- Canada

- /

- Metals and Mining

- /

- TSX:APM

Market Might Still Lack Some Conviction On Andean Precious Metals Corp. (TSE:APM) Even After 26% Share Price Boost

Andean Precious Metals Corp. (TSE:APM) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 135% following the latest surge, making investors sit up and take notice.

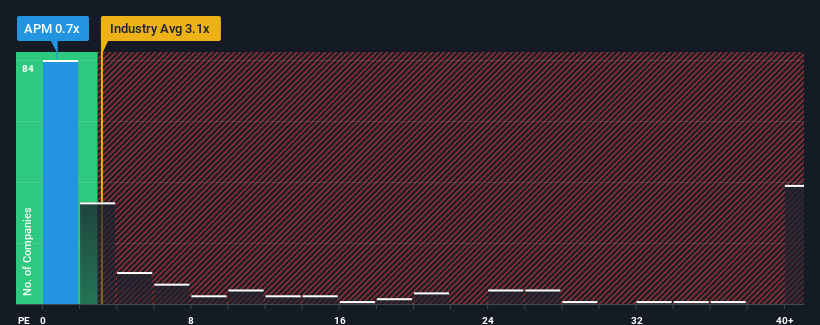

In spite of the firm bounce in price, Andean Precious Metals' price-to-sales (or "P/S") ratio of 0.7x might still make it look like a strong buy right now compared to the wider Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 3.1x and even P/S above 26x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Andean Precious Metals

What Does Andean Precious Metals' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Andean Precious Metals has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Andean Precious Metals' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Andean Precious Metals?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Andean Precious Metals' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 125% last year. The strong recent performance means it was also able to grow revenue by 36% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Andean Precious Metals' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Andean Precious Metals' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Andean Precious Metals' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Andean Precious Metals that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:APM

Andean Precious Metals

Engages in the acquisition, exploration, development, and processing of mineral resource properties in the United States.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives