- Canada

- /

- Metals and Mining

- /

- TSX:LIF

Is Labrador Iron Ore Royalty's Earnings Drop and CFO Change Recasting Its Investment Thesis (TSX:LIF)?

Reviewed by Sasha Jovanovic

- Labrador Iron Ore Royalty Corporation recently reported third quarter 2025 earnings, announcing revenue of C$43.99 million and net income of C$30.45 million, both down from the prior year, along with an upcoming CFO transition as Alan R. Thomas steps down and Stephen D. Pearce takes over.

- Despite slightly higher quarterly revenue year-over-year, the company experienced a pronounced drop in earnings, significantly impacting its year-to-date results.

- We'll explore how the earnings decline and executive change shape Labrador Iron Ore Royalty's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Labrador Iron Ore Royalty's Investment Narrative?

To invest in Labrador Iron Ore Royalty, you have to believe in the enduring strength of Canadian iron ore demand, the reliability of royalty payouts, and the company's unique position as a conduit between a major iron ore operation and income-seeking shareholders. The recent earnings release, showing both quarterly and year-to-date declines in profit despite steady revenue, suggests some of the short-term catalysts, like production recovery or a dividend hike, may be less likely or delayed. Production was already expected at the lower end of guidance, and while the CFO transition appears orderly, ongoing earnings pressure makes cost discipline and capital allocation decisions especially important in the near term. None of this warrants a full-scale change to the risk profile yet, but it places more weight on execution and leaves dividends looking more exposed until earnings recover.

However, the thinner margin for dividend coverage is a risk that investors should pay close attention to.

Exploring Other Perspectives

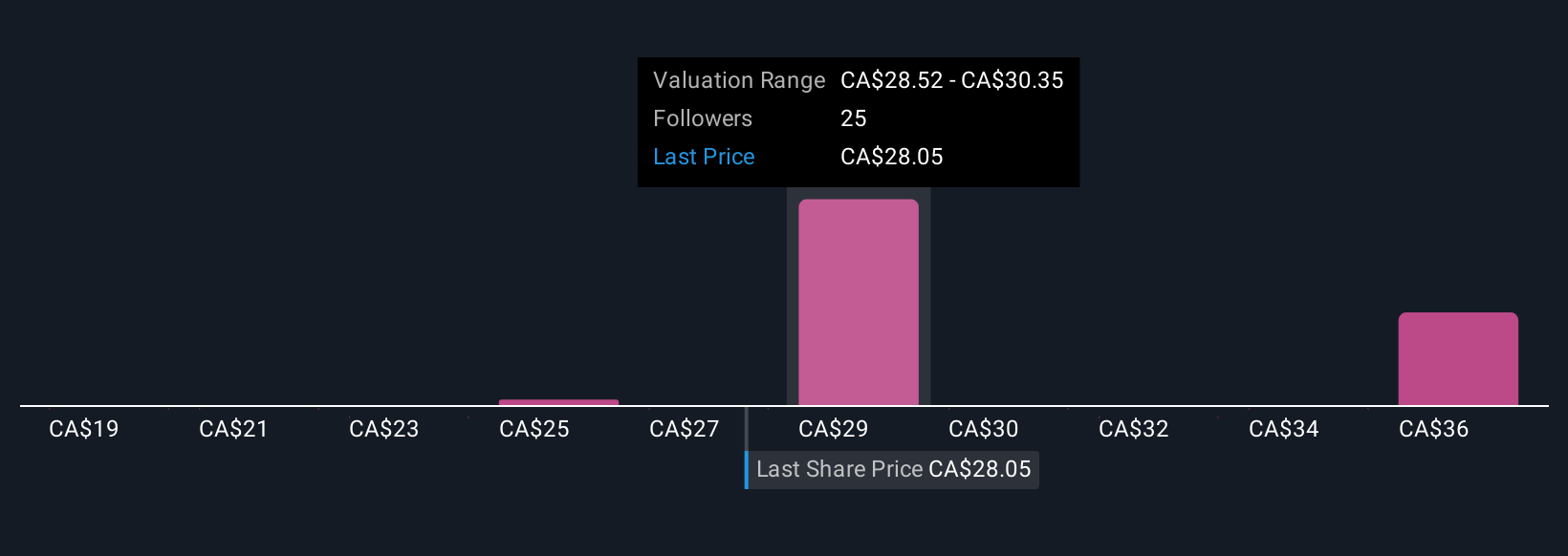

Explore 7 other fair value estimates on Labrador Iron Ore Royalty - why the stock might be worth 24% less than the current price!

Build Your Own Labrador Iron Ore Royalty Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Labrador Iron Ore Royalty research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Labrador Iron Ore Royalty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Labrador Iron Ore Royalty's overall financial health at a glance.

No Opportunity In Labrador Iron Ore Royalty?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LIF

Labrador Iron Ore Royalty

Through its subsidiary, Hollinger-Hanna Limited, holds a 15.10% equity interest in Iron Ore Company of Canada that produces and processes iron ores in Canada.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives