- Canada

- /

- Metals and Mining

- /

- TSX:LAC

Lithium Americas (TSX:LAC) Is Down 11.5% After Reports of Potential US Government Stake in Thacker Pass

Reviewed by Sasha Jovanovic

- Recent media reports indicate that the Trump administration is considering taking up to a 10% stake in Lithium Americas as part of renegotiations for a US$2.26 billion Department of Energy loan tied to its Thacker Pass lithium mine.

- This arrangement could provide significant backing for the company's position in the domestic electric vehicle supply chain, reflecting government interest in securing battery materials.

- We'll examine how potential U.S. government investment and support for Thacker Pass shapes Lithium Americas' long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Lithium Americas' Investment Narrative?

To buy into Lithium Americas as a shareholder, you have to believe in the future of domestic lithium supply and the company’s potential to supply the fast-growing electric vehicle industry. Until now, the main short-term catalyst had been the steady progress at Thacker Pass, with key loans and joint-venture support from General Motors, set against deepening losses and high capital needs. The recent surge in LAC's share price follows news that the Trump administration could take up to a 10% stake and secure federal backing for the US$2.26 billion DOE loan to kickstart the Nevada project. If completed, this government involvement could significantly accelerate funding and permit milestones, reduce financing risk, and even help secure customers via purchase guarantees. This fundamentally shifts both catalyst and risk profiles: closer government ties may bring faster progress, but could also mean new political considerations for shareholders.

However, closer government participation may introduce new uncertainties around ownership and control investors should consider.

Exploring Other Perspectives

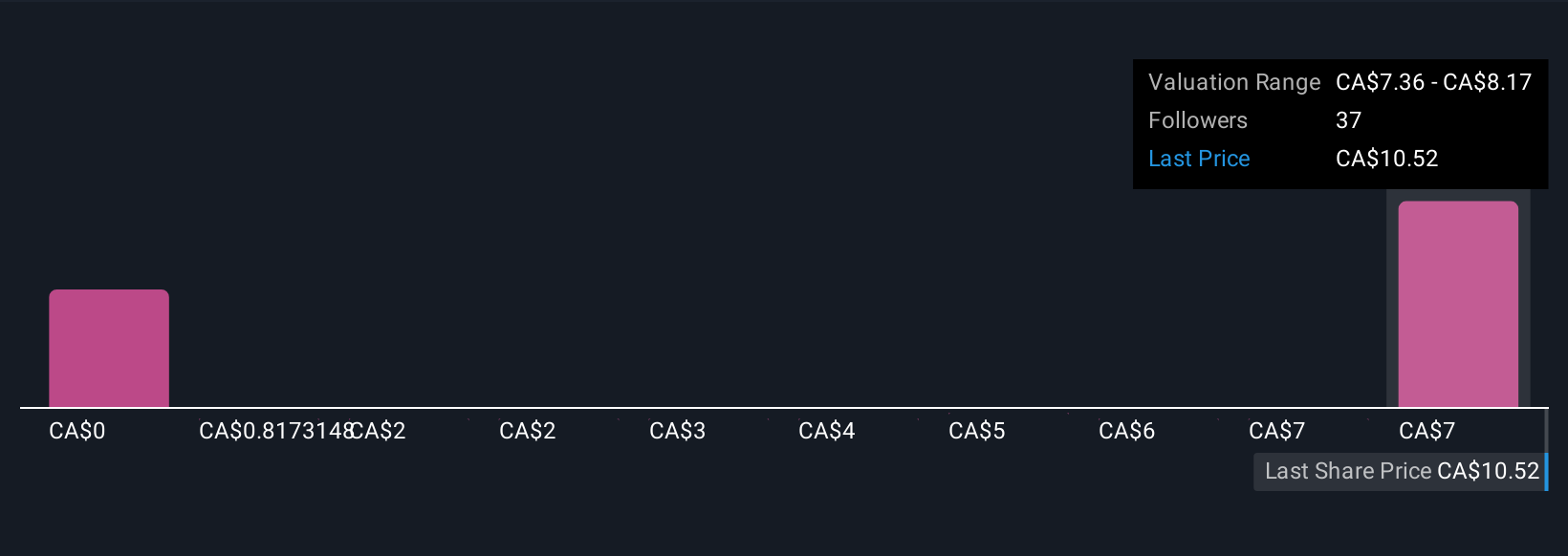

Explore 12 other fair value estimates on Lithium Americas - why the stock might be worth as much as 16% more than the current price!

Build Your Own Lithium Americas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithium Americas research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Lithium Americas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithium Americas' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAC

Lithium Americas

Focuses on developing, building, and operating of lithium deposits and chemical processing facilities in the United States and Canada.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives