- Canada

- /

- Metals and Mining

- /

- TSX:FNV

A Fresh Look at Franco-Nevada (TSX:FNV) Valuation After Record Profit, Revenue, and Dividend Increase

Reviewed by Simply Wall St

Franco-Nevada (TSX:FNV) delivered record third-quarter profit and revenue, supported by strong gold prices, increased precious metal deliveries, and a series of new acquisitions. The company also issued updated sales guidance and announced a dividend increase.

See our latest analysis for Franco-Nevada.

Franco-Nevada’s latest run of record results comes after positive headlines, including six new acquisitions, a dividend hike, and optimism about the Cobre Panama restart. The recent year-to-date share price return of 54.4% shows momentum building. The one-year total shareholder return of nearly 60% highlights both the company’s strong capital gains and dividend appeal over the longer term.

If you’re interested in what else is working in today’s volatile market, now’s a smart time to broaden your approach and discover fast growing stocks with high insider ownership

But with the stock up more than 50% year to date and now trading close to analyst price targets, the key question is whether Franco-Nevada remains undervalued or if the market has already priced in its future growth potential.

Most Popular Narrative: 20.1% Undervalued

Compared to the last close of CA$269.47, the narrative’s fair value estimate of CA$337.23 suggests there could be material upside for Franco-Nevada. Here is what is driving this standout target from the market’s most widely followed viewpoint.

Robust, record-level gold prices combined with ongoing global inflation concerns and monetary debasement are driving record royalty revenues and expanding margins for Franco-Nevada. This strengthens top-line revenue growth and leads to higher operating and net margins.

Want to know what is behind this high target? Discover which exponential growth assumptions and bold margin projections could change the entire valuation landscape for Franco-Nevada. The full narrative unpacks a financial playbook you cannot afford to miss.

Result: Fair Value of $337.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on high gold prices and concentrated revenue sources could quickly challenge the bull case if market conditions shift unexpectedly.

Find out about the key risks to this Franco-Nevada narrative.

Another View: What Does the Market Multiple Say?

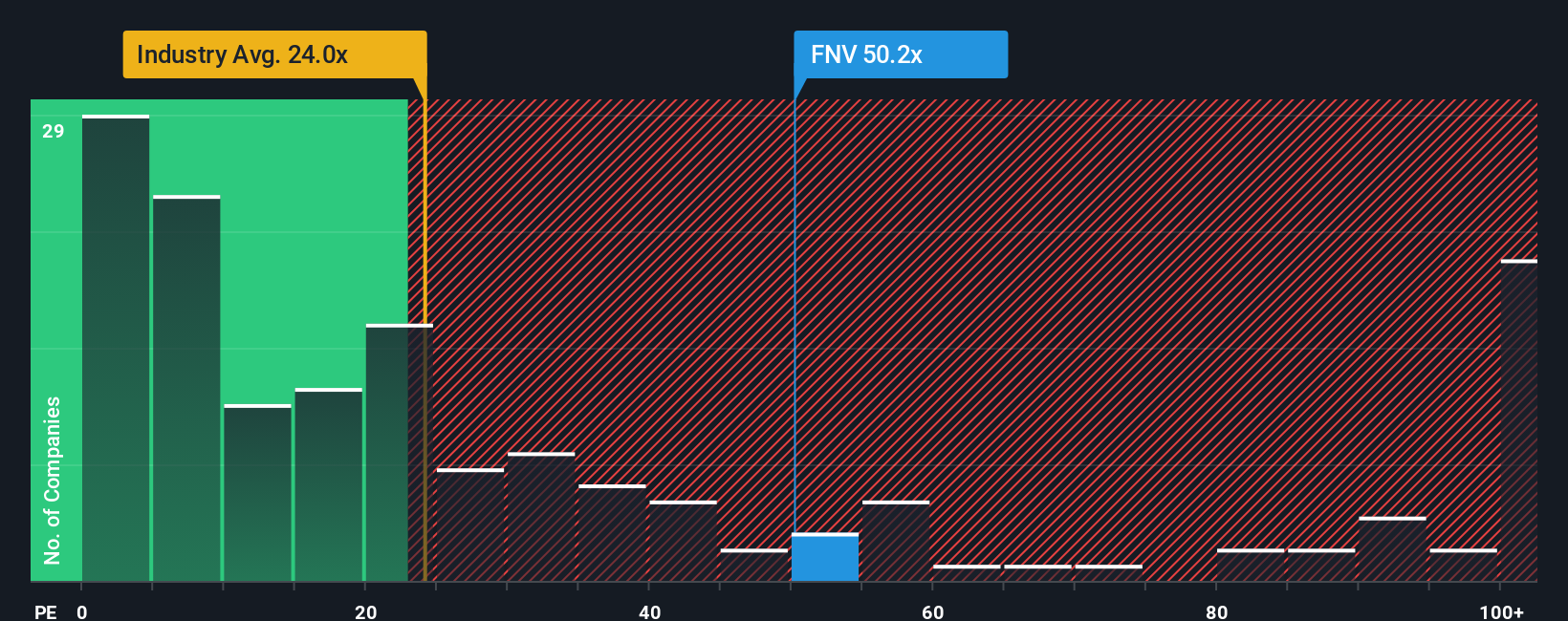

Looking at Franco-Nevada’s price-to-earnings ratio of 40.3x, the stock trades much higher than its Canadian Metals and Mining peers at 20.1x, and above the fair ratio of 27.3x estimated for its fundamentals. This steep premium means extra valuation risk if the market’s current optimism fades. Is this justified by growth, or are investors paying up too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franco-Nevada Narrative

If you would like to test different assumptions or dig into the numbers yourself, it only takes a few minutes to build your own storyline. Do it your way

A great starting point for your Franco-Nevada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with opportunities others might be missing. Uncover compelling stocks across different trends using these powerful tools from Simply Wall Street:

- Boost your income by targeting reliable payers through these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Stay ahead of the curve by tapping into innovation with these 24 AI penny stocks powering the rapid evolution of artificial intelligence.

- Capture value now by zeroing in on these 870 undervalued stocks based on cash flows that the market has overlooked, but might not for long.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives