- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Should Hudbay Minerals' Q3 Profit Surge and Reaffirmed Outlook Prompt Action From TSX:HBM Investors?

Reviewed by Sasha Jovanovic

- Hudbay Minerals Inc. recently reported third-quarter results showing net income rose to US$222.4 million from US$49.7 million a year ago, reaffirmed its 2025 production guidance, and announced expectations for strong copper and gold output in the fourth quarter after overcoming operational interruptions.

- Despite lower sales and output compared to the prior year, Hudbay achieved significantly higher earnings, highlighting the impact of cost controls, improved efficiency, and resilience in its operations.

- We'll examine how Hudbay's sharply improved earnings amid guidance reaffirmation strengthens its investment narrative and sector positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hudbay Minerals Investment Narrative Recap

To be a Hudbay Minerals shareholder, you need to believe in the company’s ability to drive long-term growth and margin expansion through disciplined execution on large-scale copper projects, especially Copper World, while managing operational risks in Peru and Manitoba. The latest results don’t materially change the most important short-term catalyst, which is restoring and sustaining copper and gold output after recent disruptions, but they do reinforce the company’s resilience. The biggest near-term risk remains potential permitting or execution challenges at key development sites.

Among Hudbay’s latest announcements, the Q4 2025 production guidance reaffirmation stands out. Despite lower third-quarter copper and gold output, management expects a recovery in the coming quarter, highlighting confidence in overcoming recent operational setbacks and supporting the near-term production catalyst.

In contrast, investors should be aware that any future delay or escalation of costs at Copper World could...

Read the full narrative on Hudbay Minerals (it's free!)

Hudbay Minerals' outlook anticipates $2.4 billion in revenue and $373.5 million in earnings by 2028. This is based on a 2.6% annual revenue growth rate and an $84.5 million increase in earnings from the current $289.0 million.

Uncover how Hudbay Minerals' forecasts yield a CA$26.20 fair value, a 25% upside to its current price.

Exploring Other Perspectives

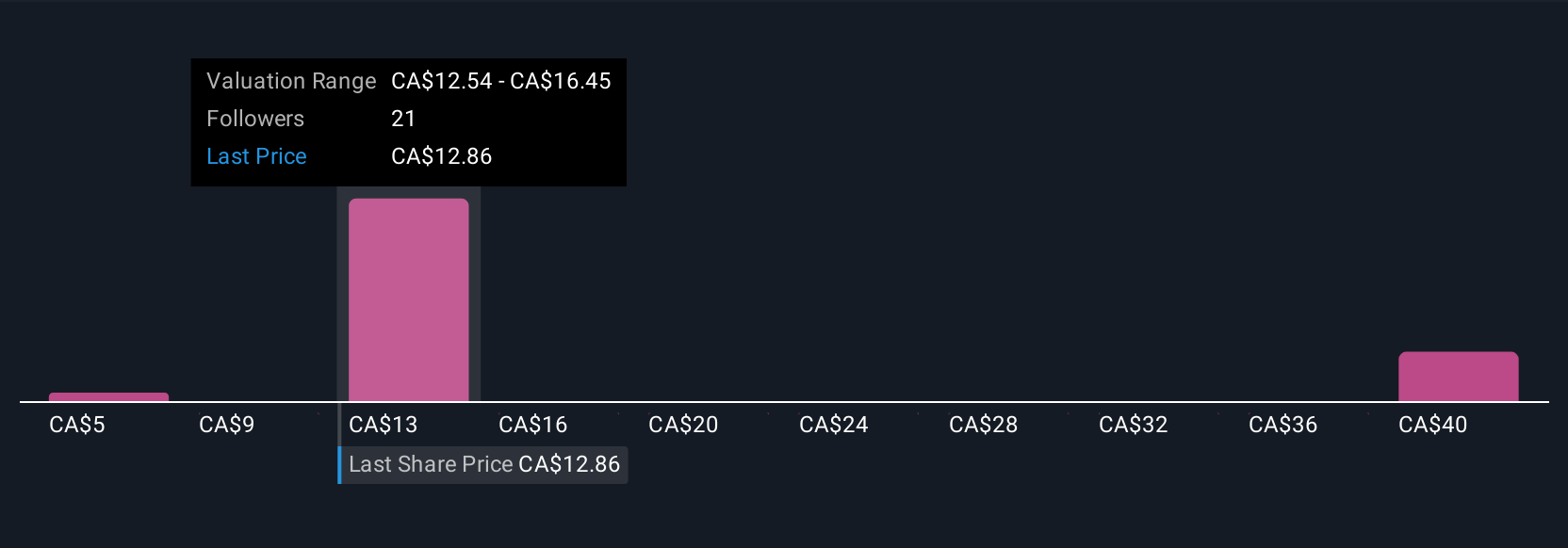

Simply Wall St Community members set fair values for Hudbay Minerals from as low as US$6.60 to as high as US$56.20, based on six separate analyses. These wide-ranging outlooks appear at odds with analyst expectations, given the pivotal importance of execution risk at Copper World for Hudbay’s future earnings and margins, so it’s worth comparing differing views before making decisions.

Explore 6 other fair value estimates on Hudbay Minerals - why the stock might be worth over 2x more than the current price!

Build Your Own Hudbay Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hudbay Minerals research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hudbay Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hudbay Minerals' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success