- Canada

- /

- Metals and Mining

- /

- TSX:GGD

GoGold Resources Inc.'s (TSE:GGD) P/S Still Appears To Be Reasonable

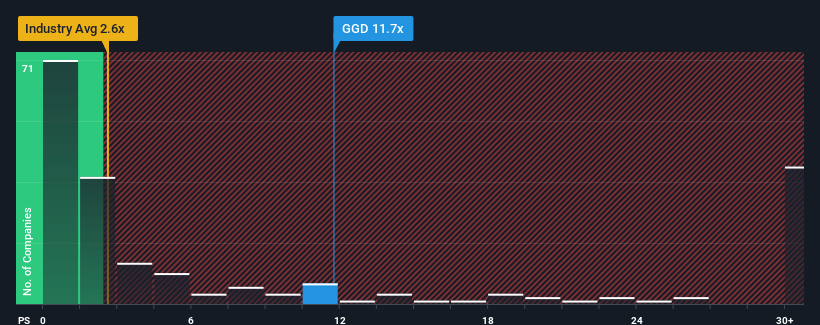

When you see that almost half of the companies in the Metals and Mining industry in Canada have price-to-sales ratios (or "P/S") below 2.6x, GoGold Resources Inc. (TSE:GGD) looks to be giving off strong sell signals with its 11.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for GoGold Resources

How Has GoGold Resources Performed Recently?

While the industry has experienced revenue growth lately, GoGold Resources' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think GoGold Resources' future stacks up against the industry? In that case, our free report is a great place to start.How Is GoGold Resources' Revenue Growth Trending?

In order to justify its P/S ratio, GoGold Resources would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 27% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 3.1% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 34% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 22%, which is noticeably less attractive.

In light of this, it's understandable that GoGold Resources' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into GoGold Resources shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for GoGold Resources that you need to be mindful of.

If you're unsure about the strength of GoGold Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives