- Canada

- /

- Metals and Mining

- /

- TSX:ARA

3 Promising Penny Stocks On TSX With Market Caps Over CA$3M

Reviewed by Simply Wall St

As the Canadian economy experiences a cooling labor market and anticipates further interest rate cuts by the Bank of Canada, financial markets are poised to navigate these shifts with cautious optimism. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing investment area for those seeking growth opportunities at lower price points. When backed by strong financial health, these stocks can offer potential upside without many of the risks typically associated with this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.80 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.30 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.33 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.07 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.09 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 963 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

SOL Global Investments (CNSX:SOL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOL Global Investments Corp. is a private equity firm that focuses on providing growth capital to small and mid-sized businesses, with a market cap of CA$3.81 million.

Operations: The company's revenue segment in Pharmaceuticals reported a negative CA$38.51 million.

Market Cap: CA$3.81M

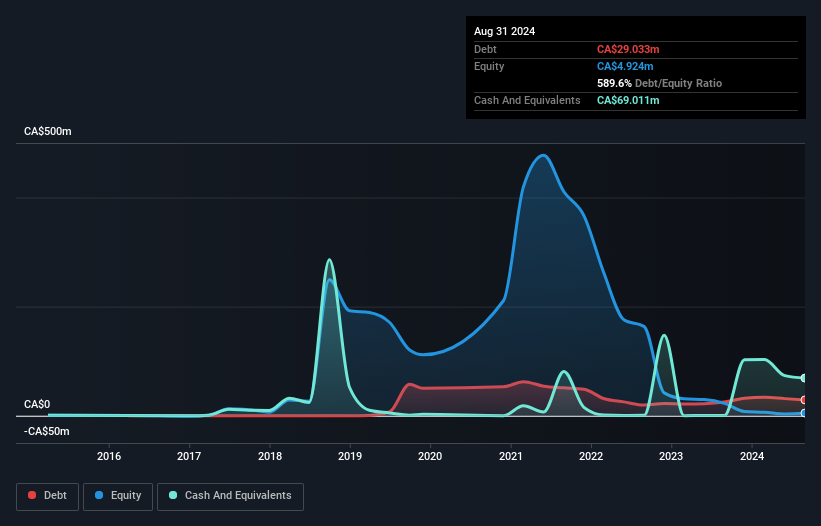

SOL Global Investments Corp., with a market cap of CA$3.81 million, is pre-revenue, reporting less than US$1 million in revenue and a significant net loss for the third quarter of 2024. Despite this, the company has more cash than debt and sufficient short-term assets to cover liabilities. The firm has not diluted shareholders recently and maintains a cash runway exceeding three years due to positive free cash flow growth. However, its share price remains highly volatile, and the board's lack of experience could be concerning for investors seeking stability in penny stocks.

- Click here to discover the nuances of SOL Global Investments with our detailed analytical financial health report.

- Review our historical performance report to gain insights into SOL Global Investments' track record.

Aclara Resources (TSX:ARA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aclara Resources Inc. is a mining company focused on the exploration and development of rare-earth mineral resources in Chile, with a market cap of CA$78.21 million.

Operations: Aclara Resources Inc. does not currently report any revenue segments.

Market Cap: CA$78.21M

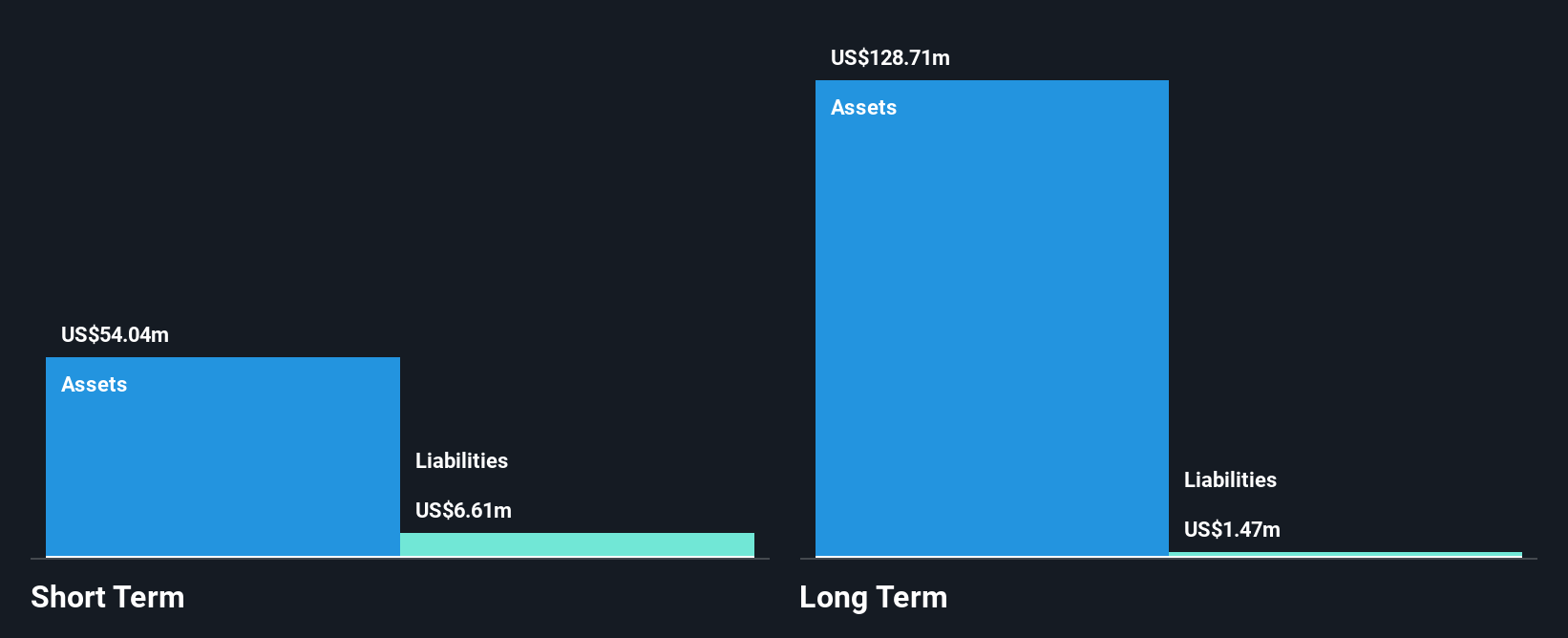

Aclara Resources Inc., with a market cap of CA$78.21 million, is pre-revenue, focusing on rare-earth mineral exploration in Chile. The company recently completed a promising engineering study for its U.S.-based REE separation project, highlighting significant environmental benefits and strategic vertical integration plans to create an independent supply chain for electric vehicle components. Despite being unprofitable and not expected to achieve profitability soon, Aclara remains debt-free with sufficient short-term assets covering liabilities. Its innovative extraction technology minimizes environmental impact, aligning with global decarbonization efforts while maintaining a stable cash runway of over one year.

- Take a closer look at Aclara Resources' potential here in our financial health report.

- Explore Aclara Resources' analyst forecasts in our growth report.

Grey Wolf Animal Health (TSXV:WOLF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grey Wolf Animal Health Corp. is a Canadian company focused on animal health and wellness, with a market cap of CA$25.45 million.

Operations: The company generates revenue from two main segments: Pharmacy, contributing CA$13.85 million, and Animal Health, with CA$12.08 million.

Market Cap: CA$25.45M

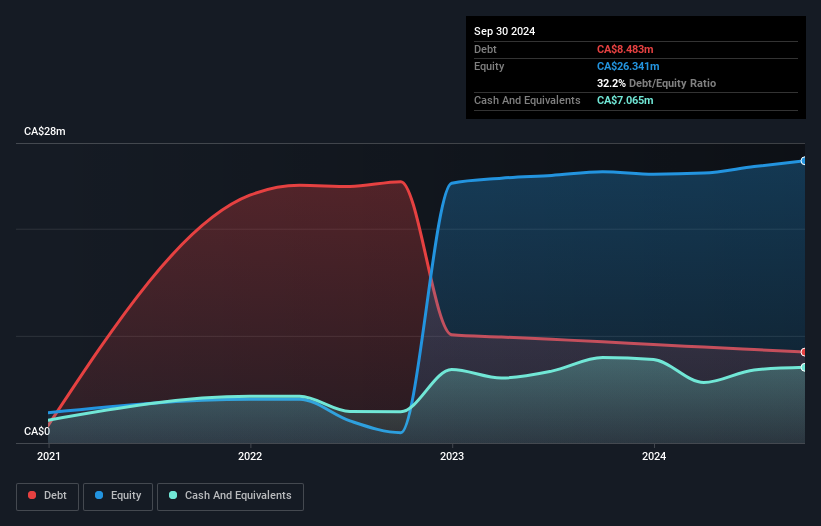

Grey Wolf Animal Health Corp., with a market cap of CA$25.45 million, shows a mixed financial picture typical of penny stocks. Despite recent earnings growth and stable weekly volatility, the company faces challenges such as declining profit margins and low return on equity at 2.7%. The company's net debt to equity ratio is satisfactory at 7.4%, and its short-term assets cover both short- and long-term liabilities comfortably. Recent product launches like SILEO® could enhance revenue streams in the animal health sector, but the board's lack of experience may impact strategic decisions going forward.

- Navigate through the intricacies of Grey Wolf Animal Health with our comprehensive balance sheet health report here.

- Understand Grey Wolf Animal Health's track record by examining our performance history report.

Key Takeaways

- Get an in-depth perspective on all 963 TSX Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARA

Aclara Resources

A mining company, engages in the exploration and development of rare-earth mineral resources in Chile.

Excellent balance sheet slight.