- Canada

- /

- Metals and Mining

- /

- TSX:III

Loss-making Imperial Metals (TSE:III) has seen earnings and shareholder returns follow the same downward trajectory over past -43%

It's nice to see the Imperial Metals Corporation (TSE:III) share price up 15% in a week. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 43% in the last three years, falling well short of the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Imperial Metals

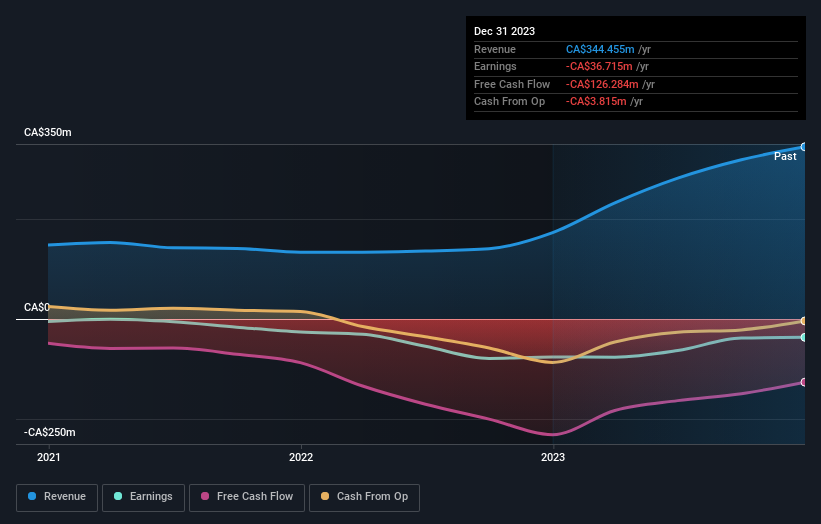

Because Imperial Metals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Imperial Metals saw its revenue grow by 34% per year, compound. That's well above most other pre-profit companies. The share price drop of 13% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It seems likely that actual growth fell short of shareholders' expectations. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Imperial Metals has rewarded shareholders with a total shareholder return of 28% in the last twelve months. That certainly beats the loss of about 1.6% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Imperial Metals , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:III

Imperial Metals

Engages in the exploration, development, and production of base and precious metals in the United States, Switzerland, China, the Philippines, Singapore, and Canada.

Slightly overvalued very low.