- Canada

- /

- Metals and Mining

- /

- TSX:ALS

Altius Minerals Corporation's (TSE:ALS) Shares Climb 25% But Its Business Is Yet to Catch Up

Altius Minerals Corporation (TSE:ALS) shares have had a really impressive month, gaining 25% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 9.0% over the last year.

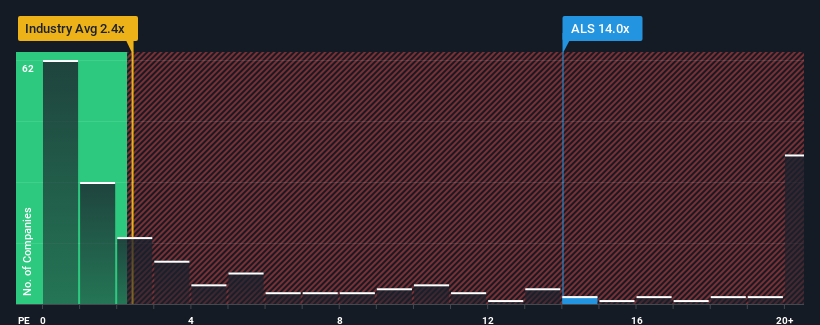

Following the firm bounce in price, you could be forgiven for thinking Altius Minerals is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14x, considering almost half the companies in Canada's Metals and Mining industry have P/S ratios below 2.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Altius Minerals

What Does Altius Minerals' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Altius Minerals' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Altius Minerals' future stacks up against the industry? In that case, our free report is a great place to start.How Is Altius Minerals' Revenue Growth Trending?

Altius Minerals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 15% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 2.9% per annum during the coming three years according to the seven analysts following the company. With the industry predicted to deliver 7.9% growth per year, that's a disappointing outcome.

With this in mind, we find it intriguing that Altius Minerals' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Altius Minerals' P/S Mean For Investors?

Altius Minerals' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Altius Minerals currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Altius Minerals that you need to be mindful of.

If you're unsure about the strength of Altius Minerals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ALS

Altius Minerals

Engages in the mineral and renewable royalties and project generation businesses in Canada, Brazil, and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives