- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Fortuna Mining (TSX:FVI): Valuation in Focus After Diamba Sud Gold Project Economic Assessment Highlights Strong Growth Potential

Reviewed by Simply Wall St

Fortuna Mining (TSX:FVI) has just released the Preliminary Economic Assessment for its Diamba Sud Gold Project in Senegal. The company outlined a new open-pit mine and carbon-in-leach processing plant. The assessment details strong project returns and a quick payback period, drawing attention from investors.

See our latest analysis for Fortuna Mining.

The news of a rapid payback and robust economics has been a clear catalyst for Fortuna Mining, with investor enthusiasm reflected in a year-to-date share price return of nearly 74%. While there was a dip in the past week, the company’s one-year total shareholder return still stands at an impressive 59%. The three-year figure also showcases substantial long-term momentum.

If you’re watching gold miners’ fortunes shift, now is a timely moment to explore opportunities beyond the obvious with our fast growing stocks with high insider ownership.

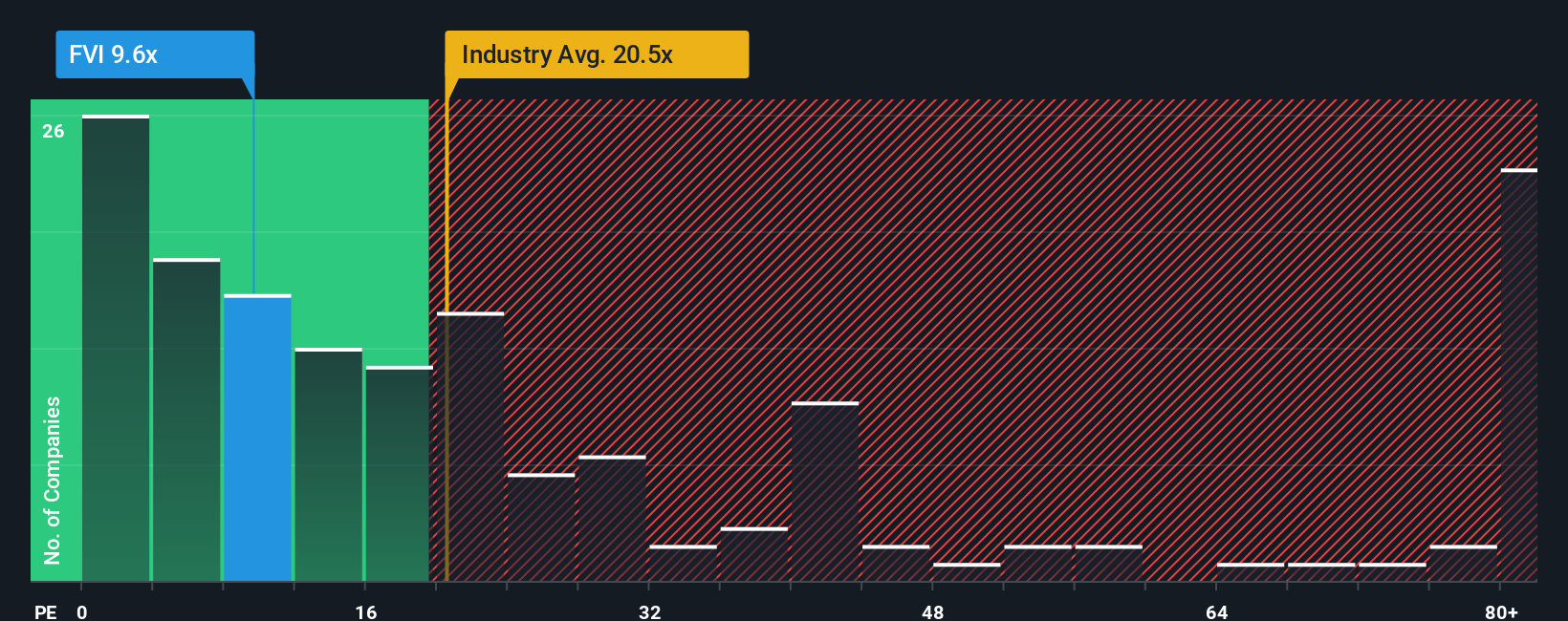

Yet with all the excitement around Diamba Sud and a share price running ahead of peers, the question remains whether Fortuna Mining is trading below its true worth or if the market is already factoring in all future upside potential.

Most Popular Narrative: 16% Undervalued

Compared to the last closing price of CA$11.46, the narrative sets a notably higher fair value for Fortuna Mining. This points to solid upside potential based on projected operational and financial improvements.

Expansion projects and exploration in West Africa and Latin America position Fortuna to boost production, access new revenue streams, and support long-term growth. Operational efficiencies, rising precious metals prices, and improved ESG performance collectively strengthen profitability, reduce risks, and enhance earnings stability.

Want to know why analysts are so bullish? The fair value is built around bold production plans and a leap in future profits. What are the numbers driving these high hopes, and how do they compare to industry averages? Unpack the key projections that might reset expectations for Fortuna Mining’s next chapter.

Result: Fair Value of CA$13.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on a few assets and high operating costs could challenge future growth if project execution falls short or if gold prices reverse.

Find out about the key risks to this Fortuna Mining narrative.

Another View: Analyst Price Target Versus Market Price

Looking from the angle of analyst consensus, the average price target for Fortuna Mining sits at CA$9.92, which is actually about 8% below the current share price. This indicates that, while one model sees upside, the analyst view suggests the market may have already priced in most of the good news. Is the gap between analyst caution and narrative optimism a sign of unrealized value or looming risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortuna Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortuna Mining Narrative

If you prefer to chart your own course or disagree with the current view, dive into the data and craft a personal outlook in just minutes with our Do it your way.

A great starting point for your Fortuna Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Opportunities?

Why stop at one winning idea? Confidently step into new sectors and spot potential before the crowd by leveraging data-driven screens tailored for today’s market.

- Unlock future profits by targeting under-the-radar gems with these 3570 penny stocks with strong financials, which boast strong financials and breakout potential.

- Accelerate your portfolio’s tech edge when you hunt for the next big thing in artificial intelligence, starting with these 27 AI penny stocks.

- Boost your passive income with these 17 dividend stocks with yields > 3% offering yields above 3% for consistent, long-term rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives