Methanex (TSX:MX) Profit Margin Rebound Reinforces Bullish Narratives Despite Cautious Earnings Outlook

Reviewed by Simply Wall St

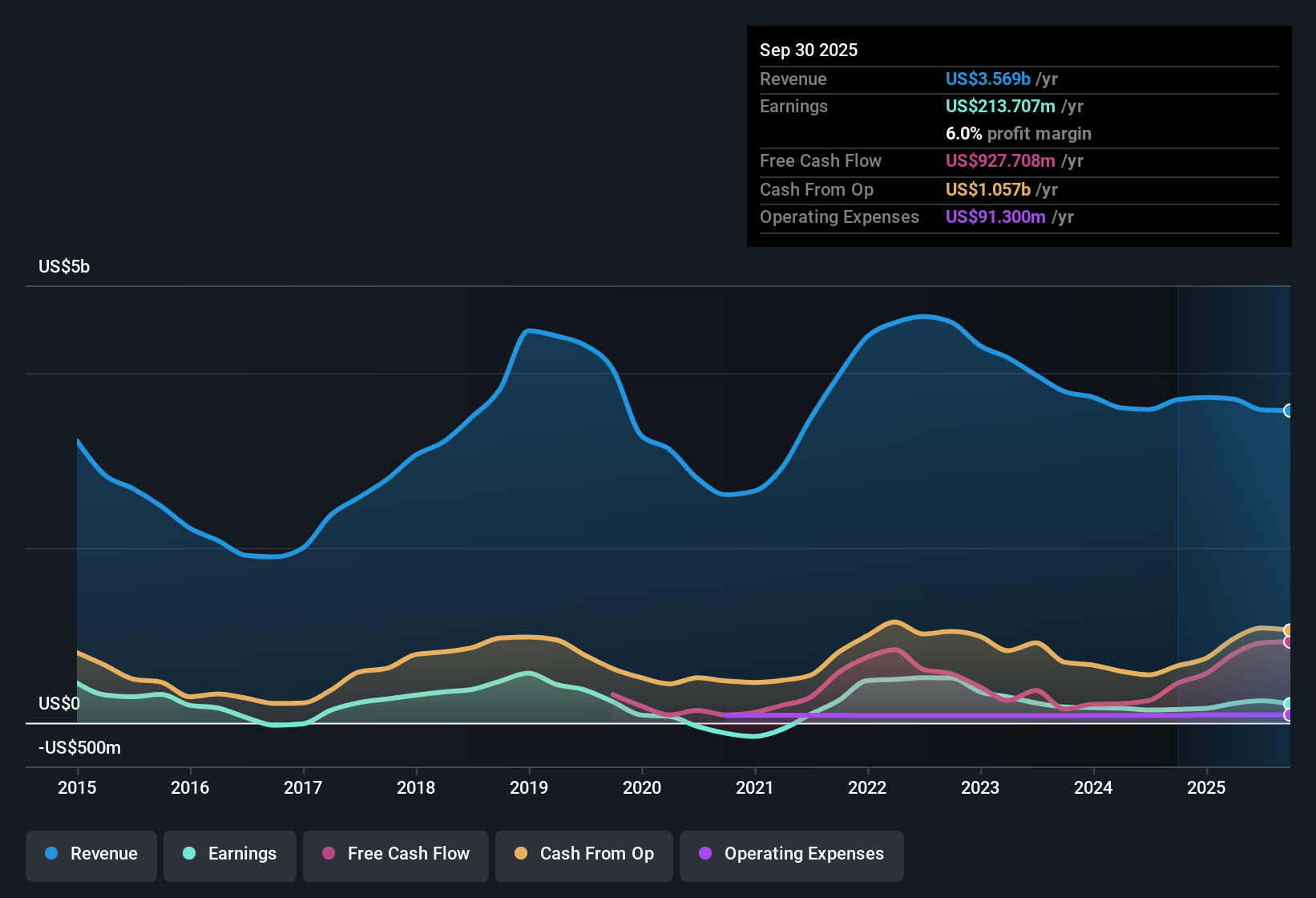

Methanex (TSX:MX) delivered headline growth in its latest results, with revenue forecasted to rise by 7.1% per year, beating the broader Canadian market’s 5% growth rate. Net profit margins reached 7%, up significantly from last year’s 4.1%, and earnings growth surged 73.1% over the past year, well above the company’s 10.7% annual average over five years. These numbers point to a strong uptick in profitability trends that could shape how investors view Methanex going forward.

See our full analysis for Methanex.Now let’s put those results side by side with the key market narratives to see exactly where consensus is confirmed and where new questions might be raised.

See what the community is saying about Methanex

Debt Reduction Plan Targets $550-$600 Million

- Methanex plans to pay down $550 million to $600 million in debt over the next 18 months, which is a major move to improve its financial stability and margin resilience.

- Analysts' consensus view sees this deleveraging as a catalyst for operational efficiency, with expectations that boosting free cash flow will help support both net margin improvements and greater shareholder returns.

- Consensus narrative highlights that strong free cash flow has enabled this strategy, aiming to reinforce financial strength.

- If successfully executed, lower debt could reduce interest costs, freeing up resources for growth or distributions.

- Consensus narrative notes these moves are set against the backdrop of improving net margins, which are forecast to rise from 4.4% to 9.3% within three years, enhancing the company's earnings power.

- Browse the full consensus narrative to see how analysts weigh Methanex's leverage plan and public signals for future stability. 📊 Read the full Methanex Consensus Narrative.

Acquisition of OCI Brings Capacity Upside, but With Integration Hurdles

- The recent acquisition of OCI is expected to expand Methanex's production capacity and broaden its market reach, but flagging by analysts points to potential integration challenges that could impact cost control and margin gains.

- Consensus narrative recognizes that pulling off the operational synergies from OCI is crucial for achieving the anticipated earnings uplift.

- Consensus notes that higher capacity, if well integrated, should help meet growing methanol demand forecasted for 2025.

- However, any problems with integration could push up costs or limit profit improvements, moderating some of the bullish projections on margin expansion.

Undervalued Versus Peers and DCF Fair Value

- Methanex trades at a price-to-earnings (P/E) ratio of 10.4x, well below both its peer average of 19.1x and the North American chemicals industry average of 24.6x; the stock price of $47.41 also remains under the DCF fair value estimate of $101.32.

- According to analysts' consensus view, this discount reflects cautious bets on future earnings, as earnings are forecast to decline by 3.2% per year over the next three years, creating a tension between apparent value and the concerns flagged in risk statements.

- Consensus points to the strong profitability uptick and below-average P/E as positives for valuation-focused investors.

- Yet, market caution lingers due to downbeat medium-term earnings forecasts and flagged risks around financial stability and dividend sustainability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Methanex on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? It only takes a few minutes to turn your insights into a personal narrative and share your view. Do it your way

A great starting point for your Methanex research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Methanex’s recent profitability increase, analysts are wary of ongoing debt levels and concerns about medium-term earnings decline impacting overall financial stability.

If you want investments with more secure balance sheets, check out solid balance sheet and fundamentals stocks screener (1981 results). These companies are built to weather uncertainty and offer stronger financial resilience right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MX

Methanex

Produces and supplies methanol in Asia Pacific, North America, Europe, and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives