- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

Will NGEx Minerals' (TSX:NGEX) Largest Drill Campaign Yet Redefine Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- NGEx Minerals has launched its largest drill program to date at the Lunahuasi property in Argentina, aiming to complete up to 25,000 meters of diamond drilling after raising C$175 million in fresh funding.

- This ambitious exploration phase builds on previous discoveries of multiple high-grade copper, gold, and silver zones, expanding the potential scope and scale of the project.

- With significant capital backing, we explore how the expanded drill campaign at Lunahuasi could reshape NGEx Minerals' investment outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is NGEx Minerals' Investment Narrative?

To hold NGEx Minerals, an investor needs confidence in the potential of early-stage exploration to deliver future value, as the company remains pre-revenue and has posted sizeable losses over recent periods. The recent kick-off of the largest-ever Phase 4 drilling campaign at Lunahuasi, following a C$175 million capital raise, marks a substantial short-term catalyst by funding and accelerating resource definition, expanding new mineral zones, and boosting investor attention. This is especially relevant given past discoveries of high-grade copper, gold and silver and a new porphyry system, which arguably support an optimistic view on project upside. However, with the share price already up significantly over the past year, the main risk remains unchanged: the timeline and uncertainty of commercial production, especially as future earnings depend on successful exploration results and eventual development progress. The impact of this drilling news is material, as it could reshape resource estimates and market sentiment, but the timeline for initial assay results leaves investors watching for tangible progress over the next several quarters.

By contrast, the absence of revenue and a rising loss trajectory are realities all investors must consider.

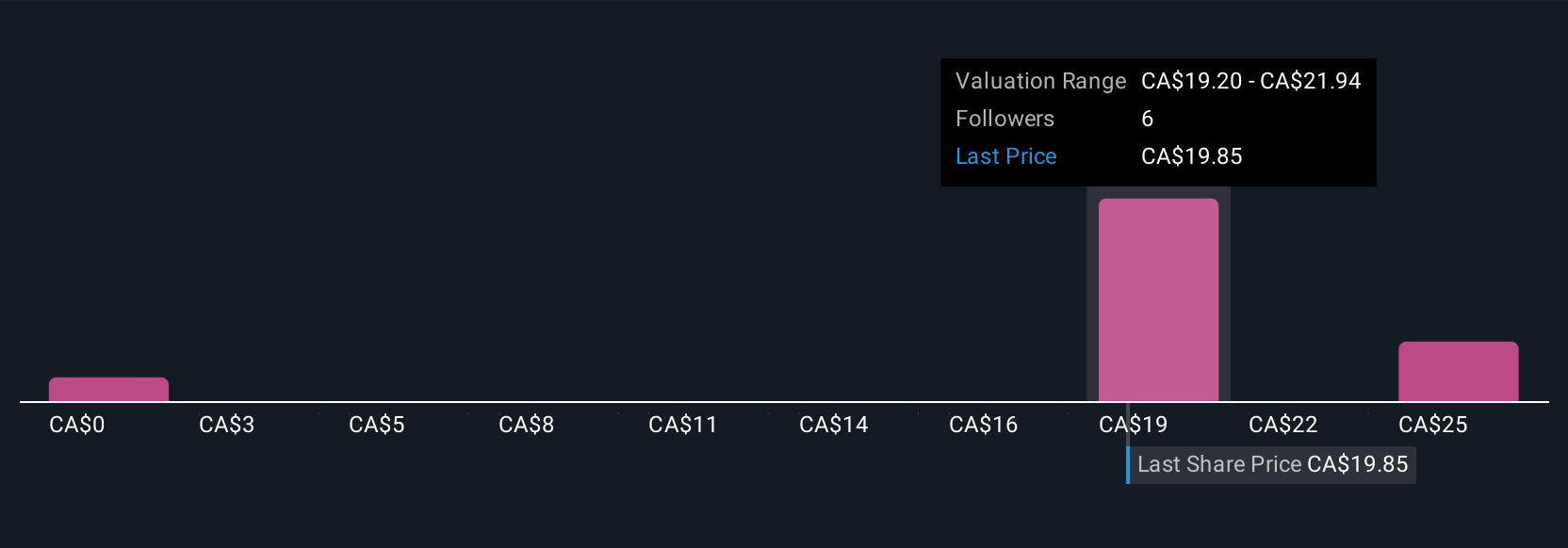

Despite retreating, NGEx Minerals' shares might still be trading 16% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on NGEx Minerals - why the stock might be worth less than half the current price!

Build Your Own NGEx Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGEx Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NGEx Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGEx Minerals' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and fair value.

Market Insights

Community Narratives