- Canada

- /

- Metals and Mining

- /

- CNSX:EMPS

TSX Penny Stocks Spotlight EMP Metals And Two Others For Your Portfolio

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of easing trade tensions, resilient corporate earnings, and cautious central bank policies, investors are finding renewed confidence despite recent volatility. In this context, penny stocks—often representing smaller or newer companies—continue to capture attention for their potential growth opportunities at accessible price points. While the term "penny stocks" may seem outdated, these investments can still offer substantial value when supported by strong financials and promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.53 | CA$63.96M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.25 | CA$243.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.405 | CA$3.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.01 | CA$698.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.07 | CA$20.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.15 | CA$1.01B | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.95 | CA$152.27M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.08 | CA$200.29M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 414 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

EMP Metals (CNSX:EMPS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMP Metals Corp. is involved in the exploration and evaluation of mineral properties with a market cap of CA$56.88 million.

Operations: EMP Metals Corp. has not reported any revenue segments.

Market Cap: CA$56.88M

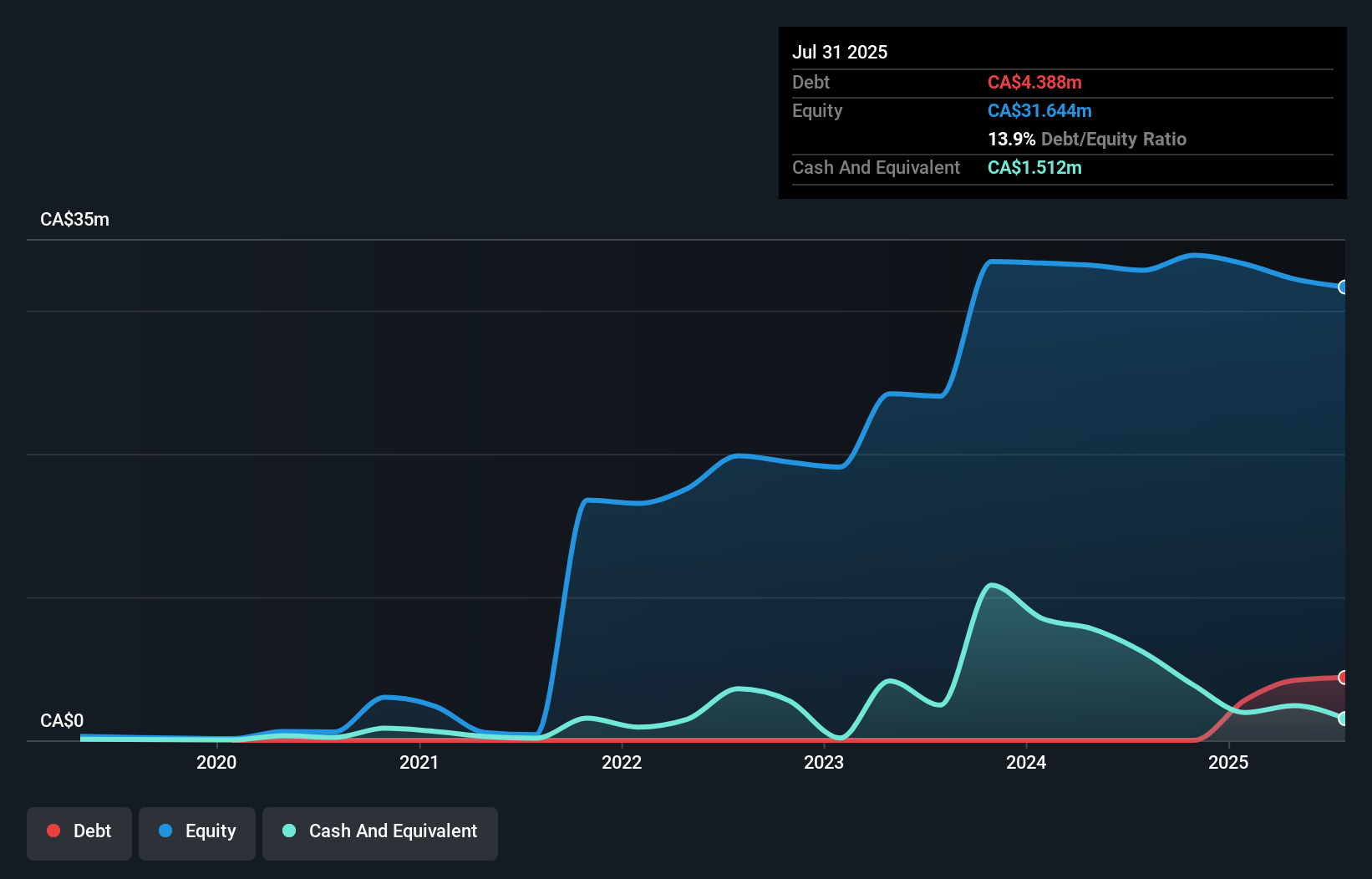

EMP Metals Corp., with a market cap of CA$56.88 million, is pre-revenue and currently unprofitable, facing short-term liabilities that exceed its assets. The company recently announced a private placement to raise up to CA$2 million, which could extend its cash runway beyond the current two months. EMP's lithium demonstration plant project in Saskatchewan, Project Aurora, is progressing as planned and aims to optimize lithium extraction processes. Despite the positive developments in resource expansion and strategic partnerships for technology advancement, concerns remain about financial sustainability due to ongoing losses and high share price volatility.

- Get an in-depth perspective on EMP Metals' performance by reading our balance sheet health report here.

- Evaluate EMP Metals' historical performance by accessing our past performance report.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities, with a market cap of CA$35.73 million.

Operations: The company's revenue is primarily generated from Switzerland ($0.82 million), followed by the United States ($0.21 million) and other countries ($0.03 million).

Market Cap: CA$35.73M

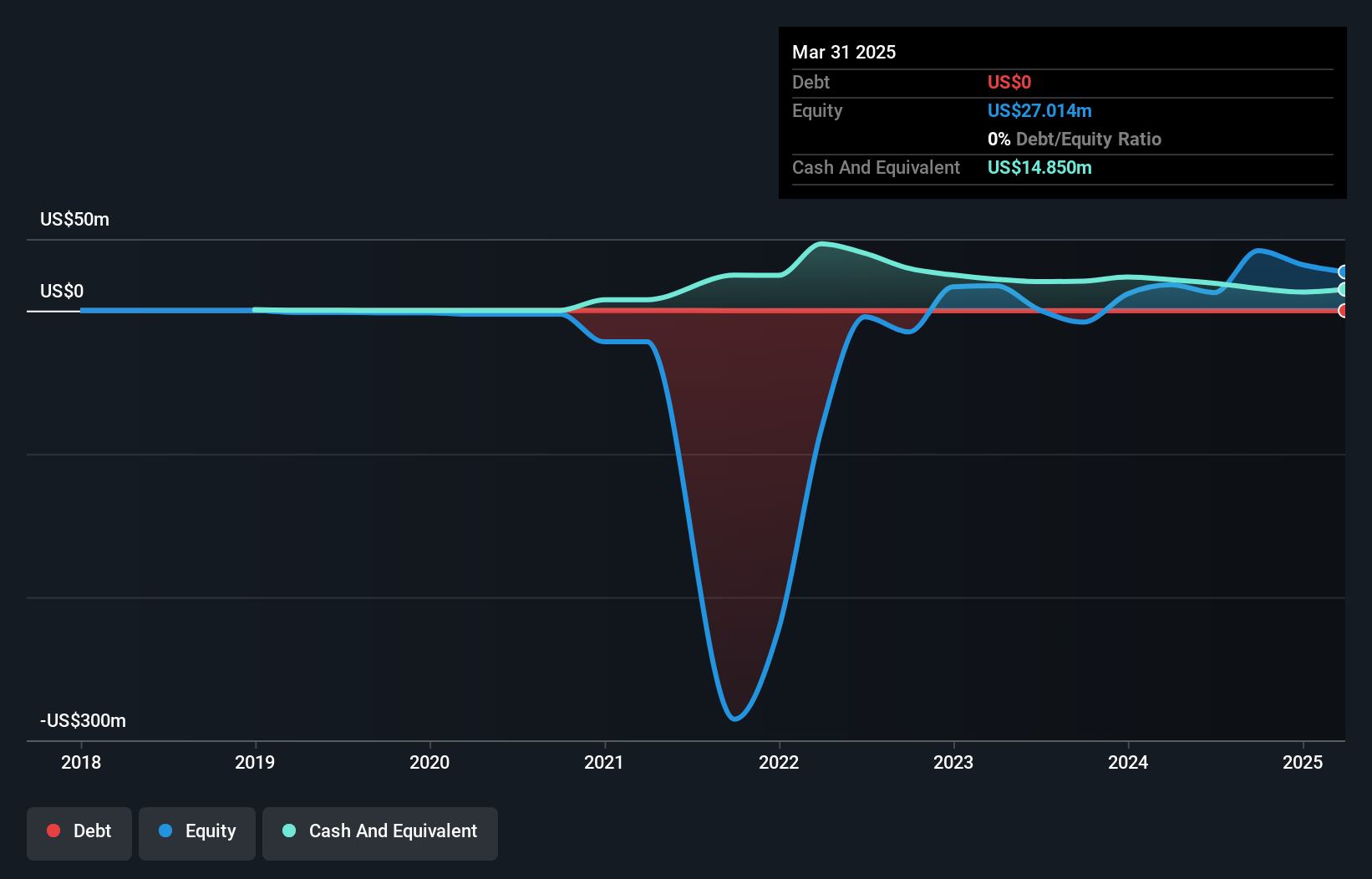

INX Digital Company, with a market cap of CA$35.73 million, is pre-revenue and unprofitable, reporting a significant net loss of US$16.44 million for the second quarter of 2025. Despite its negative return on equity and lack of meaningful revenue streams, the company benefits from being debt-free with short-term assets exceeding liabilities by US$1.9 million. The board and management are experienced, averaging tenures over three years. While INX has reduced losses at an annual rate of 29.6% over five years, recent earnings results highlight ongoing financial challenges amidst decreased volatility in stock returns.

- Click here to discover the nuances of INX Digital Company with our detailed analytical financial health report.

- Gain insights into INX Digital Company's past trends and performance with our report on the company's historical track record.

Century Global Commodities (TSX:CNT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Century Global Commodities Corporation, along with its subsidiaries, is involved in the exploration and mining of mineral properties in Canada and has a market cap of CA$7.68 million.

Operations: The company generates revenue from its food segment, which amounts to CA$13.66 million.

Market Cap: CA$7.68M

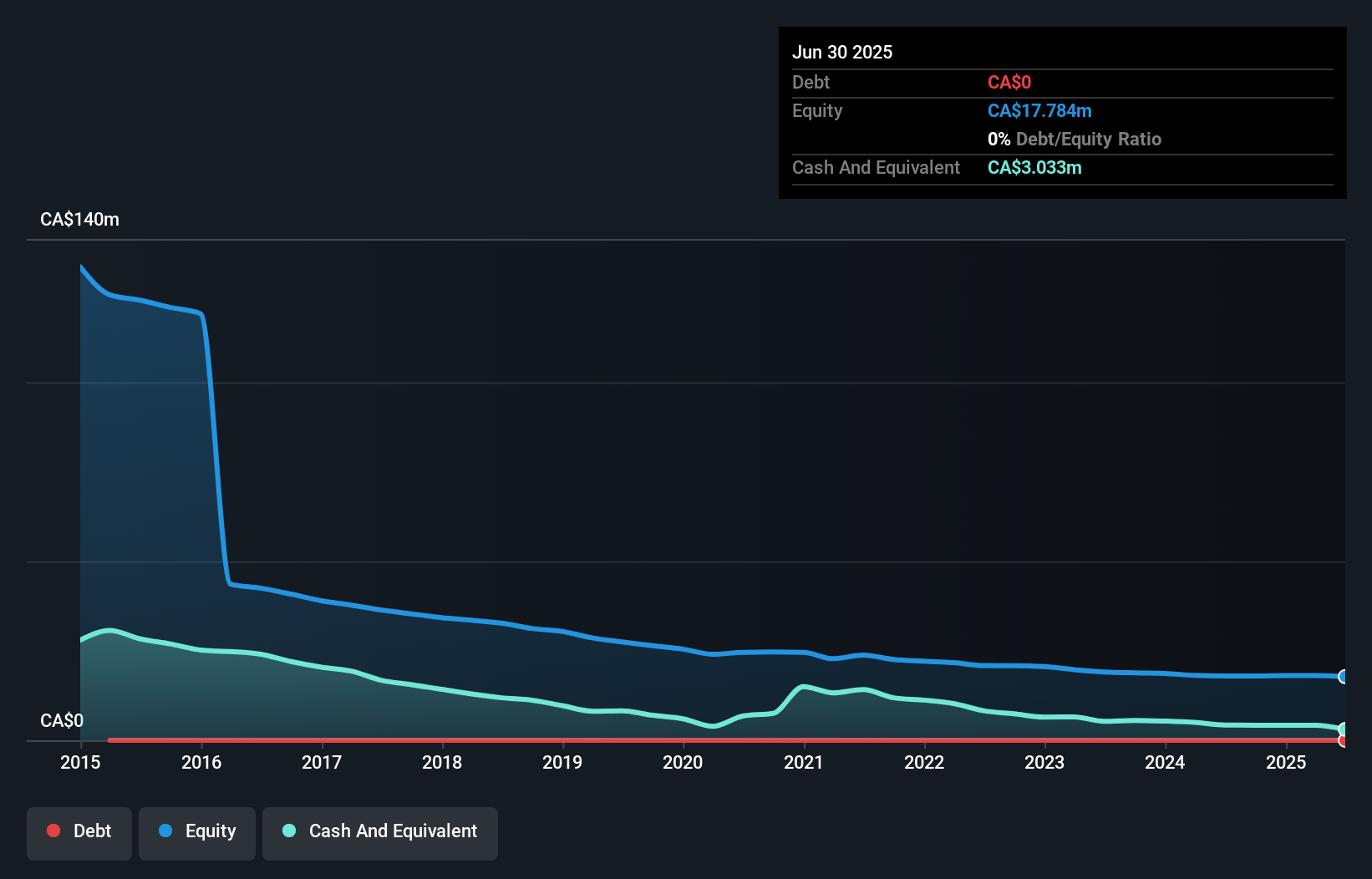

Century Global Commodities Corporation, with a market cap of CA$7.68 million, operates in the mining sector but generates significant revenue from its food segment, totaling CA$13.66 million annually. Despite being unprofitable, the company has reduced losses by 20.9% per year over five years and maintains a strong liquidity position with short-term assets of CA$8.6 million surpassing both its short-term and long-term liabilities significantly. The management team is seasoned with an average tenure of 8.7 years, and the company is debt-free with sufficient cash runway to support operations for over a year based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Century Global Commodities.

- Understand Century Global Commodities' track record by examining our performance history report.

Key Takeaways

- Access the full spectrum of 414 TSX Penny Stocks by clicking on this link.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMP Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:EMPS

EMP Metals

Engages in the exploration and evaluation of mineral properties.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives