- Canada

- /

- Metals and Mining

- /

- TSX:OLA

Orla Mining (TSX:OLA) Valuation in Focus Following Steady Q3 Output and Sector Volatility

Reviewed by Simply Wall St

Orla Mining (TSX:OLA) just released its third quarter and year-to-date production results, highlighting steady gold output through September. This comes during a turbulent period for gold stocks as prices have recently pulled back sharply.

See our latest analysis for Orla Mining.

The recent volatility in gold prices has definitely weighed on miners across the sector, and Orla Mining has felt the pressure too. After a strong rally, the share price tumbled over 19% in the past week, even as third quarter results confirm reliably robust production. Still, the bigger picture is hard to ignore: the company’s share price has surged nearly 80% year-to-date, and the one-year total shareholder return stands at a remarkable 115%, highlighting long-term momentum despite short-term swings.

If you’re interested in where opportunity might strike next, now’s an ideal time to broaden your perspective and discover fast growing stocks with high insider ownership

With Orla’s shares still trading at a steep discount to analyst targets and solid production growth in hand, the key question now is whether investors are being offered a genuine buying opportunity, or if the market has already factored in the next stage of growth.

Most Popular Narrative: 24.9% Undervalued

Orla Mining’s most widely followed narrative calculates a fair value nearly 25% above the latest close, highlighting a sizable gap between recent market pessimism and a more bullish long-term view.

Robust production growth and revenue diversification from integrating Musselwhite, as well as future contributions from South Railroad and expanded Camino Rojo underground, are likely underappreciated catalysts that will increase long-term revenue and reduce operational risk.

Earnings per share set to soar. Margins on a dramatic trajectory. The forecast? An aggressive expansion story fueled by market-defying assumptions about profit and sales. Want the core financial drivers that shaped this bold valuation? See the full narrative and dig into the details that could move the stock.

Result: Fair Value of $20.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational setbacks at Camino Rojo or delays in key permits could quickly erode both earnings momentum and confidence in Orla's growth story.

Find out about the key risks to this Orla Mining narrative.

Another View: What Do Earnings Multiples Say?

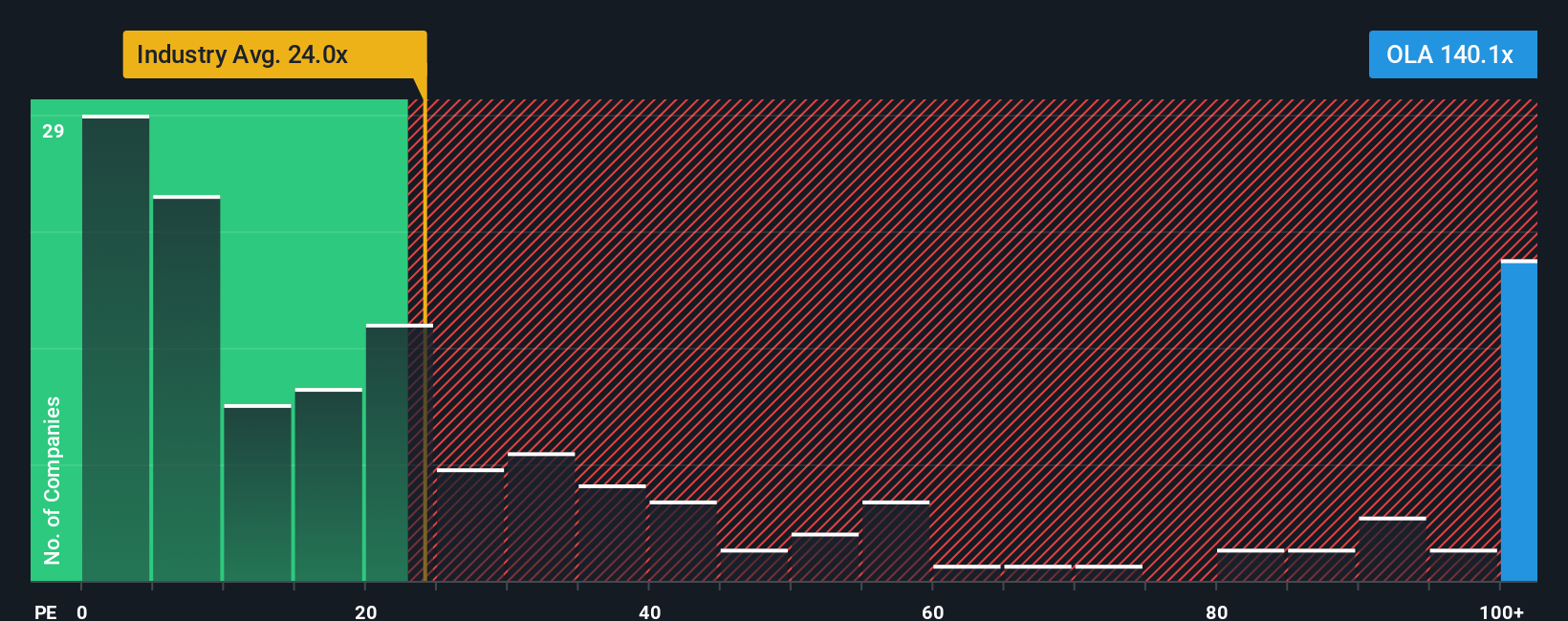

Taking a closer look at the share price compared to earnings, Orla Mining trades at 139.2 times earnings. This is much higher than the Canadian Metals and Mining industry average of 21.2, its peer group at 20.2, and even the fair ratio of 63.7. Such a premium suggests investors are either banking on rapid future growth or taking on real valuation risk if those expectations do not materialize. Could this be optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orla Mining Narrative

If you see things differently or want to dive into your own research, you can shape your own story in just a few minutes. Do it your way

A great starting point for your Orla Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop here when other promising stocks are just a click away? Level up your portfolio with fresh opportunities and powerful data-backed insights tailored to your goals.

- Unlock big potential in fast-growing sectors with these 27 AI penny stocks, which are setting new standards in artificial intelligence and automation.

- Capture consistent income by checking out these 17 dividend stocks with yields > 3%, yielding strong returns for investors seeking dependable cash flow.

- Seize massive upside in value with these 875 undervalued stocks based on cash flows, picked by our models to highlight compelling bargains hiding in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

High growth potential with acceptable track record.

Market Insights

Community Narratives