- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

NGEx Minerals (TSX:NGEX): Examining Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for NGEx Minerals.

Despite some recent volatility, NGEx Minerals has shown serious momentum this year. After a strong run, the 12-month share price return sits at 89.72%. What really stands out is the total shareholder return of 111.10% over the same period, suggesting that growth potential and shifting sentiment are fueling the rally.

If NGEx’s strong run has you wondering where else opportunity is building, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares soaring nearly 90 percent in the past year and outperforming targets, the big question remains: is NGEx Minerals undervalued at current levels, or is the stock’s future growth already priced in?

Price-to-Book Ratio of 36.1x: Is it justified?

NGEx Minerals is currently trading at a price-to-book (P/B) ratio of 36.1x, which is significantly above both its industry peers and the broader market. With the last closing share price at CA$25.10, this lofty multiple may raise eyebrows about how investors are valuing the company’s assets relative to its book value.

The price-to-book ratio compares a company’s market value to its net assets, helping gauge whether shares are priced high or low versus what the company owns. For resource and mining companies in particular, this multiple can reflect market confidence in future discoveries or project developments, in addition to present financials.

At 36.1x, NGEx Minerals is trading at more than ten times the Canadian Metals and Mining industry average, which sits at just 2.6x. This suggests the market is pricing in significant growth potential or viewing NGEx’s assets as exceptionally strategic or valuable. While the company is good value based on its P/B ratio compared to its peer average of 59.6x, the premium to the sector is hard to ignore.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 36.1x (OVERVALUED)

However, potential delays in resource development or disappointing exploration results could quickly shift sentiment and challenge the bullish outlook on NGEx Minerals.

Find out about the key risks to this NGEx Minerals narrative.

Another View: Discounted Cash Flow Perspective

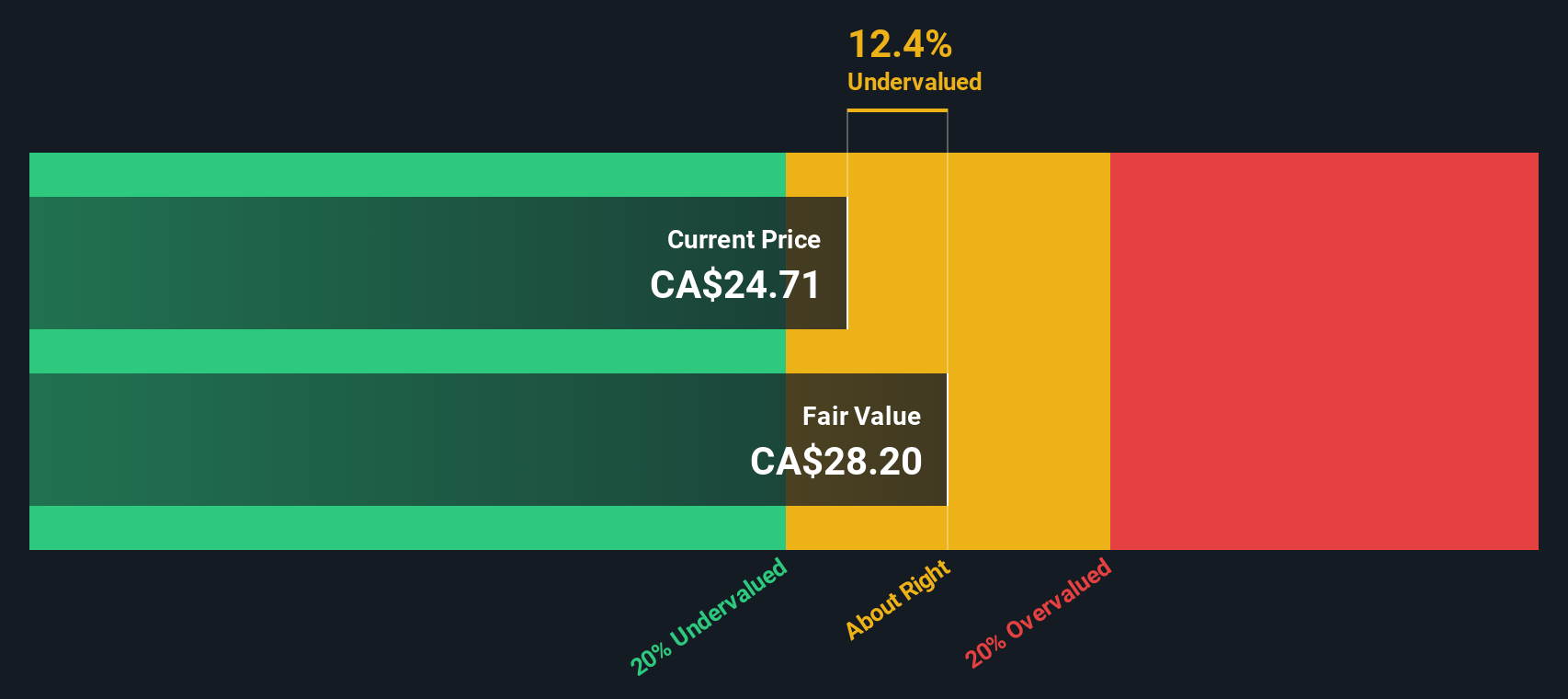

Looking at NGEx Minerals through the lens of our SWS DCF model provides a different angle. The shares are trading about 11.7% below our estimate of fair value, which hints at possible undervaluation despite the high price-to-book ratio. Could this suggest the market is missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NGEx Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NGEx Minerals Narrative

If you’d like to dig deeper or want to form your own conclusions, you can analyse the numbers directly and craft your own story with Do it your way.

A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level and get ahead of the crowd by searching for proven opportunities using our premium screeners on Simply Wall Street.

- Unlock fresh growth in AI-driven businesses that are primed to reshape entire industries by starting with these 27 AI penny stocks.

- Position yourself for the future and explore opportunities in digital currencies with these 80 cryptocurrency and blockchain stocks.

- Boost your income and add stability to your portfolio with companies offering attractive yields through these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives