Here's Why I Think Stella-Jones (TSE:SJ) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Stella-Jones (TSE:SJ). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Stella-Jones

How Quickly Is Stella-Jones Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, Stella-Jones has grown EPS by 23% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Stella-Jones is growing revenues, and EBIT margins improved by 3.2 percentage points to 14%, over the last year. That's great to see, on both counts.

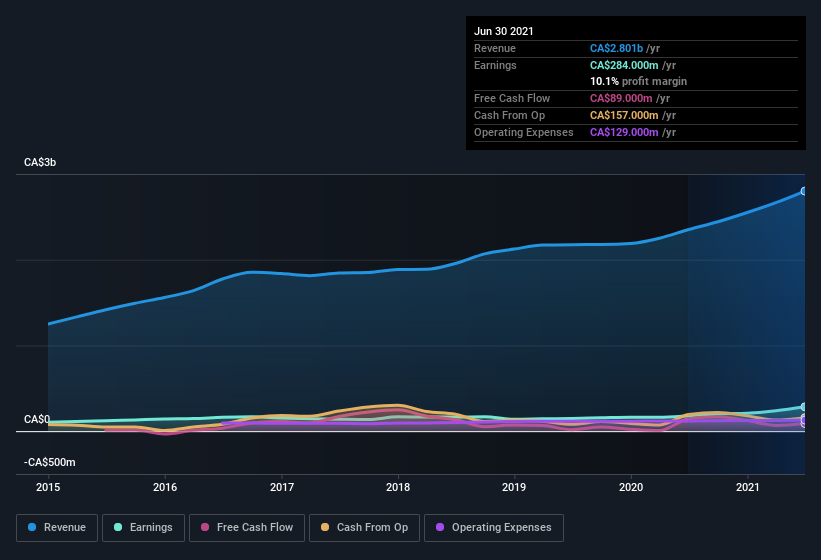

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Stella-Jones's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Stella-Jones Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Stella-Jones insiders refrain from selling stock during the year, but they also spent CA$203k buying it. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Corporate Independent Director Karen Laflamme for CA$70k worth of shares, at about CA$46.50 per share.

I do like that insiders have been buying shares in Stella-Jones, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. I discovered that the median total compensation for the CEOs of companies like Stella-Jones with market caps between CA$1.2b and CA$4.0b is about CA$2.4m.

Stella-Jones offered total compensation worth CA$1.8m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Stella-Jones To Your Watchlist?

For growth investors like me, Stella-Jones's raw rate of earnings growth is a beacon in the night. And that's not the only positive, either. We have both insider buying and reasonable and remuneration to consider. On balance the message seems to be that this stock is worth looking at, at least for a while. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Stella-Jones (at least 1 which is significant) , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But Stella-Jones isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SJ

Stella-Jones

Produces and sells pressure-treated wood products in Canada and the United States.

Very undervalued with solid track record and pays a dividend.