- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Franco-Nevada (TSX:FNV): Evaluating Valuation After Investor Shift on Geopolitical Risk and Precious Metals Sentiment

Reviewed by Simply Wall St

Recent news points to a shift in precious metals, as investors trim positions with fading geopolitical risks. This changing sentiment is affecting gold stocks like Franco-Nevada (TSX:FNV), even after considerable gains this year.

See our latest analysis for Franco-Nevada.

Franco-Nevada’s share price has pulled back 14.6% over the past month as investors reassess precious metals in light of easing global tensions. Still, momentum is far from lost. The stock is up an impressive 51.6% year-to-date, and its 44.5% total shareholder return over the past year suggests long-term optimism remains for gold-focused names like FNV.

If you’re looking beyond gold for other strong performers, this could be the perfect time to discover fast growing stocks with high insider ownership.

After such rapid gains and a recent pullback, the big question is whether Franco-Nevada’s strong fundamentals and growth are already priced in or if there is still real upside for new investors from here.

Most Popular Narrative: 18.2% Undervalued

According to the most widely followed narrative, Franco-Nevada’s latest fair value estimate sits well above the last close. This indicates analysts expect further upside even after the recent surge. This sets the stage for a closer look at what justifies such optimism, especially given the stock’s already impressive run and high expectations built into its current price.

Robust, record-level gold prices combined with ongoing global inflation concerns and monetary debasement are driving record royalty revenues and expanding margins for Franco-Nevada. This strengthens top-line revenue growth and leads to higher operating and net margins.

Want the real story behind the market’s bold price target? The narrative is built on relentless growth forecasts, margin resilience, and extraordinary forward-looking assumptions rarely seen outside tech’s elite. Unpack which future metrics make this valuation stand out from the rest.

Result: Fair Value of $323.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as falling gold prices or disruptions at major assets like Candelaria could quickly undermine the current growth outlook for Franco-Nevada.

Find out about the key risks to this Franco-Nevada narrative.

Another View: Market Ratios Signal Caution

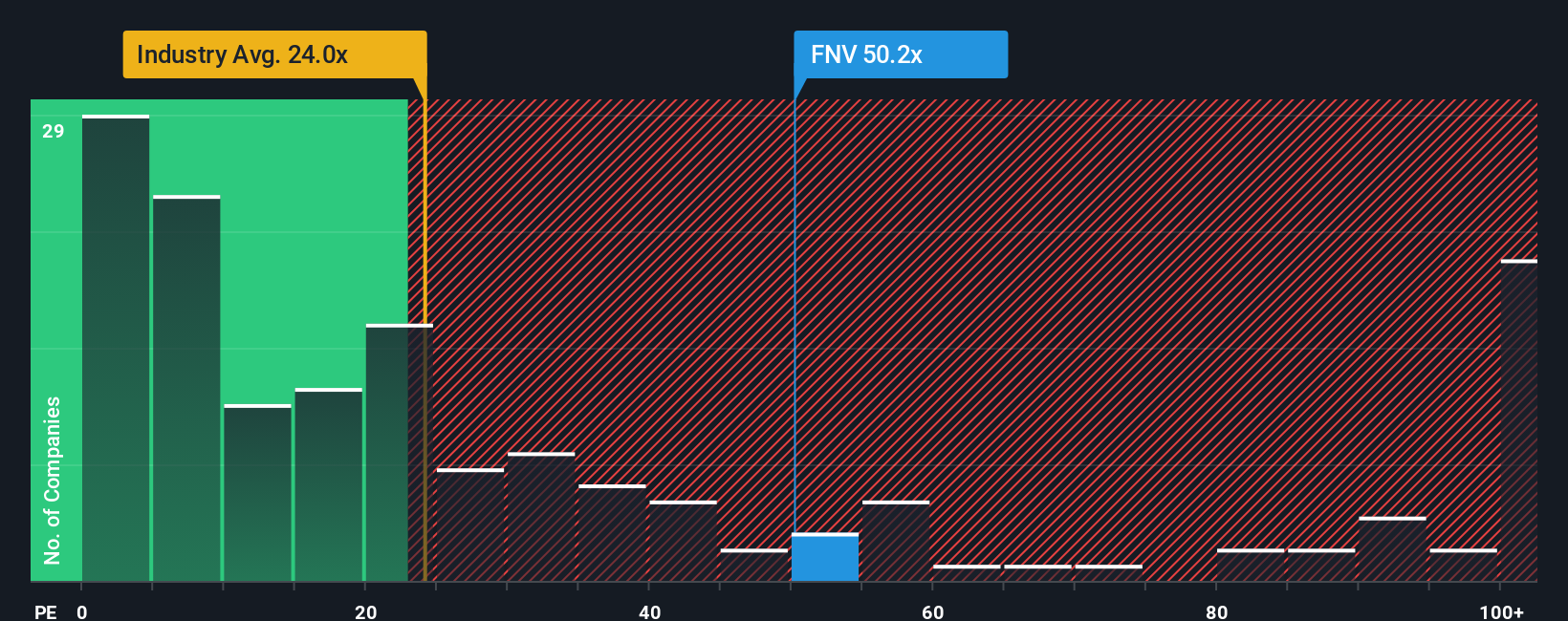

Looking from another perspective, Franco-Nevada’s current price-to-earnings ratio is 46.4x. This is significantly higher than both the Canadian Metals and Mining industry average of 21.2x and the peer average of 30.7x. Even when compared to its estimated fair ratio of 24.6x, Franco-Nevada appears expensive.

This kind of premium may reflect expectations for future growth, but it also introduces valuation risk if those expectations are not met. Is this high price justified, or is the market facing potential disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franco-Nevada Narrative

Curious to see if the data supports your own view, or want to dig a little deeper? You can easily craft a personalized take in just a few minutes by using Do it your way.

A great starting point for your Franco-Nevada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities slip past you. The Simply Wall Street Screener uncovers stocks making waves so you can take charge and find your next move before the crowd catches on.

- Unlock powerful growth potential by checking out these 26 AI penny stocks that are transforming entire industries with artificial intelligence innovation.

- Boost your portfolio income with these 24 dividend stocks with yields > 3% offering strong yields above 3% and robust financial health.

- Capitalize on hidden value plays through these 838 undervalued stocks based on cash flows based on solid cash flow fundamentals and long-term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives