- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

NGEx Minerals (TSX:NGEX): Assessing Valuation as Phase 4 Drilling Targets Resource Growth at Lunahuasi

Reviewed by Simply Wall St

NGEx Minerals (TSX:NGEX) has launched its Phase 4 drilling program at the Lunahuasi property in Argentina, following the momentum of previous high-grade copper, gold, and silver discoveries. This drill campaign is well capitalized thanks to recent financing.

See our latest analysis for NGEx Minerals.

The launch of Phase 4 drilling comes as NGEx Minerals’ share price has powered up an impressive 72.7% year-to-date. Despite some recent volatility, with a sharp pullback earlier this month followed by a quick rebound, long-term shareholders have enjoyed a stellar 96.6% total return over the past year and extraordinary multi-year gains. The latest resource news adds fuel to a story that has already captured plenty of momentum in both the share price and investor optimism.

If high-impact exploration stories like this pique your interest, it might be time to expand your watchlist and discover fast growing stocks with high insider ownership

With NGEx shares near record highs and new drilling milestones ahead, the key question is whether the current price leaves upside for investors or if the market has already priced in all future growth.

Price-to-Book of 34x: Is it justified?

NGEx Minerals is trading at a steep 34 times its book value, compared to industry peers and recent share price performance near record highs. This high multiple signals bullish sentiment, but is the current valuation sustainable in light of the company’s financials?

The price-to-book ratio compares the company’s market capitalization to its net assets on the balance sheet. It is especially relevant for miners and resource explorers, as these companies are often valued based on the potential of their assets rather than cash flows.

NGEx’s 34x ratio is significantly higher than the Canadian Metals and Mining industry average of 2.6x. This suggests that considerable optimism is being priced in for exploration success and future resource gains. However, when compared to select peers trading at an average of 57x, NGEx still trades at a relative discount. There is not enough data to determine an objective “fair” ratio, so investors must assess if premium expectations are warranted.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 34x (OVERVALUED)

However, investors should be mindful that exploration stocks like NGEx face risks, including drilling setbacks or commodity price volatility. These factors could quickly shift sentiment.

Find out about the key risks to this NGEx Minerals narrative.

Another View: Discounted Cash Flow Model

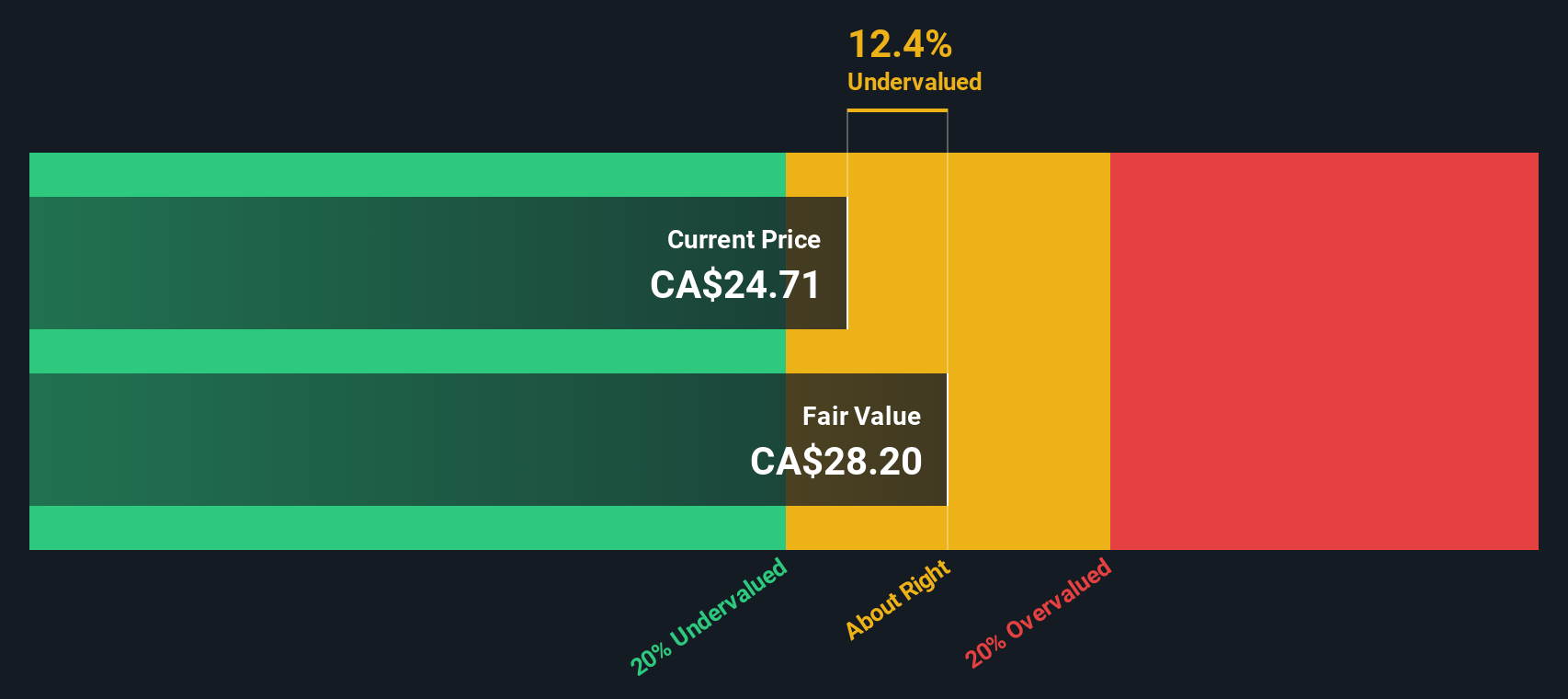

While the 34x price-to-book ratio makes NGEx Minerals look expensive, our SWS DCF model presents a different picture. According to this method, NGEx is currently trading 16% below its estimated fair value. This suggests the stock could be undervalued from a cash flow perspective. Which outlook provides the more accurate value signal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NGEx Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NGEx Minerals Narrative

If you have a different perspective or would like to dig into the numbers for yourself, you can assemble your own narrative in just a few minutes. Do it your way

A great starting point for your NGEx Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss the chance to uncover unique stocks and sectors that could strengthen your portfolio. These ideas are just waiting to be found on Simply Wall Street.

- Capture fast-growing yields by checking out these 22 dividend stocks with yields > 3% and see which income powerhouses are rewarding investors with superior dividend payouts.

- Spot tomorrow’s industry leaders when you review these 26 AI penny stocks and watch how AI innovation is transforming the investment landscape.

- Position yourself ahead of the next market movers by exploring these 3584 penny stocks with strong financials with proven financials backing their growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and fair value.

Market Insights

Community Narratives