- Canada

- /

- Metals and Mining

- /

- TSX:DRX

ADF Group Inc. (TSE:DRX) Shares Fly 26% But Investors Aren't Buying For Growth

Despite an already strong run, ADF Group Inc. (TSE:DRX) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days were the cherry on top of the stock's 394% gain in the last year, which is nothing short of spectacular.

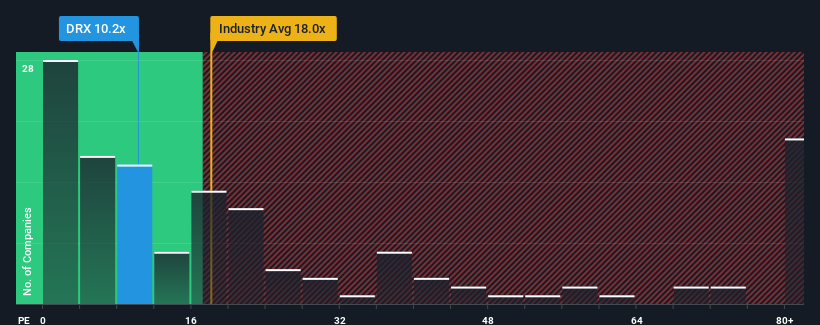

In spite of the firm bounce in price, ADF Group's price-to-earnings (or "P/E") ratio of 10.2x might still make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 15x and even P/E's above 29x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been pleasing for ADF Group as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for ADF Group

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as ADF Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 152% gain to the company's bottom line. Pleasingly, EPS has also lifted 448% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 13% during the coming year according to the one analyst following the company. With the market predicted to deliver 18% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that ADF Group's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From ADF Group's P/E?

The latest share price surge wasn't enough to lift ADF Group's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ADF Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for ADF Group with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:DRX

ADF Group

Engages in the design and engineering of connections including industrial coatings in Canada and the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives