- Canada

- /

- Metals and Mining

- /

- TSX:AII

TSX Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

In November 2025, the Canadian market is navigating through a period of recalibration as AI valuation concerns lead to fluctuations in equity markets, despite robust corporate earnings and strong job growth. In this environment, stocks that exhibit both growth potential and high insider ownership can be particularly appealing, as they may offer a blend of innovation-driven upside with the confidence that comes from significant insider investment.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 22.5% | 90.3% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.4% |

| PowerBank (NEOE:SUNN) | 16.2% | 64.2% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| goeasy (TSX:GSY) | 21.9% | 27.3% |

| Enterprise Group (TSX:E) | 31.8% | 30.6% |

| California Nanotechnologies (TSXV:CNO) | 19% | 153% |

| Almonty Industries (TSX:AII) | 12.2% | 64.5% |

| Allied Gold (TSX:AAUC) | 14.9% | 103.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Almonty Industries (TSX:AII)

Simply Wall St Growth Rating: ★★★★★★

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate with a market cap of CA$2.32 billion.

Operations: The company's revenue segments focus on the extraction, refinement, and distribution of tungsten concentrate.

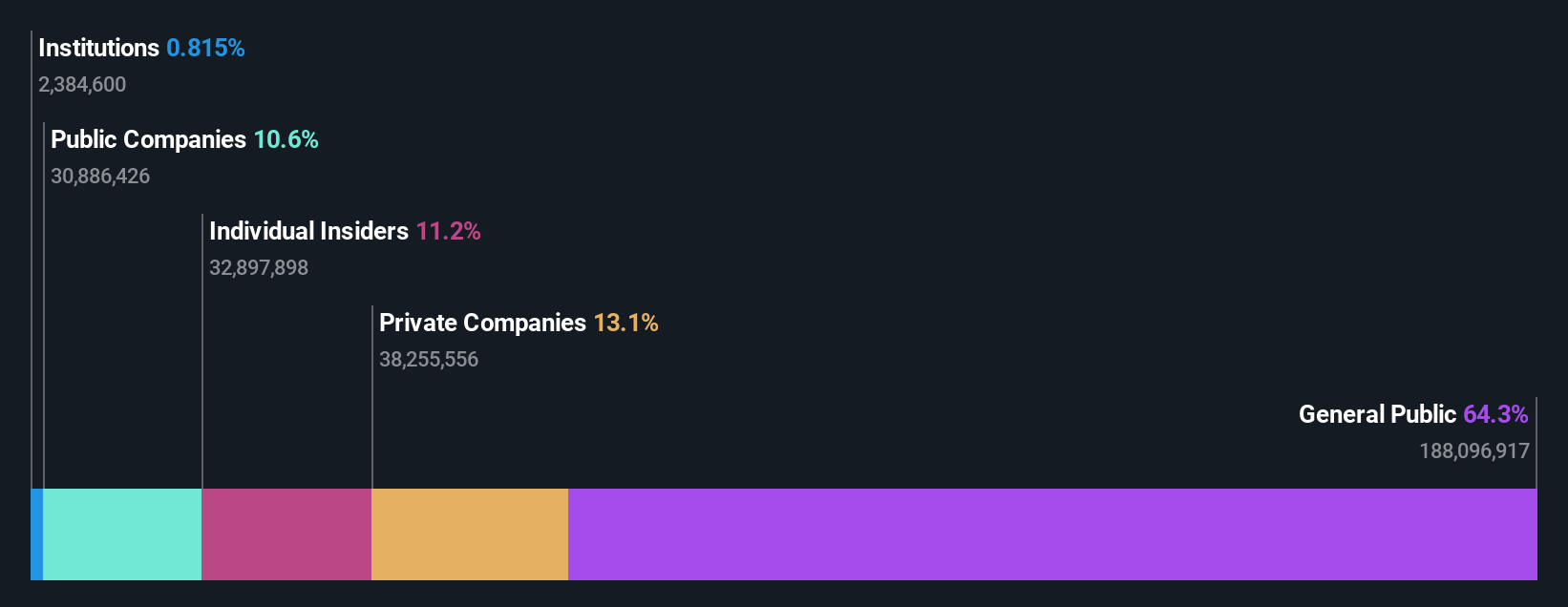

Insider Ownership: 12.2%

Revenue Growth Forecast: 53.3% p.a.

Almonty Industries, with substantial insider ownership, is positioned for significant revenue growth at 53.3% annually, outpacing the Canadian market. While recent earnings show improvement with a CAD 33.19 million net income for Q3 2025, past shareholder dilution remains a concern. The company has initiated large-scale drilling programs in Portugal and South Korea to expand production capabilities and extend mine life, supported by a EUR 2.5 million investment in Panasqueira Mine's Level 4 expansion.

- Dive into the specifics of Almonty Industries here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Almonty Industries is priced higher than what may be justified by its financials.

Meridian Mining UK Societas (TSX:MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meridian Mining UK Societas, with a market cap of CA$551.88 million, focuses on the acquisition, exploration, and development of mineral properties in Brazil through its subsidiaries.

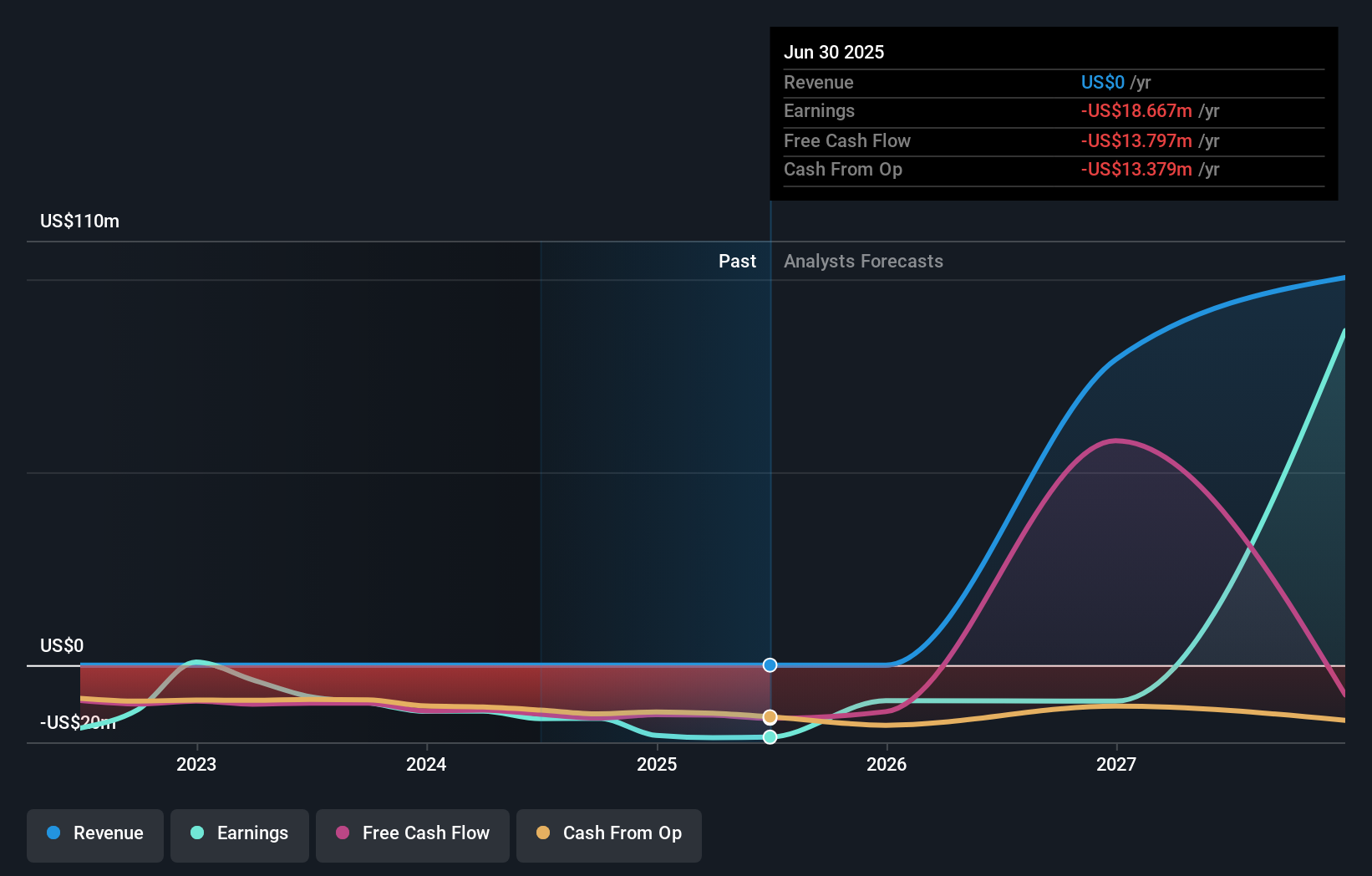

Operations: Meridian Mining UK Societas does not currently report any revenue segments in its business operations.

Insider Ownership: 12.2%

Revenue Growth Forecast: 54.3% p.a.

Meridian Mining UK Societas is experiencing rapid growth, with forecasted revenue growth of 54.3% annually, surpassing the Canadian market average. Despite past shareholder dilution and a net loss of US$6.76 million for the first half of 2025, insider buying activity suggests confidence in future prospects. Recent advancements include securing a Preliminary Licence for its Cabacal project and progressing towards production in Brazil's modern mining district, indicating potential long-term economic benefits and project financing alignment.

- Click here to discover the nuances of Meridian Mining UK Societas with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Meridian Mining UK Societas' current price could be inflated.

Logan Energy (TSXV:LGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Logan Energy Corp. is involved in the exploration, development, and production of crude oil and natural gas properties with a market cap of CA$500.37 million.

Operations: The company's revenue primarily stems from its oil and gas exploration and production segment, generating CA$129.04 million.

Insider Ownership: 20%

Revenue Growth Forecast: 50.1% p.a.

Logan Energy is experiencing robust growth, with forecasted annual revenue growth of 50.1%, significantly outpacing the Canadian market. The company reported a substantial increase in net income to C$17.31 million for Q2 2025 from C$0.416 million a year ago, indicating improved profitability alongside increased production across its energy segments. Recent executive changes include appointing Ms. Linda Brown as interim CFO, reflecting stability in leadership during this expansion phase without notable insider trading activity recently reported.

- Navigate through the intricacies of Logan Energy with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Logan Energy's shares may be trading at a premium.

Make It Happen

- Click this link to deep-dive into the 41 companies within our Fast Growing TSX Companies With High Insider Ownership screener.

- Contemplating Other Strategies? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AII

Almonty Industries

Engages in mining, processing, and shipping of tungsten concentrate.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives