A look at the shareholders of Nighthawk Gold Corp. (TSE:NHK) can tell us which group is most powerful. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. We also tend to see lower insider ownership in companies that were previously publicly owned.

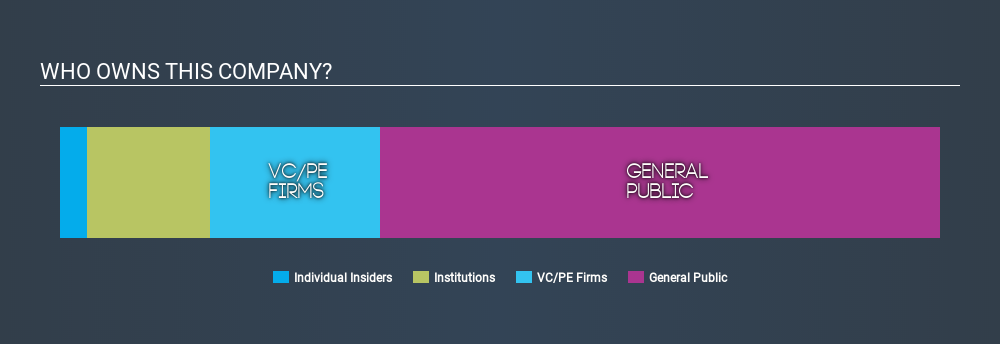

Nighthawk Gold is not a large company by global standards. It has a market capitalization of CA$52m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions own shares in the company. Let's take a closer look to see what the different types of shareholder can tell us about Nighthawk Gold.

View our latest analysis for Nighthawk Gold

What Does The Institutional Ownership Tell Us About Nighthawk Gold?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

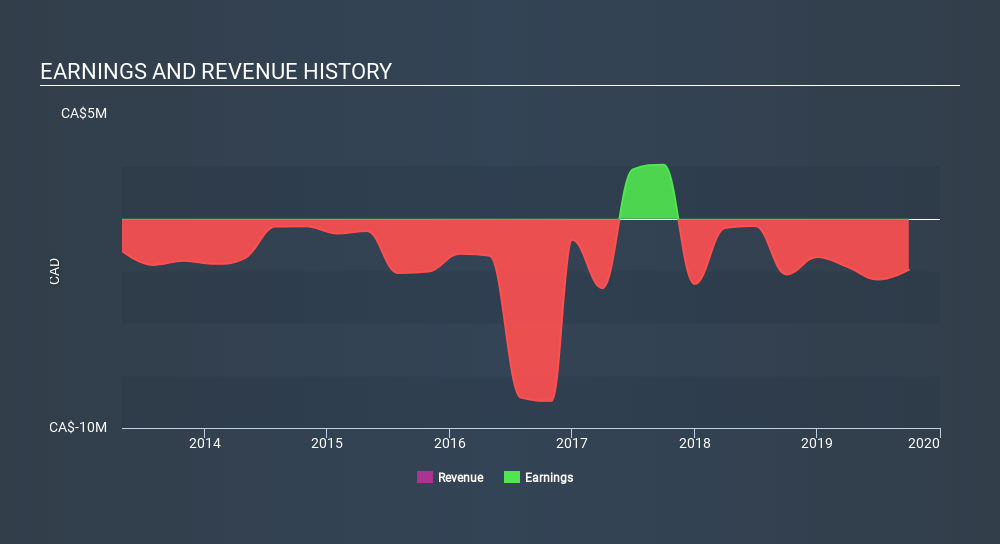

We can see that Nighthawk Gold does have institutional investors; and they hold 14% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Nighthawk Gold's historic earnings and revenue, below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in Nighthawk Gold. Looking at our data, we can see that the largest shareholder is Northfield Capital Corporation with 19% of shares outstanding. The second largest shareholder with 7.9%, is Wellington Management Group LLP, followed by Ruffer LLP, with an ownership of 2.6%.

On studying our ownership data, we found that 22 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Nighthawk Gold

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in Nighthawk Gold Corp.. In their own names, insiders own CA$1.6m worth of stock in the CA$52m company. This shows at least some alignment, but I usually like to see larger insider holdings. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, mostly retail investors, hold a substantial 64% stake in NHK, suggesting it is a fairly popular stock. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Private Equity Ownership

With an ownership of 19%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Nighthawk Gold better, we need to consider many other factors. Take risks, for example - Nighthawk Gold has 5 warning signs (and 1 which is a bit concerning) we think you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:NHK

Nighthawk Gold

Nighthawk Gold Corp. operates as a gold exploration company in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success