- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Did Eldorado Gold's (TSX:ELD) Tighter Outlook and Buyback Mark a Shift in Capital Discipline?

Reviewed by Sasha Jovanovic

- In recent weeks, Eldorado Gold tightened its 2025 gold production guidance to 470,000–490,000 ounces and reported third quarter output of 115,190 ounces, reflecting a slight decrease year-on-year, while repurchasing 2,015,696 shares for US$53.22 million as part of its ongoing buyback initiative.

- The guidance revision, together with the completion of a significant share buyback, signals management's active approach toward operational performance and capital allocation at a time of industry-wide cost pressures.

- We will examine how Eldorado Gold's narrowed production outlook and completed share buyback factor into its ongoing investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Eldorado Gold Investment Narrative Recap

To be a shareholder in Eldorado Gold, you need to have confidence in the company’s ability to steadily optimize production, control costs, and unlock value from upcoming projects like Skouries. The recent news, including tightened 2025 gold production guidance and a completed buyback of 2,015,696 shares for US$53.22 million, does not directly change the short-term outlook for Skouries commissioning, but persistent all-in sustaining cost (AISC) pressures remain the most prominent risk noted by analysts. Among recent company actions, the completed buyback stands out. Share repurchases remove shares from circulation, which can provide some support for per-share metrics, but amid ongoing cost challenges, the investment case is still reliant on the company improving operating efficiency and executing on near-term catalysts like optimizing flagship sites. Yet, when it comes to rising costs and sustained margin pressures, investors should also be aware that ...

Read the full narrative on Eldorado Gold (it's free!)

Eldorado Gold's narrative projects $3.2 billion in revenue and $1.0 billion in earnings by 2028. This requires 26.5% yearly revenue growth and a $579.7 million increase in earnings from the current $420.3 million.

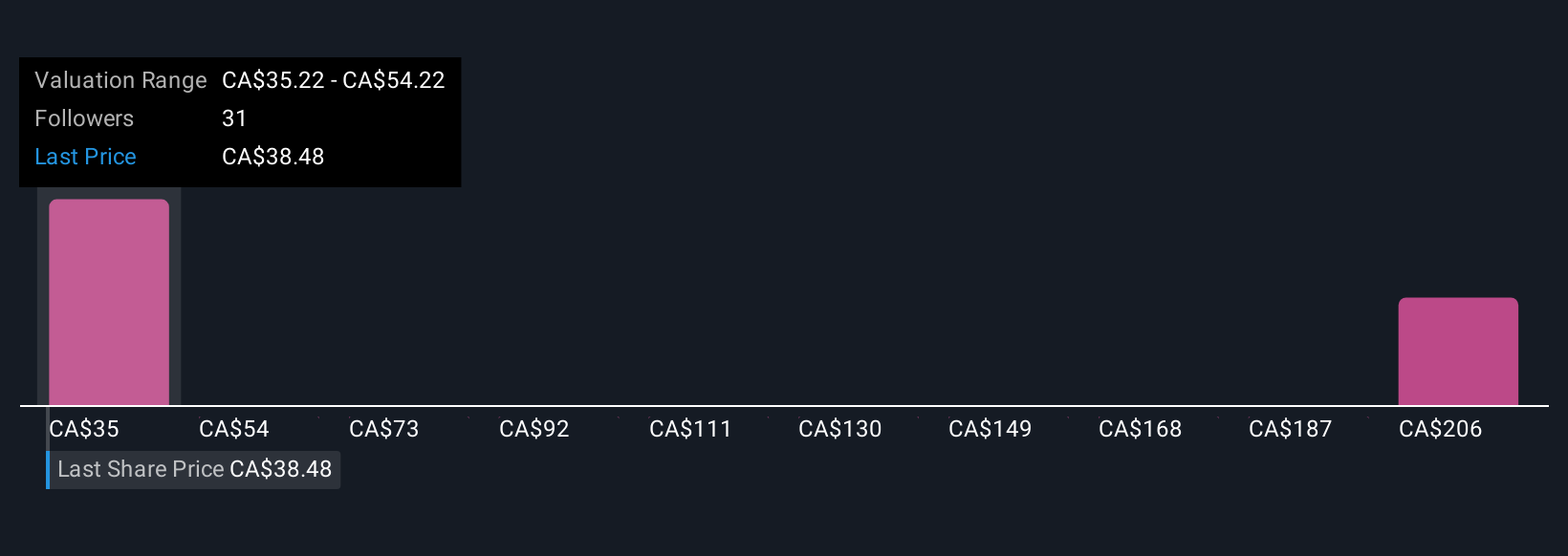

Uncover how Eldorado Gold's forecasts yield a CA$50.17 fair value, a 35% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from US$35.35 to US$374.96 per share. With ongoing cost pressure as a key risk, you can see just how much investor opinions can vary so it can pay to consider a spread of views.

Explore 6 other fair value estimates on Eldorado Gold - why the stock might be worth just CA$35.35!

Build Your Own Eldorado Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eldorado Gold research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Eldorado Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eldorado Gold's overall financial health at a glance.

No Opportunity In Eldorado Gold?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives