- Canada

- /

- Metals and Mining

- /

- TSX:AII

Almonty Industries (TSX:AII) Losses Worsen 43.8% Yearly, Challenging Turnaround Narrative

Reviewed by Simply Wall St

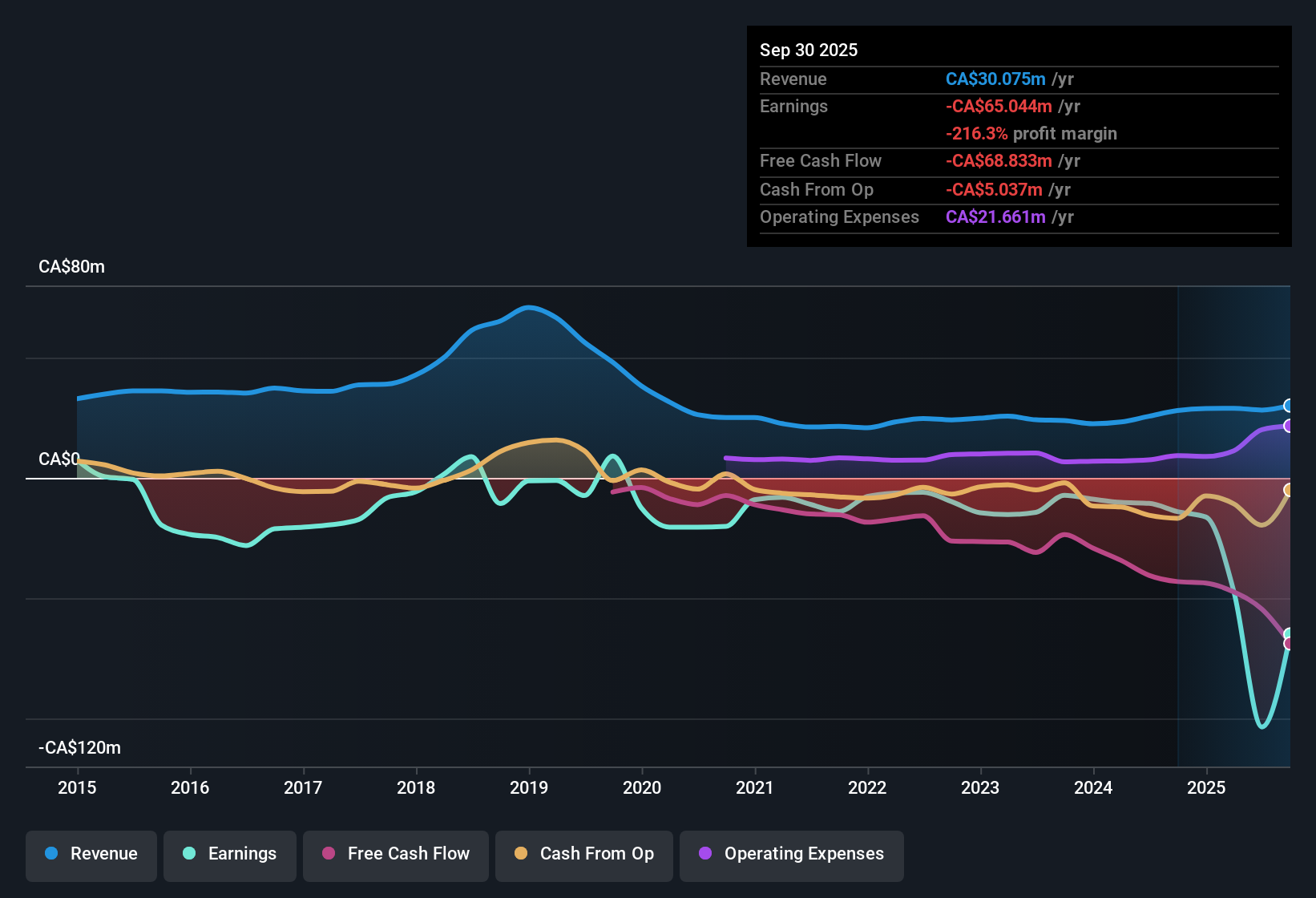

Almonty Industries (TSX:AII) remains unprofitable, with net losses worsening at an annual rate of 43.8% over the past five years, and no year-over-year profit growth to point to as margins have stayed in negative territory. While current figures do not reflect improvement, forecasts are bullish. Some sources suggest earnings could grow 65.29% per year and flip to profitability within three years. Revenue is expected to rise 53% per year compared to the Canadian average of 5.1%.

See our full analysis for Almonty Industries.Next up, we’ll measure these headline results against the market’s most widely followed narratives to see which perspectives hold up and which might need rethinking.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Accelerate Despite Bigger Revenue Potential

- Net losses have been increasing at a steep rate of 43.8% per year over the last five years, underlining how operational growth has not yet translated into bottom-line improvement for Almonty Industries.

- What stands out, based on the prevailing market view, is that while forecasts call for annual earnings growth of over 65% and a potential shift to profitability within three years, the lack of any historical profit growth or margin recovery so far highlights execution risk:

- The ongoing negative profit margin, without year-over-year improvement, challenges the notion that higher revenues alone will secure profits.

- Investors must watch for whether new project milestones can fulfill these aggressive growth forecasts or if losses continue to deepen despite broader sector optimism.

Share Dilution Weighs on Existing Holders

- Almonty has issued new shares over the last year, increasing dilution for existing shareholders even as the company works toward its potential turnaround.

- From the prevailing market view, critics highlight that shareholder dilution can offset the benefits of future growth and adds to the risk profile:

- Bearish voices emphasize that as new shares enter circulation, each share represents a smaller claim on any future profits or assets.

- This move may have been necessary to fund growth, but it puts added pressure on management to deliver on bullish projections to justify the expanded share base.

Valuation Gap: Discount by Model, Premium to Peers

- The current share price of CA$8.74 trades significantly below Almonty’s DCF fair value estimate of CA$28.82, but is expensive compared to industry peers, with a Price-to-Book ratio of 11.8x versus the sector average of 2.5x and 6x for peers.

- The prevailing market view calls attention to this valuation tension, underscoring that:

- Value investors may see opportunity if the DCF assumptions prove accurate, but the rich Price-to-Book multiple signals cautious optimism in the market, especially given ongoing losses.

- The debate comes down to whether Almonty can meet or exceed ambitious forecasts and thus close the gap between operational results and valuation expectations.

See our latest analysis for Almonty Industries.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Almonty Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong revenue forecasts, Almonty Industries continues to post steep losses, faces rising dilution, and remains valued well above its sector as profitability remains elusive.

If you’re after companies with more reasonable valuations and healthier performance, discover better prospects now with these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AII

Almonty Industries

Engages in mining, processing, and shipping of tungsten concentrate.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives