- Canada

- /

- Metals and Mining

- /

- TSX:GGD

We Take A Look At Why GoGold Resources Inc.'s (TSE:GGD) CEO Has Earned Their Pay Packet

It would be hard to discount the role that CEO Brad Langille has played in delivering the impressive results at GoGold Resources Inc. (TSE:GGD) recently. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 24 March 2022. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for GoGold Resources

How Does Total Compensation For Brad Langille Compare With Other Companies In The Industry?

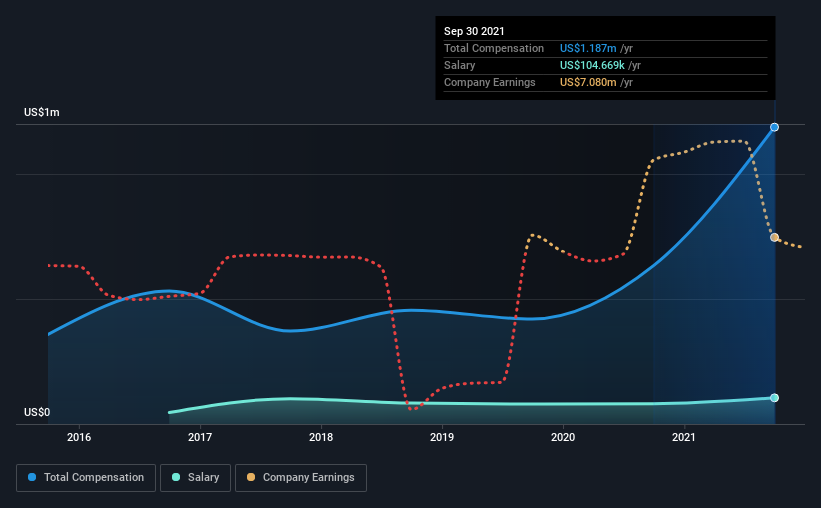

At the time of writing, our data shows that GoGold Resources Inc. has a market capitalization of CA$916m, and reported total annual CEO compensation of US$1.2m for the year to September 2021. That's a notable increase of 87% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$105k.

In comparison with other companies in the industry with market capitalizations ranging from CA$506m to CA$2.0b, the reported median CEO total compensation was US$919k. So it looks like GoGold Resources compensates Brad Langille in line with the median for the industry. Moreover, Brad Langille also holds CA$48m worth of GoGold Resources stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$105k | US$81k | 9% |

| Other | US$1.1m | US$553k | 91% |

| Total Compensation | US$1.2m | US$633k | 100% |

Speaking on an industry level, nearly 86% of total compensation represents salary, while the remainder of 14% is other remuneration. GoGold Resources pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at GoGold Resources Inc.'s Growth Numbers

GoGold Resources Inc.'s earnings per share (EPS) grew 107% per year over the last three years. It achieved revenue growth of 8.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has GoGold Resources Inc. Been A Good Investment?

Most shareholders would probably be pleased with GoGold Resources Inc. for providing a total return of 1,096% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for GoGold Resources that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives