- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Is Equinox Gold’s 98% Rally in 2025 Justified After Strong Gold Price Surge?

Reviewed by Bailey Pemberton

If you’re trying to make sense of Equinox Gold’s stock right now, you’re not alone. With a closing price of $15.17 and an almost unbelievable 98% jump year to date, it’s no wonder investors are taking another look. The past month alone has seen the stock climb 20.6%, and those who bought in three years ago are sitting on a 214.7% total return. Yes, gold’s recent momentum and shifting global financial trends have created a tailwind. There is clearly something about Equinox Gold that has been catching the market’s eye and possibly recalibrating the stock’s risk profile.

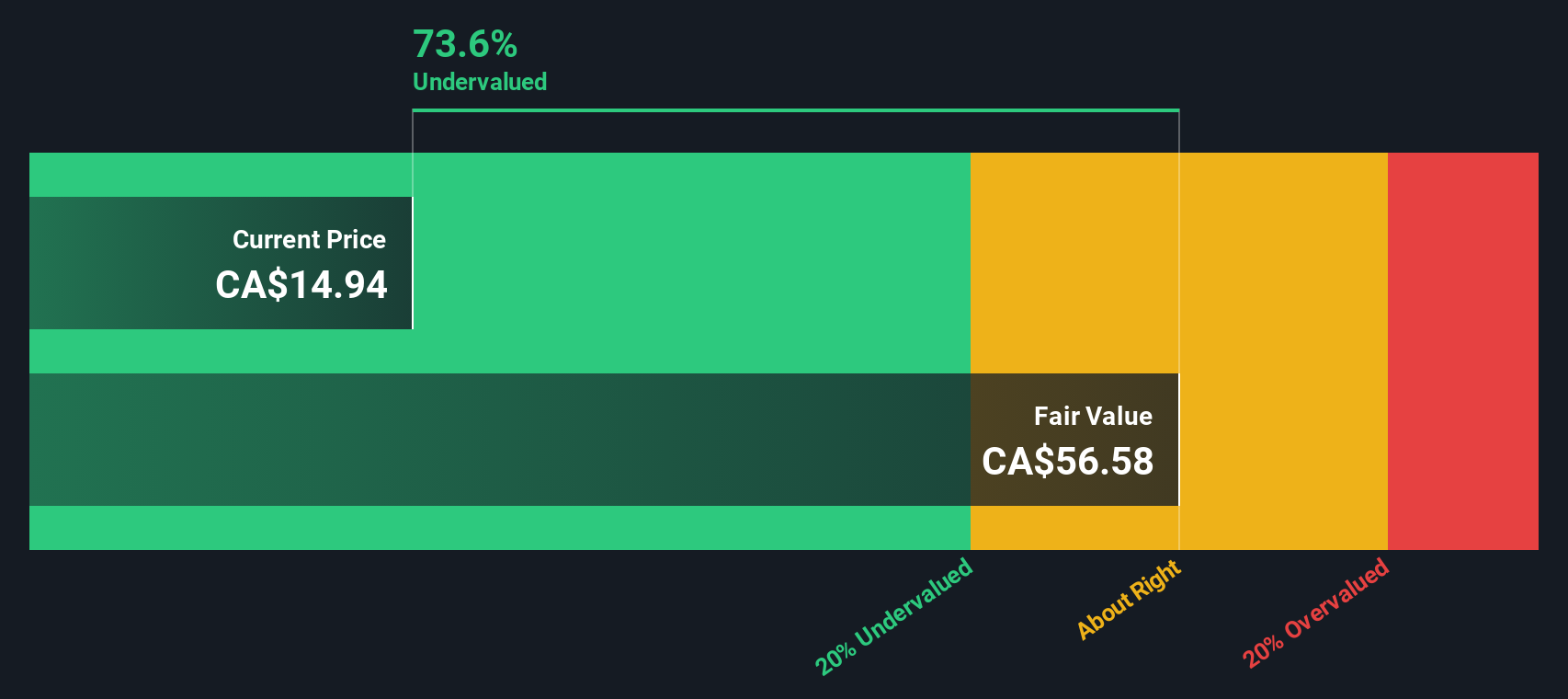

If you’re looking for underappreciated value, Equinox Gold’s numbers beg for a deeper look. Out of six key valuation checks, the company is undervalued in four, giving it a solid value score of 4. That suggests there is real potential for investors who like to buy what’s overlooked, but also reason to pay attention if you like a margin of safety.

So, is this run-up getting ahead of itself or could the valuation still stack up even at these new highs? Let’s break down how Equinox Gold fares across different valuation methods. More importantly, this can reveal a smarter way to judge whether its current price truly offers value.

Approach 1: Equinox Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its expected future cash flows and then discounting those amounts back to today's value. This approach focuses on how much cash the business is forecast to generate, looking well beyond just next year's results.

For Equinox Gold, the latest Free Cash Flow (FCF) reported is actually negative at $-98.5 Million, but projections show a substantial turnaround. Analysts estimate strong cash flow growth, with annual FCF expected to reach $813 Million by 2028. Further out, projections (via Simply Wall St extrapolations) indicate that FCF should settle into a more stable trajectory, gradually tapering off but still remaining solidly positive through 2035.

Applying this outlook, the DCF model arrives at an intrinsic value of $15.51 per share. Compared to the current share price of $15.17, this suggests Equinox Gold is about 2.2% undervalued according to this method. In practical terms, the stock is trading very close to its fair value based on expected cash flow fundamentals.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Equinox Gold's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Equinox Gold Price vs Sales

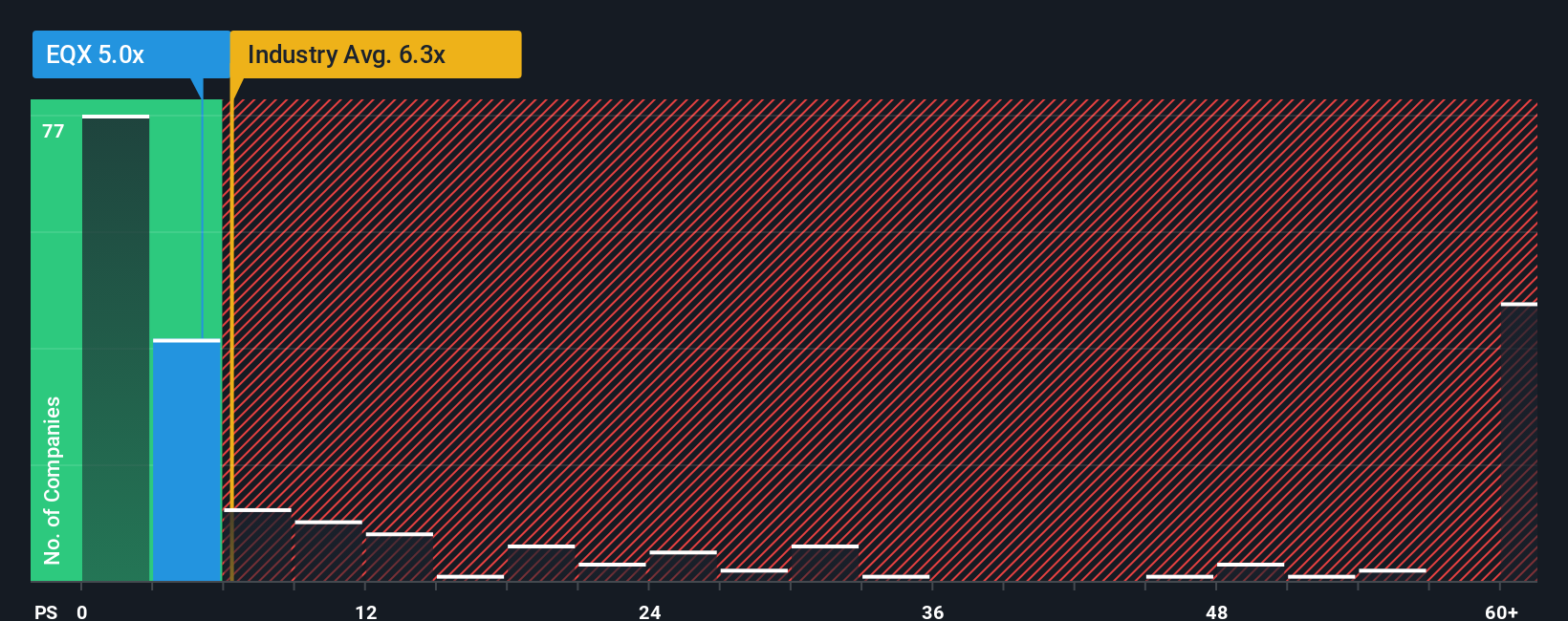

For companies in the metals and mining sector, the Price-to-Sales (P/S) ratio is a valuable metric, especially when recent or projected earnings are volatile or impacted by big investments. The P/S ratio compares a company's market value to its revenue and gives investors insight into how the market values each dollar of sales. This can serve as a useful anchor in industries where profit margins can swing widely due to commodity prices or capital spending.

Growth expectations and company-specific risks help determine what a “fair” P/S ratio should be. If a company is expected to deliver robust revenue growth with stable operations, investors might be willing to pay a premium for its sales. In contrast, uncertain outlooks or higher perceived risks typically compress acceptable multiples.

Currently, Equinox Gold trades at a P/S ratio of 4.34x. This is below the metals and mining industry average of 5.62x and also well beneath the peer group average of 11.27x. However, simply comparing to these benchmarks does not address the unique qualities and prospects of Equinox Gold itself. This is where Simply Wall St's “Fair Ratio” stands out. The Fair Ratio for Equinox Gold is 5.53x, and this model weighs factors such as Equinox’s revenue growth, risk profile, profit margins, industry dynamics, and market cap to arrive at a more personalized benchmark. It provides a more nuanced view than broad comparisons alone.

With Equinox Gold's current P/S ratio at 4.34x and the Fair Ratio at 5.53x, the stock appears attractively priced and even undervalued based on this analysis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equinox Gold Narrative

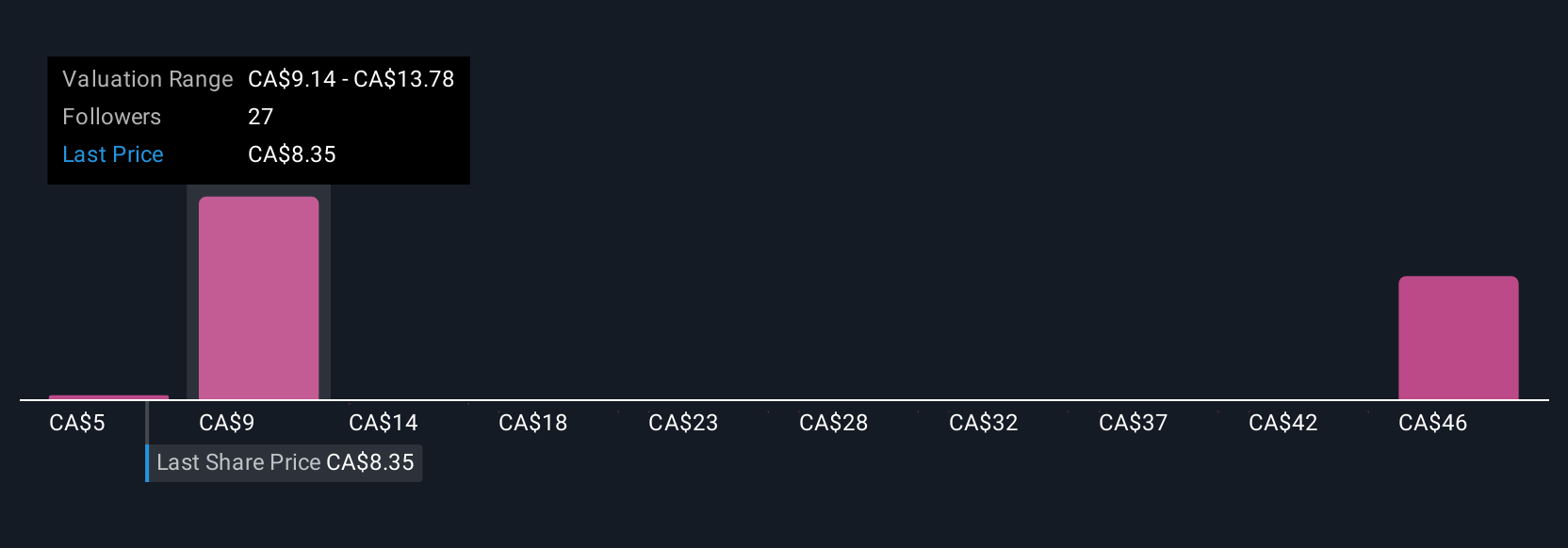

Earlier, we mentioned a smarter way to approach valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, combining your view of its prospects and risks with the numbers—what you believe about future revenue, margins, and ultimately, fair value.

With Narratives, you connect the company's story to a financial forecast, and then see what fair value that perspective supports. This makes it more meaningful than just using general ratios or analyst averages. Narratives are easy to access on Simply Wall St's Community page, where millions of investors share and refine their views in real time.

This tool allows you to test your own assumptions. When the fair value from your Narrative is above today's price, it is a potential buy signal. If it is below, it may suggest waiting or selling. Narratives also stay up to date, automatically adjusting whenever earnings or important news is released so your judgement stays relevant.

For example, some investors believe Equinox Gold is worth as much as CA$16.24, betting on strong ramp-ups and higher gold prices. Others are more cautious with a target near CA$9.47, focusing on operational and regulatory risks.

Do you think there's more to the story for Equinox Gold? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives