TSX Penny Stocks To Watch: 3 Picks With Market Caps Below CA$20M

Reviewed by Simply Wall St

The Canadian market has been navigating the aftermath of a decisive U.S. election, which has removed a significant source of uncertainty and led to a notable rally in stocks, including several record highs for the TSX this year. As investors refocus on long-term fundamentals amidst these developments, penny stocks remain an intriguing area for those interested in smaller or newer companies with growth potential. Despite being considered a niche investment category today, penny stocks can offer surprising value when they boast strong financial health and stability.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.57M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.82 | CA$285.18M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$183.06M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.425 | CA$11.75M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.90 | CA$190.72M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.87M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$237.5M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$317.69M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.09 | CA$29.28M | ★★★★★★ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Scandium International Mining (TSX:SCY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Scandium International Mining Corp. is an exploration stage company dedicated to the exploration, evaluation, and development of specialty metals assets in Australia, with a market cap of CA$7.10 million.

Operations: Scandium International Mining Corp. currently does not report any revenue segments.

Market Cap: CA$7.1M

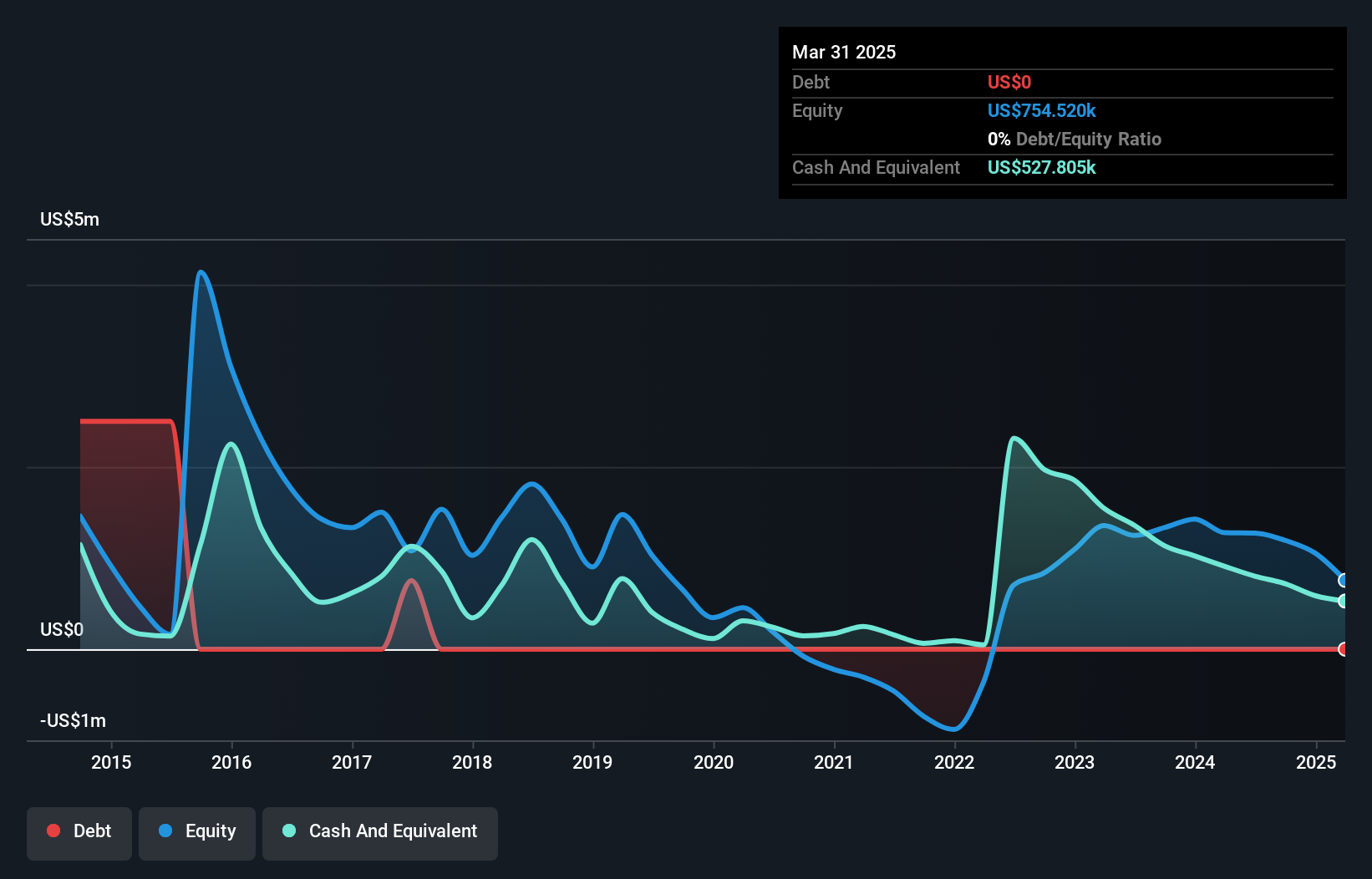

Scandium International Mining Corp., with a market cap of CA$7.10 million, remains pre-revenue and unprofitable, though it has reduced losses significantly over the past five years by 50.1% annually. The company is debt-free with short-term assets exceeding liabilities, indicating some financial stability despite its high share price volatility and lack of revenue streams. Its experienced board and management team provide strategic guidance as the company navigates its exploration stage in Australia's specialty metals sector. Recent earnings reports highlight ongoing net losses but show improvement from previous periods, reflecting efforts to manage costs effectively.

- Click here to discover the nuances of Scandium International Mining with our detailed analytical financial health report.

- Understand Scandium International Mining's track record by examining our performance history report.

Nubeva Technologies (TSXV:NBVA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nubeva Technologies Ltd. develops and licenses software-based decryption solutions, such as Ransomware Reversal, with a market cap of CA$17.89 million.

Operations: The company generates revenue of $1.07 million from its development and commercialization of software segment.

Market Cap: CA$17.89M

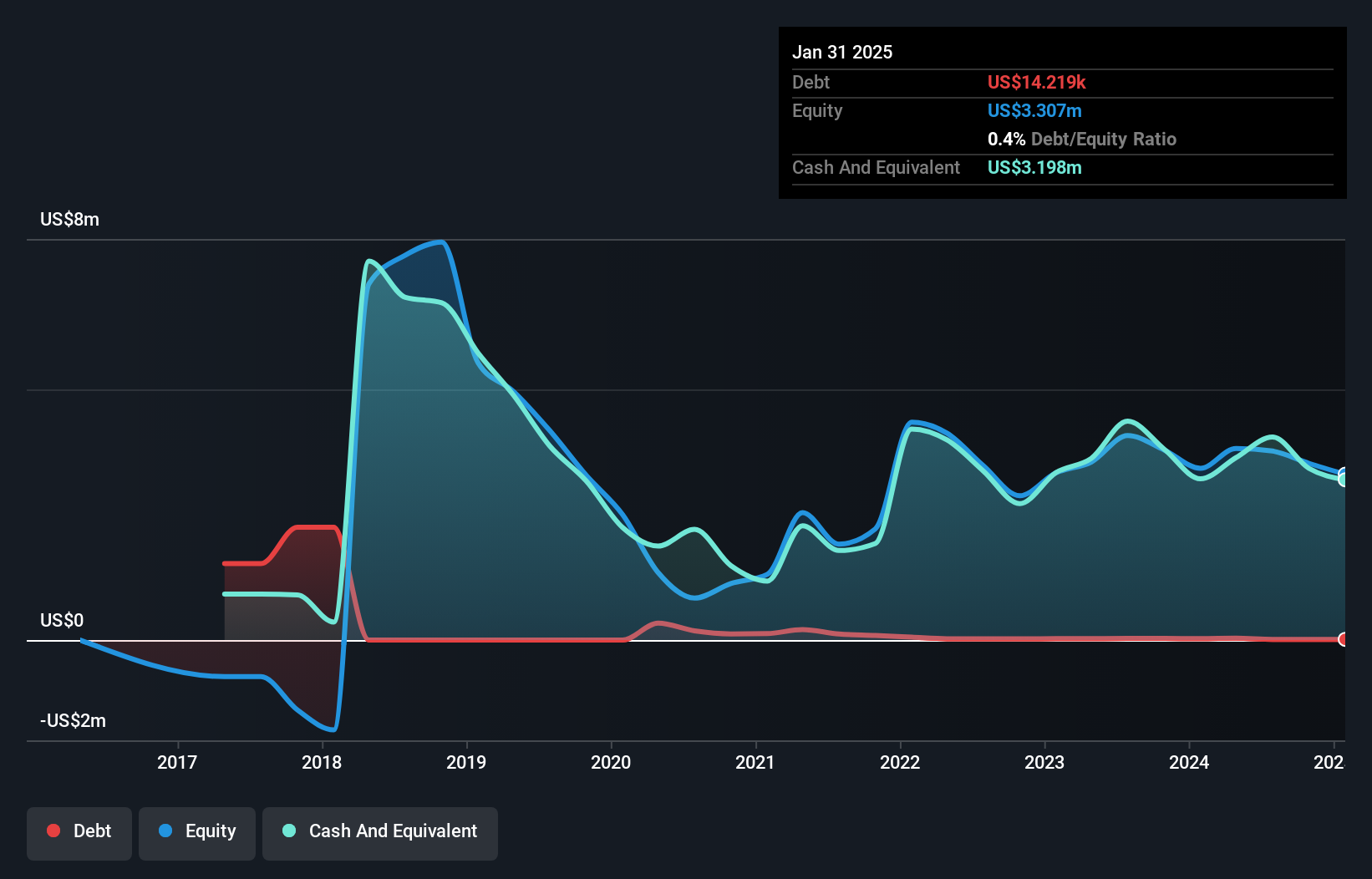

Nubeva Technologies Ltd., with a market cap of CA$17.89 million, is pre-revenue and unprofitable, though it has managed to reduce losses by 32.2% annually over the past five years. The company reported first-quarter sales of US$0.34 million, down from US$1.05 million the previous year, resulting in a net loss compared to a prior net income. Despite shareholder dilution and high share price volatility, Nubeva benefits from strong financial health with short-term assets exceeding liabilities and more cash than debt, providing a sufficient cash runway for over three years based on current free cash flow trends.

- Dive into the specifics of Nubeva Technologies here with our thorough balance sheet health report.

- Evaluate Nubeva Technologies' historical performance by accessing our past performance report.

Vendetta Mining (TSXV:VTT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Vendetta Mining Corp. is an exploration company focused on acquiring and exploring resource properties in Australia, with a market cap of CA$4.85 million.

Operations: Currently, there are no reported revenue segments for this exploration-focused company.

Market Cap: CA$4.85M

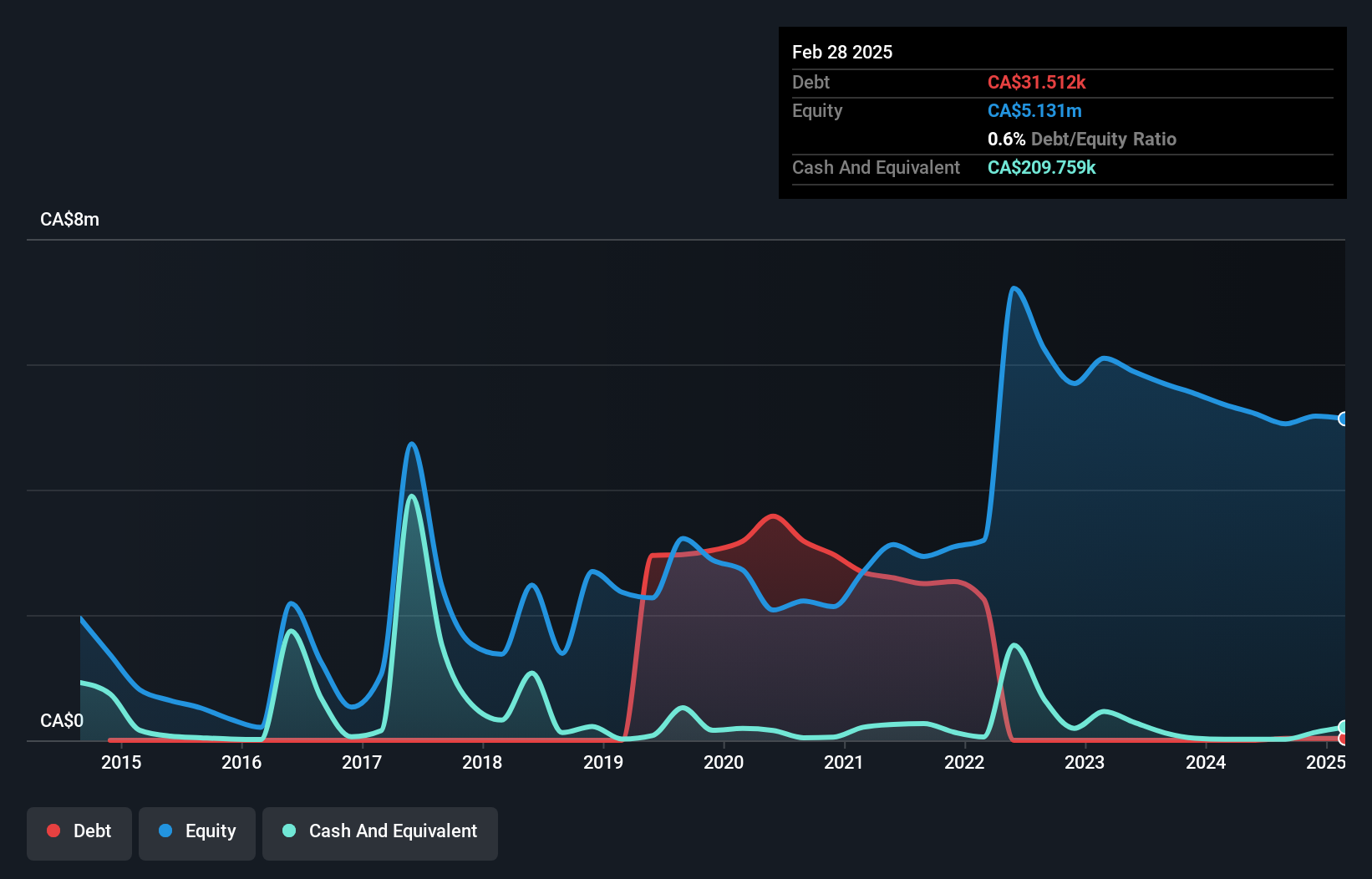

Vendetta Mining Corp., with a market cap of CA$4.85 million, is pre-revenue and has been working to reduce its financial losses, achieving an 8.5% annual reduction over the past five years. Recent private placements have bolstered its cash position, although it still faces short-term liquidity challenges as current assets fall short of liabilities. The company's debt levels are satisfactory with a net debt to equity ratio of 0.2%, reflecting effective management despite ongoing unprofitability. Vendetta's seasoned management and board bring valuable experience as the company navigates its exploration-focused strategy in Australia’s resource sector.

- Get an in-depth perspective on Vendetta Mining's performance by reading our balance sheet health report here.

- Learn about Vendetta Mining's historical performance here.

Make It Happen

- Get an in-depth perspective on all 954 TSX Penny Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nubeva Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NBVA

Nubeva Technologies

Engages in the development and licensing of software-based decryption solutions, including Ransomware Reversal for businesses, governments, and other organizations.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026