- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Eldorado Gold (TSX:ELD) Earnings Surge 137.7%, Reinforcing Bullish Growth Narratives

Reviewed by Simply Wall St

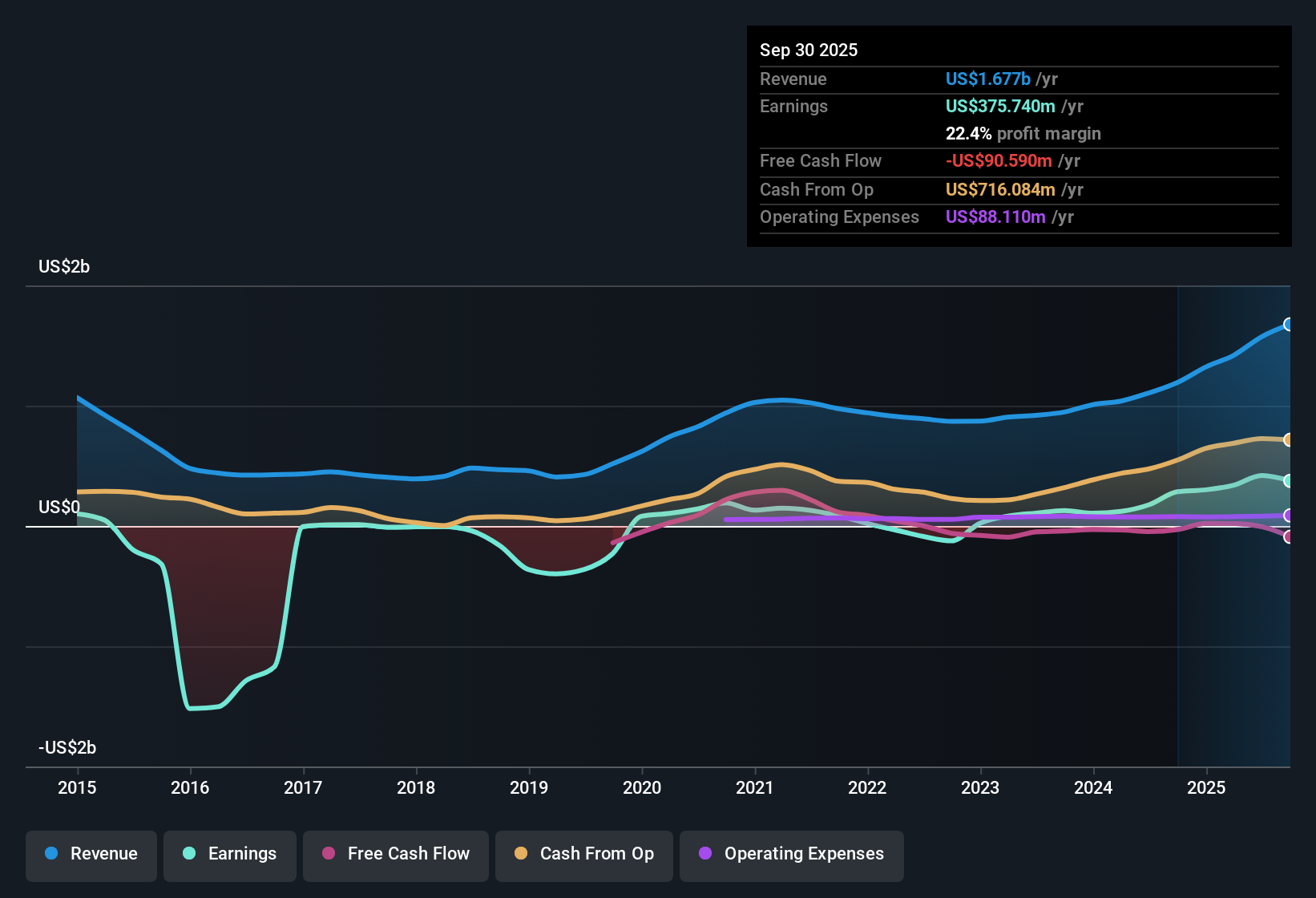

Eldorado Gold (TSX:ELD) posted a 137.7% surge in annual earnings growth, far outpacing its five-year average of 33.4% per year. Net profit margins also climbed, hitting 26.7% compared to last year’s 16%. With profit and revenue forecast to expand well ahead of the Canadian market and no flagged risks to cloud the outlook, investors are eyeing the company’s high-quality earnings and favorable valuation as compelling rewards for the quarter.

See our full analysis for Eldorado Gold.Next up, we will see how these standout results measure up against the key narratives guiding investor sentiment. We will also highlight where the numbers reinforce or challenge expectations.

See what the community is saying about Eldorado Gold

Production Set to Jump with Skouries Mine

- The Skouries copper-gold project, targeting commissioning in Q1 2026, is expected to materially increase total production volumes and EBITDA margins because of its high grades and lower costs relative to current operations.

- Consensus narrative notes this production boost, alongside ongoing optimization at existing sites, positions Eldorado Gold for stronger margins and enhanced free cash flow.

- Ongoing site improvements at Kişladağ and Lamaque are specifically forecast to reduce all-in sustaining costs, which may improve net margins beyond the recent 26.7%.

- These projects are timed with industry-wide tightening supply and resilient gold prices, supporting the view that Eldorado could capture market share as a low-cost producer.

Margin Expansion Faces Cost Headwinds

- All-in sustaining costs (AISC) currently stand at $1,520 per ounce and are expected to remain at, or above, the high end of guidance for the full year, reflecting persistent cost pressures from labor, royalties, and taxes.

- The consensus narrative warns that while margin improvement is possible, operational risks such as labor cost inflation, permitting delays, and technical challenges at Skouries could compress net profit margins and dampen the earnings growth outlook.

- For example, the company’s exposure to regulatory and geopolitical risks in Greece and Turkey could impact reliable production, with recent permitting delays at Olympias and earlier contractor issues highlighting these sensitivities.

- With capital outlays and investments increasing reliance on debt, sustainability of margin expansion will hinge on balancing cost control against growth investments over the next several years.

Discounted Valuation Versus Industry Peers

- Eldorado Gold trades at a 12.2x price-to-earnings ratio, below both the peer average (22.3x) and the Canadian metals and mining industry average (21.2x), and currently sits well below its DCF fair value of $389.71 per share.

- According to the consensus narrative, analysts see the current share price near CA$35.95 as fairly valued relative to their price target of 49.71, though some expect long-term upside if operational catalysts are delivered.

- The relatively tight gap between the current share price and consensus target suggests skepticism that all future growth and cost improvements will materialize as forecast.

- However, strong share buybacks and project-level financing activity signal management’s confidence that the stock's intrinsic value is underappreciated by the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Eldorado Gold on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique interpretation of the results? Shape your insights and contribute your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Eldorado Gold.

See What Else Is Out There

Despite robust earnings, Eldorado Gold faces significant cost pressures and rising debt levels. These factors could limit margin expansion and challenge its financial strength.

For investors seeking companies with healthier finances, check out solid balance sheet and fundamentals stocks screener (1981 results) that highlight strong balance sheets and fundamentals built for resilience over the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives