- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper (TSX:CS): Evaluating Valuation After Strong Q3 Results and Updated 2025 Guidance

Reviewed by Simply Wall St

Capstone Copper (TSX:CS) just delivered a meaningful update for investors, reporting a significant jump in third quarter earnings and revenue. The company also reaffirmed its 2025 production guidance, though output is trending towards the lower end of expectations.

See our latest analysis for Capstone Copper.

Capstone Copper’s upbeat earnings and steady production outlook have caught investors’ attention, with the share price rallying 32.97% over the past three months. While momentum has cooled a bit in the past month, the company’s one-year total shareholder return of 17.68% and impressive 156% three-year gain suggest that long-term sentiment remains strong, supported by recent growth and operational progress.

If you’re looking for more opportunities beyond Capstone’s copper story, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares running hot on strong results but production guidance softening, the big question is whether Capstone Copper is still trading below its true value or if the market has already priced in the next phase of growth.

Most Popular Narrative: 18.9% Undervalued

Capstone Copper’s most widely followed narrative points to a fair value well above the last close, suggesting further upside could exist if future projections play out as expected. The stock currently trades at CA$12.18, while the consensus fair value is set at CA$15.01.

The imminent execution of the Mantoverde Optimized project, following recent permit approval, will materially increase throughput and sustain higher copper production at lower incremental cost. This is expected to positively impact both revenue and net margins as expanded volumes are realized.

Want to understand the financial logic behind this bullish call? This narrative hinges on ambitious growth in both production efficiency and future profits. See how aggressive margin expansion assumptions and a bold take on the future profit multiple stack up. Curious what kind of financial leap the model is baking in? There is a lot more beneath the surface. Find out what is fueling this valuation.

Result: Fair Value of $15.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing climate risks for Pinto Valley and challenges in sustaining asset performance could still disrupt Capstone’s positive growth outlook.

Find out about the key risks to this Capstone Copper narrative.

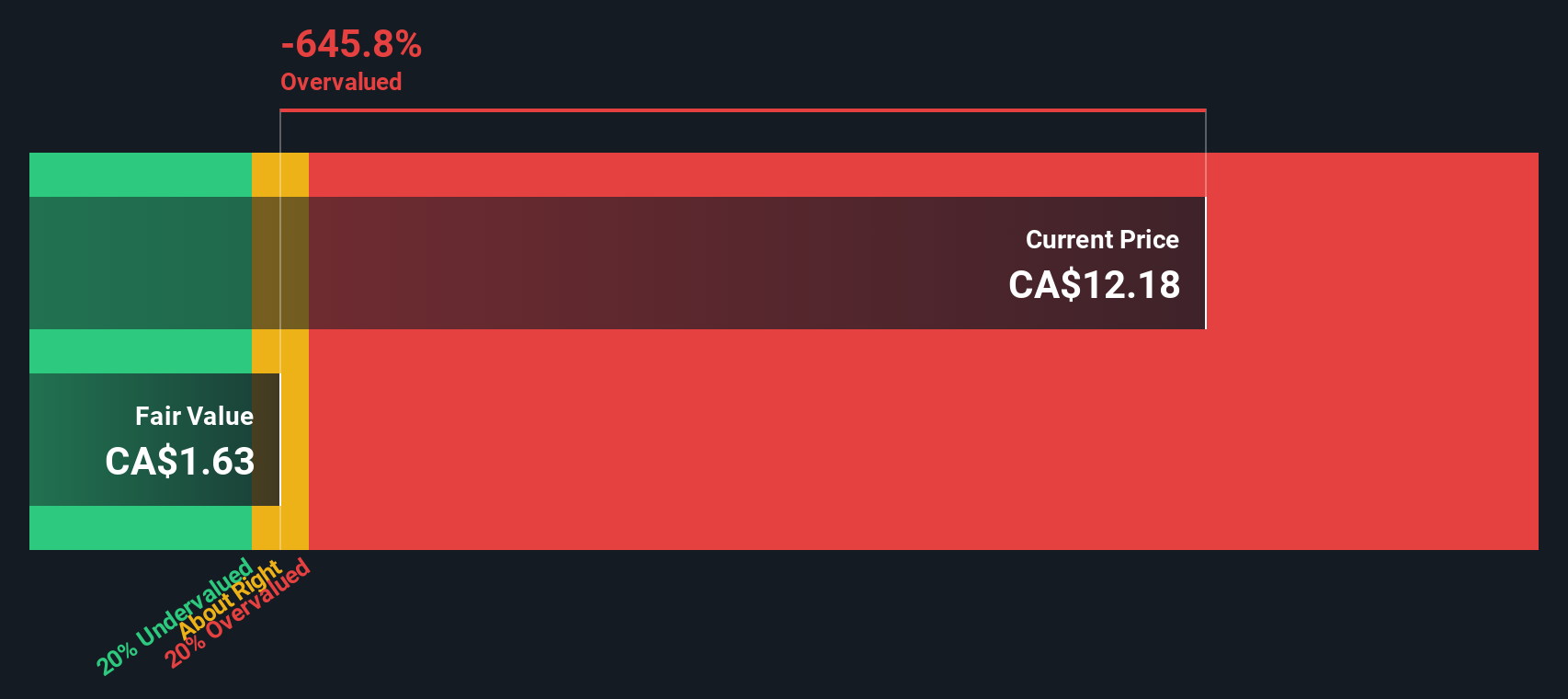

Another View: Our DCF Model Paints a Different Picture

While analysts see Capstone Copper as undervalued, our SWS DCF model tells a different story. According to this approach, the shares are actually trading above their estimated fair value. This raises a key question: Is the market too optimistic about the company's growth prospects, or could it surprise on the upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Capstone Copper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Capstone Copper Narrative

If you have a different take or would rather dig into the numbers yourself, crafting your own narrative is easier than you might think. Get started in just minutes and Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Capstone Copper.

Ready for More Investment Opportunities?

Don't let your next smart move pass you by. The best investment ideas can be found by looking beyond the obvious, and Simply Wall Street’s screeners make that search effortless.

- Uncover high-yield opportunities and boost your passive income with these 16 dividend stocks with yields > 3%, which consistently deliver attractive returns to shareholders.

- Catch the momentum of the artificial intelligence boom by reviewing these 24 AI penny stocks, which are shaping tomorrow’s industries right now.

- Zero in on real value by targeting these 870 undervalued stocks based on cash flows, companies trading below their intrinsic worth for savvy investors who want an edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives