- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Aya Gold & Silver (TSX:AYA) Valuation in Focus After Boumadine Stockpile Production and Offtake Deal

Reviewed by Simply Wall St

Aya Gold & Silver (TSX:AYA) has kicked off commercial production from a historical pyrite concentrate stockpile at its Boumadine site, following an offtake agreement with a global buyer. This move is intended to generate steady cash flow and improve project economics. It also supports environmental rehabilitation efforts at Boumadine.

See our latest analysis for Aya Gold & Silver.

Momentum is building for Aya Gold & Silver, with the Boumadine project milestone coming on the heels of a strong run. The share price has climbed 20% year-to-date, while the one-year total shareholder return sits at 2.9%. Recent quarterly results reflected a sharp jump in sales and profitability, and upbeat operating data from Boumadine appears to be fueling investor optimism for sustained long-term growth.

If you're interested in discovering what else is on the move in mining, this is a great opportunity to broaden your search and explore fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets despite impressive growth, investors are left to wonder whether Aya Gold & Silver offers hidden value or if the market has already priced in its promising outlook.

Most Popular Narrative: 41.6% Undervalued

Based on the most popular valuation narrative, Aya Gold & Silver's fair value stands out sharply against its recent market price, suggesting a meaningful gap investors are watching. The narrative framework combines aggressive growth projections with current company fundamentals to make its case for a higher valuation.

The ramp-up of the Zgounder mine is now largely complete, with processing capacity exceeding nameplate and plant recoveries reaching ~92%. This positions Aya to deliver meaningfully higher silver production and lower unit costs as operational improvements are sustained. This should result in higher revenues and expanded net margins going forward.

Curious what underpins this eye-popping fair value? The secret sauce is ambitious growth targets and profit margins usually reserved for the industry’s leaders. Explore the assumptions, projections, and bold leaps that have everyone talking. What numbers really drive this narrative?

Result: Fair Value of $23.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent issues with ore grade dilution or unexpected volatility in silver prices could quickly undermine Aya's optimistic long-term growth projections.

Find out about the key risks to this Aya Gold & Silver narrative.

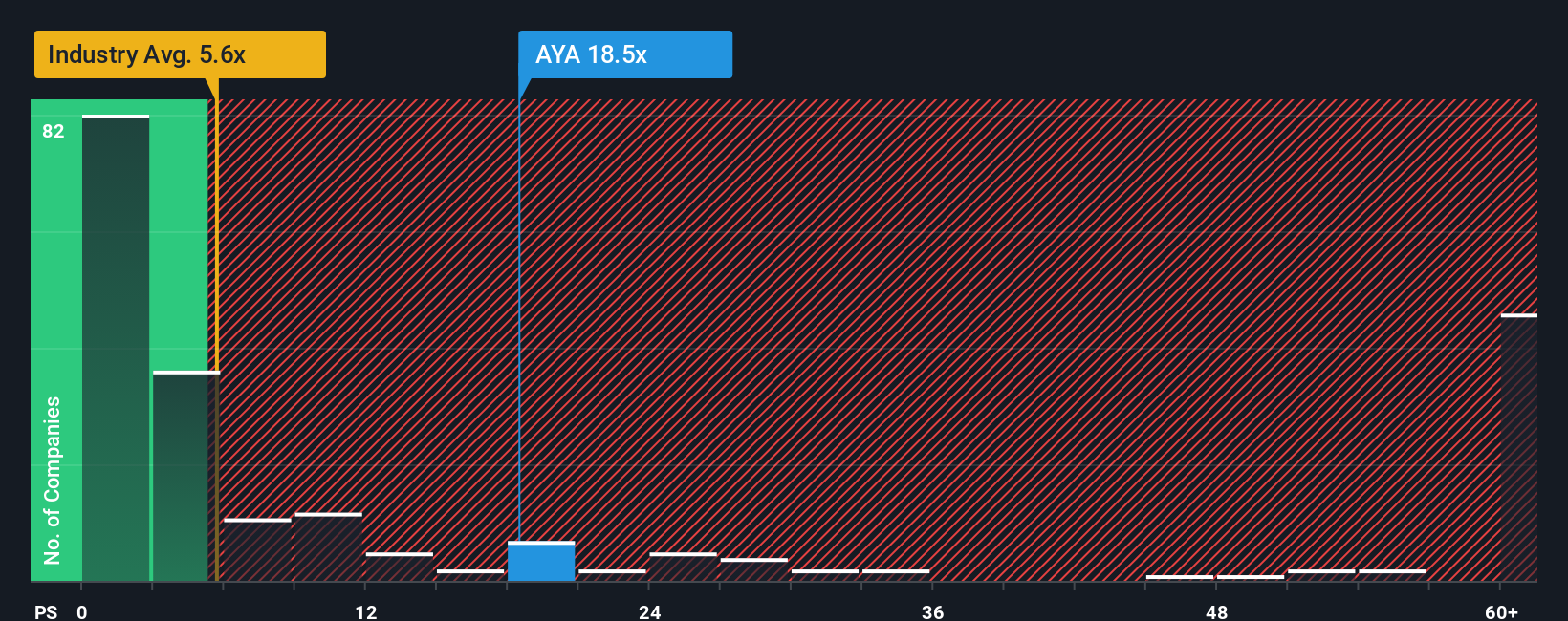

Another View: Multiple-Based Valuation Signals Caution

Taking a closer look at how Aya Gold & Silver is valued relative to peers, its price-to-sales ratio stands at 10x, nearly double the Canadian Metals and Mining industry average of 5.7x and even further above its estimated fair ratio of 3.5x. This suggests investors are paying a significant premium for future growth, which may be more than the fundamentals warrant.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aya Gold & Silver Narrative

If this perspective does not align with your view, or you prefer hands-on research, you have the tools to shape your own analysis in just a few minutes, and Do it your way.

A great starting point for your Aya Gold & Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your strategy and seize new opportunities by checking out handpicked investment lists that could set your portfolio apart from the crowd. Don’t wait until these trends pass you by. Act now and stay a step ahead.

- Catch the momentum with these 3594 penny stocks with strong financials, showcasing established companies delivering strong financials and surprising the market with their resilience.

- Secure long-term income by reviewing these 15 dividend stocks with yields > 3%, featuring stocks with healthy yields and a proven record of rewarding shareholders.

- Tap into the AI transformation by evaluating these 26 AI penny stocks, where innovative firms are redefining sectors with advanced machine learning and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives