- Canada

- /

- Metals and Mining

- /

- TSX:CMMC

Growth Investors: Industry Analysts Just Upgraded Their Copper Mountain Mining Corporation (TSE:CMMC) Revenue Forecasts By 12%

Copper Mountain Mining Corporation (TSE:CMMC) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The stock price has risen 5.9% to CA$0.72 over the past week, suggesting investors are becoming more optimistic. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

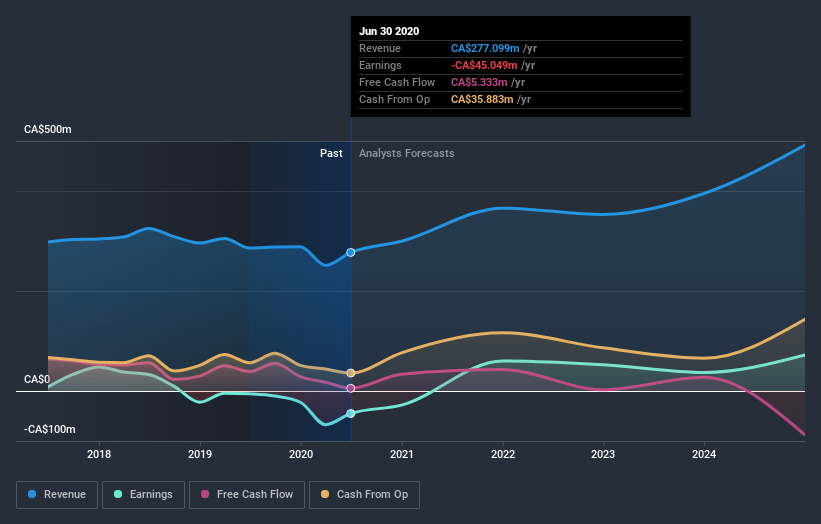

Following the upgrade, the most recent consensus for Copper Mountain Mining from its six analysts is for revenues of CA$299m in 2020 which, if met, would be a meaningful 8.0% increase on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 37% to CA$0.15. However, before this estimates update, the consensus had been expecting revenues of CA$268m and CA$0.15 per share in losses. So there's definitely been a change in sentiment in this update, with the analysts upgrading this year's revenue estimates, while at the same time holding losses per share steady.

See our latest analysis for Copper Mountain Mining

Analysts increased their price target 9.8% to CA$0.97, perhaps signalling that higher revenues are a strong leading indicator for Copper Mountain Mining's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Copper Mountain Mining at CA$1.15 per share, while the most bearish prices it at CA$0.75. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Copper Mountain Mining's past performance and to peers in the same industry. The analysts are definitely expecting Copper Mountain Mining's growth to accelerate, with the forecast 8.0% growth ranking favourably alongside historical growth of 3.2% per annum over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 6.5% per year. Copper Mountain Mining is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Copper Mountain Mining's prospects. They also upgraded their revenue forecasts, although the latest estimates suggest that Copper Mountain Mining will grow in line with the overall market. There was also an increase in the price target, suggesting that there is more optimism baked into the forecasts than there was previously. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Copper Mountain Mining.

It's great to see the analysts upgrading their estimates, but the biggest highlight to us is that the business is expected to become profitable in the foreseeable future. For more information, you can click through to our free platform to learn more about these forecasts.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Copper Mountain Mining or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:CMMC

Copper Mountain Mining

Copper Mountain Mining Corporation engages in the mining, exploration, and development of mineral properties in Canada.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026