the promise of growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$5.15 | CA$9.90 | 48% |

| Vitalhub (TSX:VHI) | CA$10.70 | CA$18.86 | 43.3% |

| SSR Mining (TSX:SSRM) | CA$35.71 | CA$70.26 | 49.2% |

| Savaria (TSX:SIS) | CA$21.50 | CA$40.89 | 47.4% |

| Meren Energy (TSX:MER) | CA$1.72 | CA$3.10 | 44.5% |

| Heliostar Metals (TSXV:HSTR) | CA$2.10 | CA$4.00 | 47.4% |

| Electrovaya (TSX:ELVA) | CA$10.27 | CA$19.51 | 47.3% |

| Bird Construction (TSX:BDT) | CA$30.00 | CA$56.91 | 47.3% |

| Aritzia (TSX:ATZ) | CA$88.41 | CA$158.77 | 44.3% |

| 5N Plus (TSX:VNP) | CA$18.06 | CA$33.67 | 46.4% |

We're going to check out a few of the best picks from our screener tool.

Electrovaya (TSX:ELVA)

Overview: Electrovaya Inc. designs, develops, manufactures, and sells lithium-ion batteries and related products for energy storage and clean electric transportation in North America, with a market cap of CA$415.51 million.

Operations: The company generates revenue of $54.88 million from the development, manufacturing, and marketing of power technology products.

Estimated Discount To Fair Value: 47.3%

Electrovaya, trading at CA$10.27, is significantly undervalued based on discounted cash flow analysis with an estimated fair value of CA$19.51. The company recently reported record revenue growth, exceeding $64 million for fiscal 2025 and showing strong year-over-year performance. Despite past shareholder dilution and interest coverage concerns, Electrovaya's earnings are forecast to grow over 41% annually, driven by robust demand for its innovative energy storage systems and strategic positioning in the North American market.

- Our growth report here indicates Electrovaya may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Electrovaya stock in this financial health report.

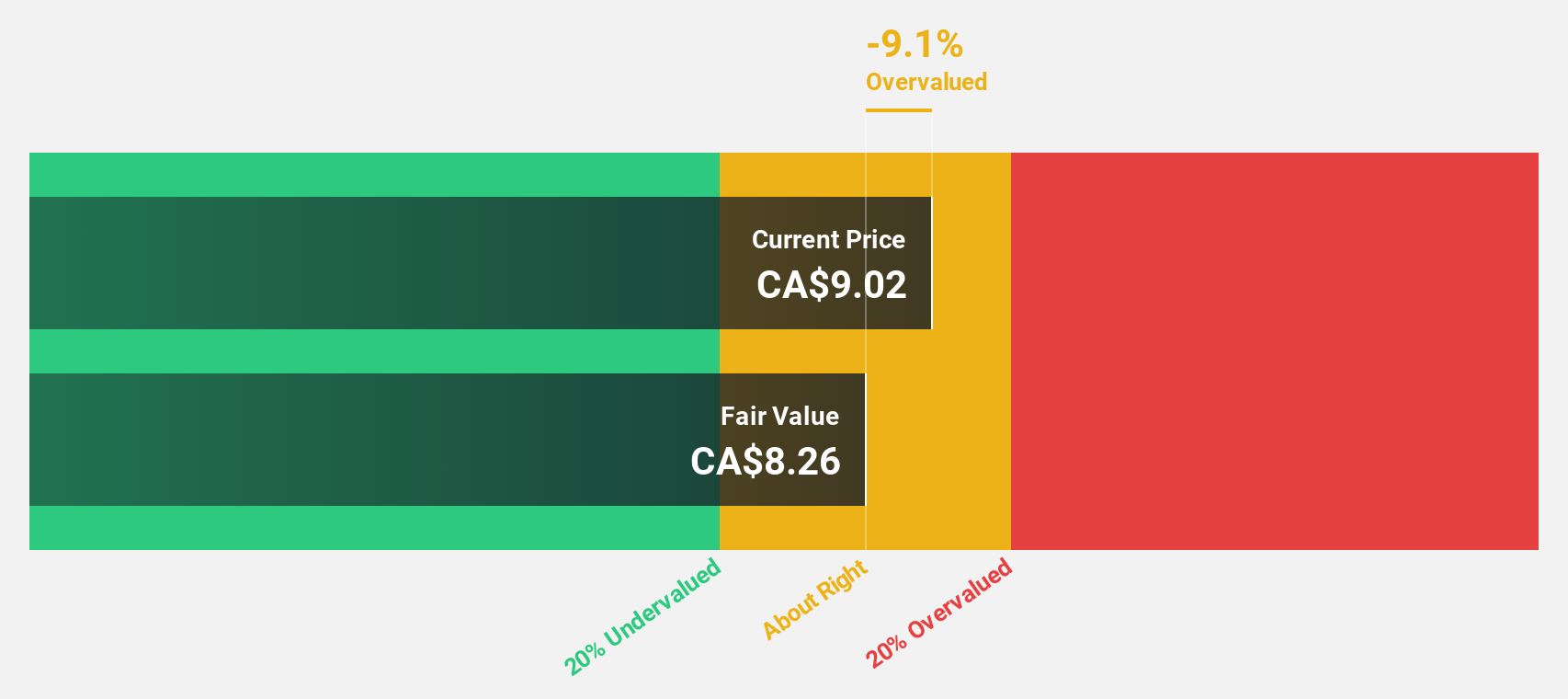

SSR Mining (TSX:SSRM)

Overview: SSR Mining Inc. is involved in the acquisition, exploration, and development of precious metal resource properties across the United States, Türkiye, Canada, and Argentina, with a market cap of CA$6.73 billion.

Operations: The company's revenue segments include Puna at $386.52 million, Seabee at $208.10 million, and Marigold at $507.43 million.

Estimated Discount To Fair Value: 49.2%

SSR Mining, trading at CA$35.71, is significantly undervalued with a fair value estimate of CA$70.26. The company forecasts robust revenue growth at 25.2% annually, outpacing the Canadian market's average. Recent results show strong operational performance, with substantial increases in gold and silver production and net income reaching US$90.08 million for Q2 2025 compared to US$9.69 million a year ago, highlighting its potential as an undervalued cash flow opportunity in Canada.

- Our comprehensive growth report raises the possibility that SSR Mining is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in SSR Mining's balance sheet health report.

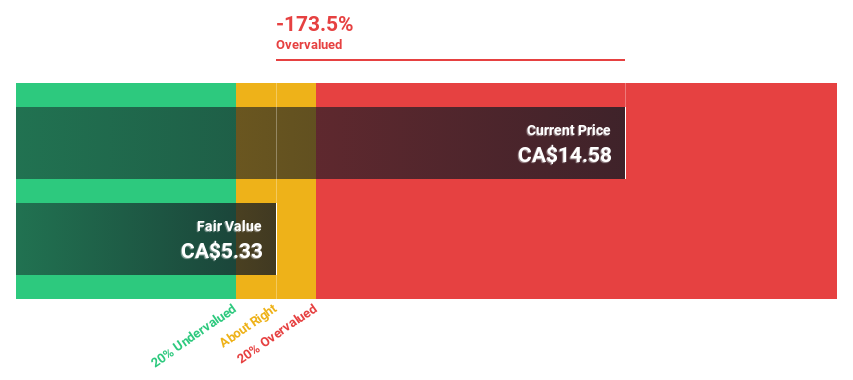

Heliostar Metals (TSXV:HSTR)

Overview: Heliostar Metals Ltd. focuses on identifying, acquiring, evaluating, and exploring mineral properties in North America with a market cap of CA$501.59 million.

Operations: Heliostar Metals Ltd. does not currently report any revenue segments.

Estimated Discount To Fair Value: 47.4%

Heliostar Metals, trading at CA$2.1, is highly undervalued with a fair value estimate of CA$4. The company's earnings and revenue are forecast to grow significantly, outpacing the Canadian market average. Recent drilling results from its Ana Paula project demonstrate promising high-grade gold mineralization, supporting future cash flow potential. Despite past shareholder dilution, Heliostar's strategic drilling approach and robust growth forecasts present it as an attractive opportunity for investors focusing on undervalued stocks based on cash flows in Canada.

- Our earnings growth report unveils the potential for significant increases in Heliostar Metals' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Heliostar Metals.

Next Steps

- Delve into our full catalog of 25 Undervalued TSX Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SSRM

SSR Mining

Engages in the acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success