- Canada

- /

- Metals and Mining

- /

- TSX:SSRM

SSR Mining (TSX:SSRM) Returns to Profit, Challenging Bearish Narratives After $255M One-Off Loss

Reviewed by Simply Wall St

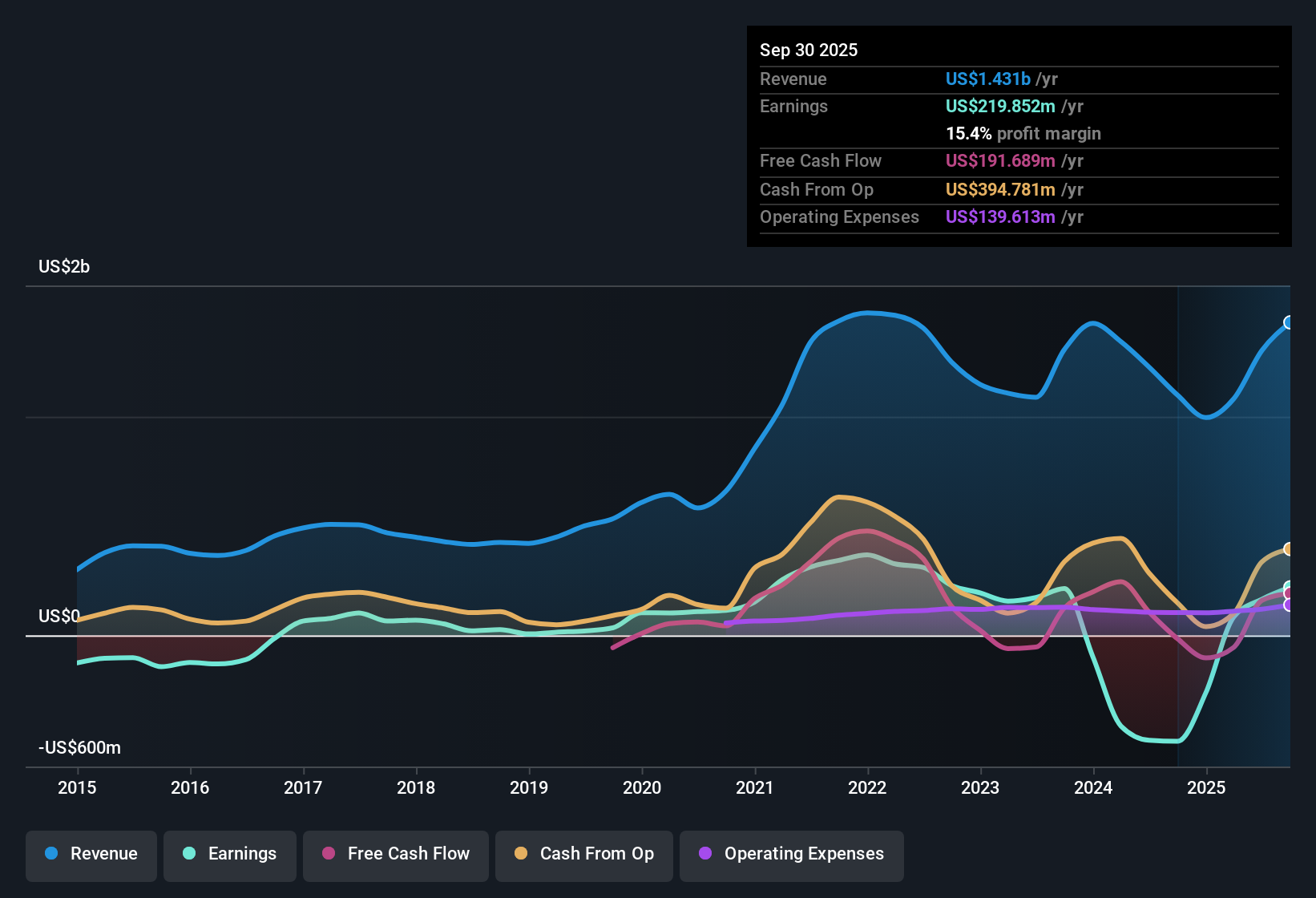

SSR Mining (TSX:SSRM) has just turned a profit, with earnings now forecast to grow at an impressive 33.8% per year over the next three years. Revenue is expected to rise 22.3% annually, easily outpacing the broader Canadian market’s 5.1% average. While the company reported a one-off loss of $255.1 million in the last twelve months and earnings had fallen by 44.6% per year over the past five years, the shift to positive profit margins signals a turnaround that investors will be watching closely.

See our full analysis for SSR Mining.Next, we will put these latest numbers side by side with the main market narratives to see which perspectives hold up and which may get challenged.

See what the community is saying about SSR Mining

Profit Margins Set for Dramatic Jump

- Analysts expect SSR Mining’s profit margin to climb from 12.7% currently to 35.1% within three years, signaling a major improvement in the business’s fundamental profitability.

- According to the analysts' consensus view, ambitious expansion of high-grade reserves and disciplined cost management are driving these margin expectations.

- Operational improvements and asset optimization, such as mine life extension initiatives at Puna and Marigold, are cited as factors for stronger cash flow and earnings resilience.

- Analysts also point to a supportive environment for gold prices from ongoing global inflation and currency instability, which would further reinforce margin gains.

- Consensus narrative highlights that with margins projected to nearly triple, the bullish scenario hinges on continued cost controls and successful execution on project expansions. 📊 Read the full SSR Mining Consensus Narrative.

Regulatory and Cost Pressures Loom Large

- Persistent regulatory and permitting challenges in Turkey, specifically around the Çöpler mine, paired with heightened reclamation and remediation liabilities, stand out as the most significant risks to SSR Mining’s outlook.

- Bears argue these uncertainties could drive continued cash outflows and pressure future free cash flow.

- Exposure to politically complex jurisdictions increases chances for mine shutdowns or permitting delays, threatening revenue stability and sustained profitability.

- The analysts' consensus view also warns that high all-in sustaining costs (AISC) at sites like Seabee and Marigold may erode net margins, particularly during softer gold price periods.

Valuation: Discounted Cash Flow Upside vs. Industry Premium

- SSR Mining trades at CA$27.49 per share, which is well below its estimated DCF fair value of CA$45.60. However, the stock’s current P/E of 24x is above the industry average of 19.8x, highlighting a tension between discounted cash flow value and industry multiples.

- The analysts' consensus view suggests the stock is only fairly priced when compared to the latest analyst price target of CA$39.37, which is about 43% higher than the current share price.

- If SSR Mining achieves its forecast $2.3 billion in revenues and $792.9 million in earnings by 2028, it would be trading on a far lower multiple than today. Still, execution risk remains key to unlocking this upside.

- Investors are encouraged to consider if they agree with the growth assumptions underlying the consensus target or see the premium multiple as a warning sign.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SSR Mining on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a different angle? Sharpen your perspective and share your own take in just a couple of minutes. Do it your way

A great starting point for your SSR Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite a strong forecast, SSR Mining faces real pressure from regulatory uncertainty, high costs, and execution risks. These factors could threaten its profitability and stability.

If you want greater consistency and fewer surprises, consider our stable growth stocks screener (2074 results) to focus on companies with steady earnings and reliable growth track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SSRM

SSR Mining

Engages in the acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives