Investors Still Aren't Entirely Convinced By AirBoss of America Corp.'s (TSE:BOS) Revenues Despite 26% Price Jump

AirBoss of America Corp. (TSE:BOS) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

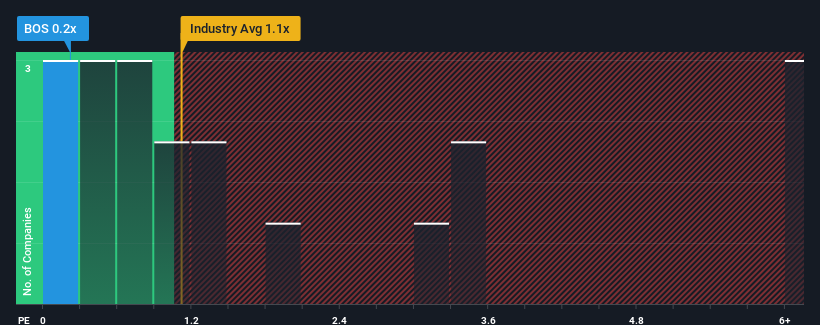

Although its price has surged higher, AirBoss of America may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Chemicals industry in Canada have P/S ratios greater than 1.1x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for AirBoss of America

What Does AirBoss of America's P/S Mean For Shareholders?

Recent times haven't been great for AirBoss of America as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on AirBoss of America will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For AirBoss of America?

The only time you'd be truly comfortable seeing a P/S as low as AirBoss of America's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 26%. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 0.04% during the coming year according to the five analysts following the company. Meanwhile, the industry is forecast to moderate by 5.7%, which indicates the company should perform better regardless.

In light of this, the fact AirBoss of America's P/S sits below the majority of other companies is peculiar but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite AirBoss of America's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that AirBoss of America currently trades on a much lower than expected P/S since its revenue forecast is not as bad as the struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the more attractive outlook. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, given the low P/S, risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for AirBoss of America (1 makes us a bit uncomfortable) you should be aware of.

If these risks are making you reconsider your opinion on AirBoss of America, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BOS

AirBoss of America

Manufactures and sells rubber-based products in Canada, the United States, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives