- Canada

- /

- Capital Markets

- /

- TSX:BAM

TSX Value Stocks Estimated Below Intrinsic Worth For August 2024

Reviewed by Simply Wall St

The Canadian market has climbed 2.1% in the last 7 days and is up 14% over the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this thriving environment, identifying stocks that are trading below their intrinsic worth can offer significant opportunities for investors seeking value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$203.19 | CA$350.07 | 42% |

| Decisive Dividend (TSXV:DE) | CA$6.67 | CA$13.15 | 49.3% |

| Amerigo Resources (TSX:ARG) | CA$1.61 | CA$3.06 | 47.3% |

| Trisura Group (TSX:TSU) | CA$46.18 | CA$86.73 | 46.8% |

| Kinaxis (TSX:KXS) | CA$169.86 | CA$296.33 | 42.7% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$7.93 | CA$14.22 | 44.2% |

| Boyd Group Services (TSX:BYD) | CA$231.48 | CA$402.88 | 42.5% |

| Pan American Silver (TSX:PAAS) | CA$31.74 | CA$62.88 | 49.5% |

| Kits Eyecare (TSX:KITS) | CA$9.95 | CA$18.96 | 47.5% |

Let's review some notable picks from our screened stocks.

Brookfield Asset Management (TSX:BAM)

Overview: Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services, with a market cap of CA$25.30 billion.

Operations: Brookfield Asset Management Ltd. generates revenue through its real estate investment and alternative asset management services.

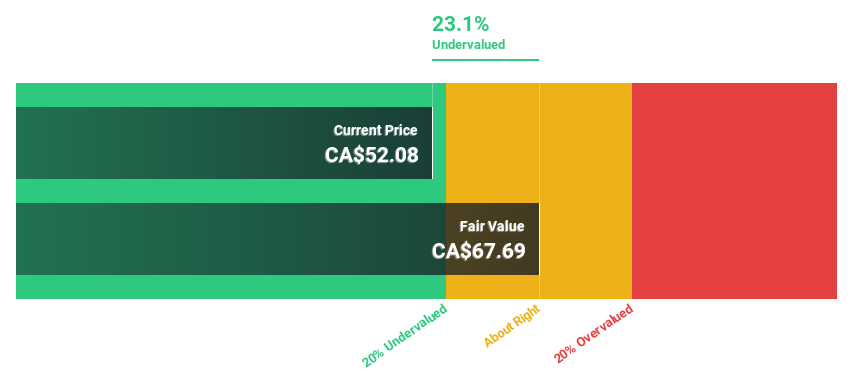

Estimated Discount To Fair Value: 20.1%

Brookfield Asset Management (CA$60.26) is trading 20.1% below its estimated fair value (CA$75.43). Despite a dividend yield of 3.48% not being well-covered by earnings, BAM's earnings are forecast to grow significantly at 74.4% per year over the next three years, outpacing the Canadian market's growth rate of 14.7%. Recent M&A discussions regarding Tritax Eurobox could impact future cash flows and valuation if finalized.

- The analysis detailed in our Brookfield Asset Management growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Brookfield Asset Management's balance sheet health report.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$24.28 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through mining, development, and exploration of minerals and precious metals across Africa.

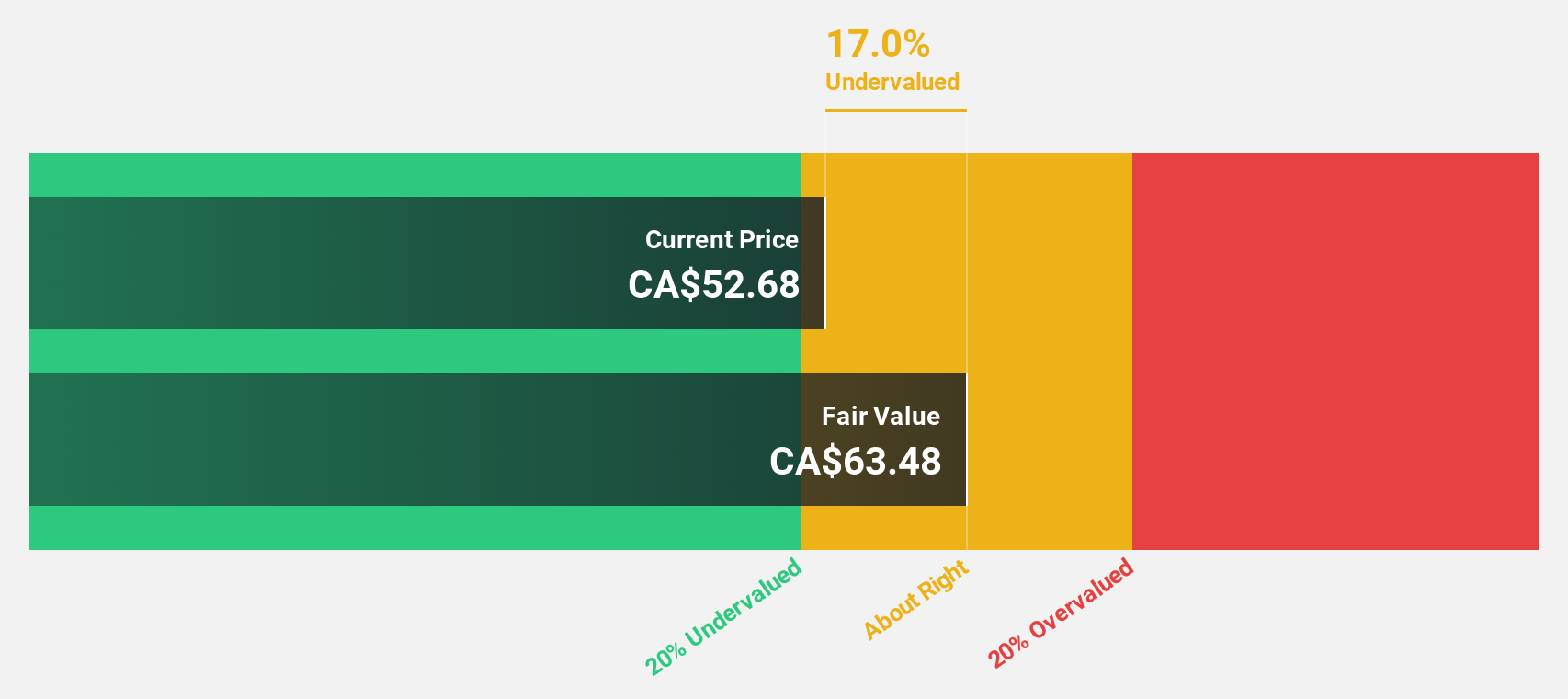

Estimated Discount To Fair Value: 20.8%

Ivanhoe Mines (CA$18.05) is trading at 20.8% below its estimated fair value (CA$22.8). Despite recent insider selling and shareholder dilution, the company's earnings are forecast to grow significantly at 74.1% annually, outpacing the Canadian market's growth rate of 14.7%. Recent developments include the completion of Phase 3 concentrator at Kamoa-Kakula Copper Complex, which will boost production capacity and cash flow potential, although net income has declined year-over-year as per recent earnings reports.

- Our growth report here indicates Ivanhoe Mines may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Ivanhoe Mines.

Pan American Silver (TSX:PAAS)

Overview: Pan American Silver Corp. engages in the exploration, development, extraction, processing, refining, and reclamation of silver, gold, zinc, lead, and copper mines across Canada, Mexico, Peru, Bolivia, Argentina, Chile and Brazil with a market cap of CA$11.52 billion.

Operations: Pan American Silver generates revenue from its mining operations in Peru (Huaron: $141.70 million, La Arena: $193.90 million, Shahuindo: $280.20 million), Canada (Timmins: $262.60 million), Mexico (Dolores: $255.50 million, La Colorada: $106.30 million), and Bolivia (San Vicente: $78.70 million), with a segment adjustment of $1.21 billion.

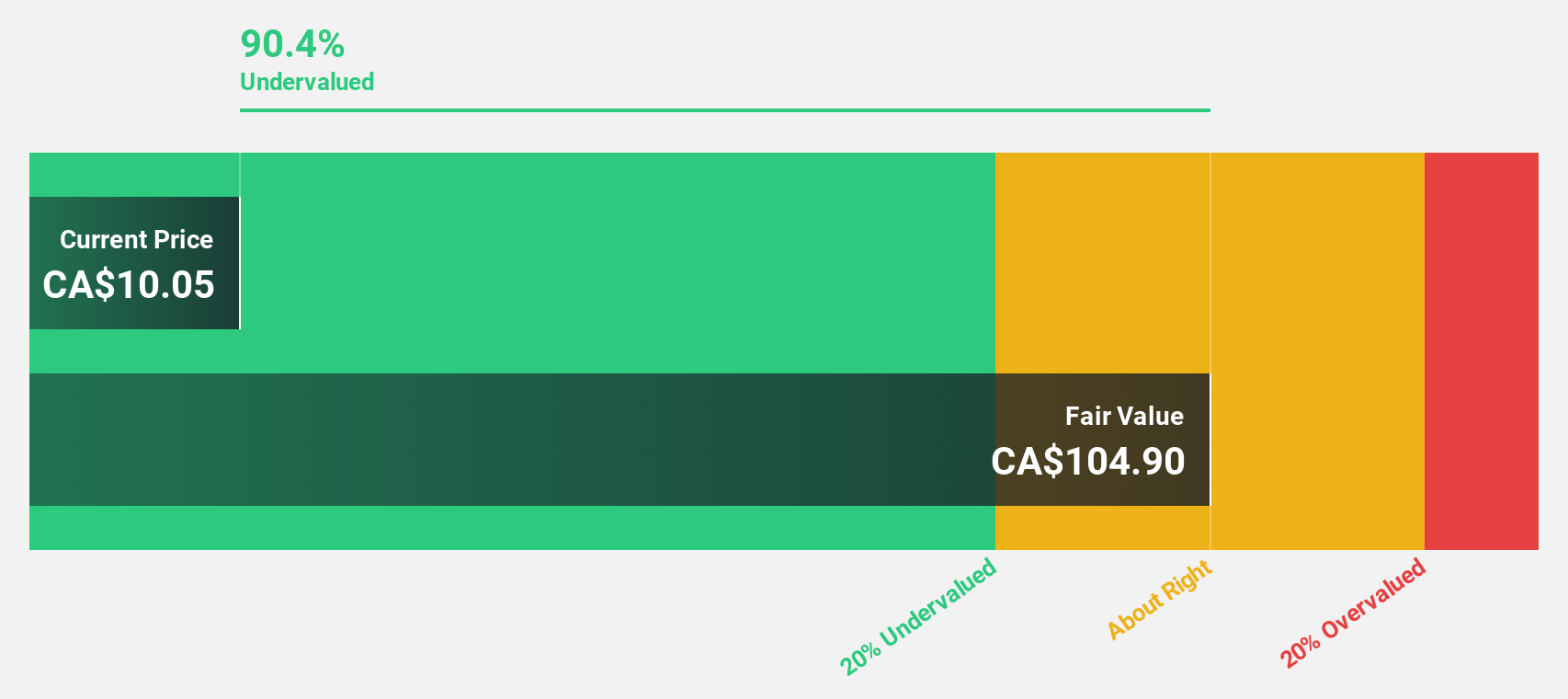

Estimated Discount To Fair Value: 49.5%

Pan American Silver (CA$31.74) is trading at 49.5% below its estimated fair value of CA$62.88, suggesting significant undervaluation based on discounted cash flows. The company is expected to become profitable within the next three years, bolstered by recent exploration successes and ongoing M&A activities aimed at enhancing synergies and extracting value from acquisitions like Yamana and Tahoe. Recent drill results indicate strong potential for mineral resource growth close to existing infrastructure, further supporting future cash flow improvements.

- In light of our recent growth report, it seems possible that Pan American Silver's financial performance will exceed current levels.

- Get an in-depth perspective on Pan American Silver's balance sheet by reading our health report here.

Key Takeaways

- Discover the full array of 23 Undervalued TSX Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A real estate investment firm specializing in alternative asset management services.

High growth potential slight.