The Compensation For Burcon NutraScience Corporation's (TSE:BU) CEO Looks Deserved And Here's Why

We have been pretty impressed with the performance at Burcon NutraScience Corporation (TSE:BU) recently and CEO Johann Tergesen deserves a mention for their role in it. Coming up to the next AGM on 15 September 2021, shareholders would be keeping this in mind. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

See our latest analysis for Burcon NutraScience

How Does Total Compensation For Johann Tergesen Compare With Other Companies In The Industry?

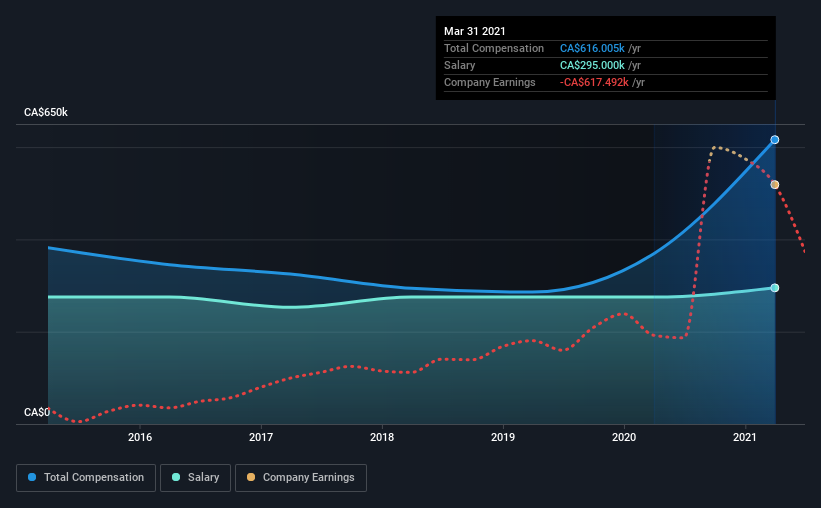

At the time of writing, our data shows that Burcon NutraScience Corporation has a market capitalization of CA$329m, and reported total annual CEO compensation of CA$616k for the year to March 2021. We note that's an increase of 67% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$295k.

On examining similar-sized companies in the industry with market capitalizations between CA$127m and CA$508m, we discovered that the median CEO total compensation of that group was CA$689k. This suggests that Burcon NutraScience remunerates its CEO largely in line with the industry average. Moreover, Johann Tergesen also holds CA$10m worth of Burcon NutraScience stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$295k | CA$275k | 48% |

| Other | CA$321k | CA$94k | 52% |

| Total Compensation | CA$616k | CA$369k | 100% |

On an industry level, roughly 67% of total compensation represents salary and 33% is other remuneration. Burcon NutraScience pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Burcon NutraScience Corporation's Growth Numbers

Burcon NutraScience Corporation's earnings per share (EPS) grew 72% per year over the last three years. It achieved revenue growth of 1,016% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Burcon NutraScience Corporation Been A Good Investment?

Most shareholders would probably be pleased with Burcon NutraScience Corporation for providing a total return of 593% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Burcon NutraScience (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Burcon NutraScience might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BU

Burcon NutraScience

Provides plant-based proteins for the food and beverage industry in Canada.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives