- Canada

- /

- Metals and Mining

- /

- TSX:EDR

Endeavour Silver Corp. (TSE:EDR) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

Endeavour Silver Corp. (TSE:EDR) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 94%, which is great even in a bull market.

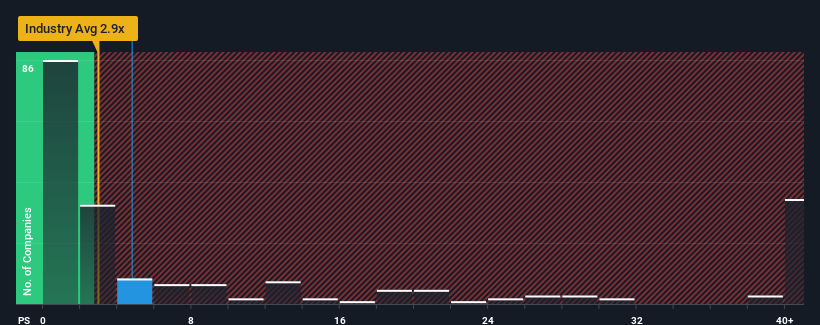

Although its price has dipped substantially, when almost half of the companies in Canada's Metals and Mining industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider Endeavour Silver as a stock probably not worth researching with its 4.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Endeavour Silver

How Has Endeavour Silver Performed Recently?

Endeavour Silver could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Endeavour Silver will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Endeavour Silver's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.7%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 27% per annum as estimated by the five analysts watching the company. With the industry predicted to deliver 38% growth per year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Endeavour Silver's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Endeavour Silver's P/S

Despite the recent share price weakness, Endeavour Silver's P/S remains higher than most other companies in the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Endeavour Silver, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 1 warning sign for Endeavour Silver that you should be aware of.

If these risks are making you reconsider your opinion on Endeavour Silver, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Endeavour Silver might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EDR

Endeavour Silver

A silver mining company, engages in the acquisition, exploration, development, extraction, processing, refining, and reclamation of mineral properties in Mexico, Chile, Peru, and the United States.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives