- Canada

- /

- Metals and Mining

- /

- TSX:ERO

Revenues Not Telling The Story For Ero Copper Corp. (TSE:ERO) After Shares Rise 25%

Those holding Ero Copper Corp. (TSE:ERO) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

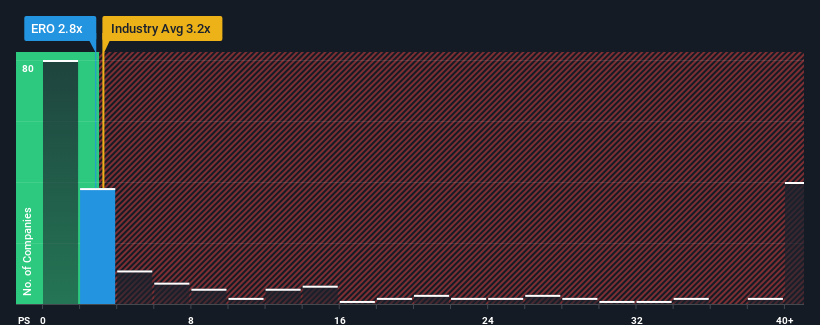

Even after such a large jump in price, there still wouldn't be many who think Ero Copper's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in Canada's Metals and Mining industry is similar at about 3.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Ero Copper

How Has Ero Copper Performed Recently?

Ero Copper could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Ero Copper's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Ero Copper?

The only time you'd be comfortable seeing a P/S like Ero Copper's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 4.0% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 50% each year, which is noticeably more attractive.

In light of this, it's curious that Ero Copper's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Ero Copper appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Ero Copper's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for Ero Copper you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives