Verde AgriTech Limited's (TSE:NPK) Shares Not Telling The Full Story

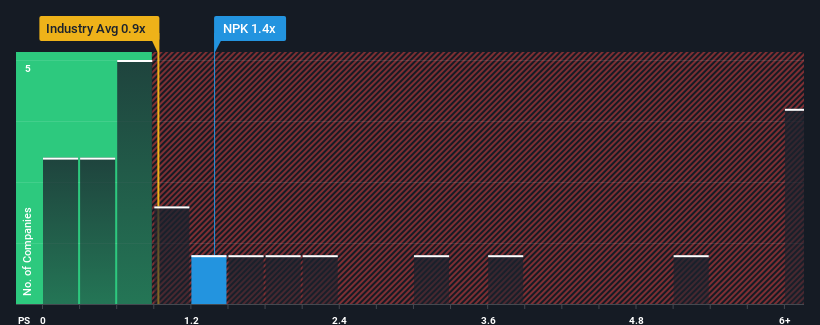

It's not a stretch to say that Verde AgriTech Limited's (TSE:NPK) price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Canada, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Verde AgriTech

What Does Verde AgriTech's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Verde AgriTech's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Verde AgriTech will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Verde AgriTech?

In order to justify its P/S ratio, Verde AgriTech would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 57%. Even so, admirably revenue has lifted 126% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 88% over the next year. That's shaping up to be materially higher than the 2.6% growth forecast for the broader industry.

With this information, we find it interesting that Verde AgriTech is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Verde AgriTech's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Verde AgriTech currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Verde AgriTech has 3 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NPK

Verde AgriTech

An agricultural technology company, produces and sells potassium fertilizers in Brazil and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives