- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG) Swings to Profitability, Challenging Bearish Narratives on Turnaround

Reviewed by Simply Wall St

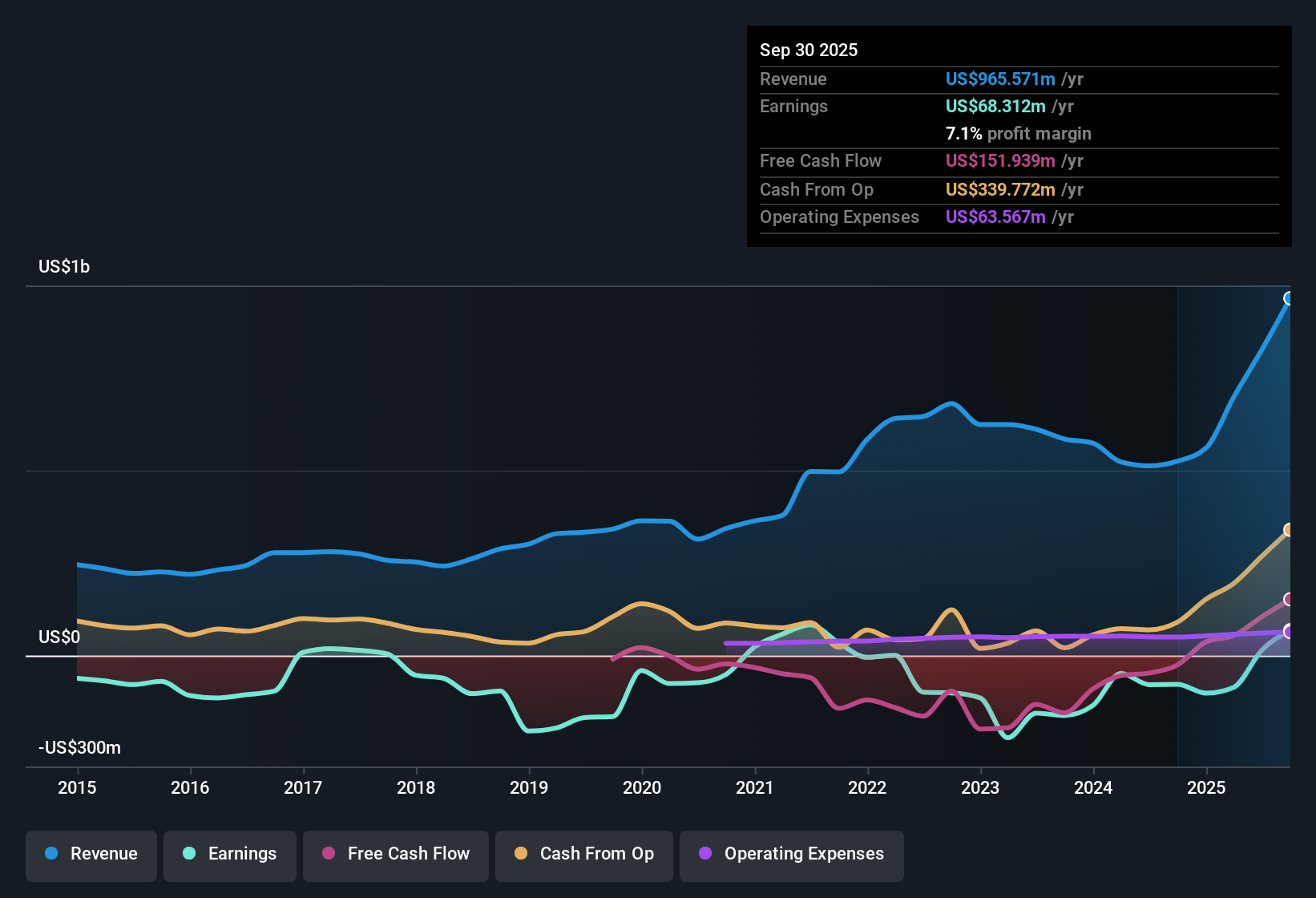

First Majestic Silver (TSX:AG) has swung into profitability, reversing a period of losses and signaling a clear shift in its earnings profile. Over the past year, the company improved its net profit margin and is now projected to grow earnings at 32.3% per year, outpacing both its historical performance and industry expectations. Revenue is forecast to increase at 16.3% annually, which stands above the broader Canadian market average. With high-quality earnings and a trading price below calculated fair value, analysts see upside. Investors should also remain aware of recent shareholder dilution and insider selling. Overall, the outlook now features a combination of recovering profits, robust growth forecasts, and competitive valuation balanced with shareholder-related risks.

See our full analysis for First Majestic Silver.Next up, we will see how these headline numbers stack up against the major narratives and consensus views in the market. Some opinions might be strengthened, while others could be in for a surprise.

See what the community is saying about First Majestic Silver

Margins Projected to Quadruple in Three Years

- Analysts expect profit margins to rise from the current 1.8% to 8.0% by 2028, a major step-change if achieved.

- According to the analysts' consensus view, this margin expansion is underpinned by several factors:

- Operational efficiencies and integration benefits, especially following consolidation at Cerro Los Gatos, are expected to lower all-in sustaining costs. This could help improve net margins.

- Ongoing investment in exploration and the development of new ore bodies, such as Navidad and Santo Niño, is projected to increase production capacity. This may offer a longer reserve life and stronger revenue growth, both of which support future margin improvement.

What stands out is how these ambitious margin forecasts compare to the consensus narrative, signaling a pivotal test for whether First Majestic can truly convert operational gains into long-term profitability. 📊 Read the full First Majestic Silver Consensus Narrative.

Share Dilution and Insider Selling Pose Headwinds

- Share count is expected to increase by 7.0% per year over the next three years. The recent quarter saw notable insider selling, creating real dilution concerns for existing shareholders.

- The analysts' consensus view highlights that, while the balance sheet strength supports growth investment, ongoing shareholder dilution and insider activity could limit upside by spreading future gains over a larger base and dampening investor confidence:

- Bears argue that expanded issuance and insider selling could weigh on per-share metrics, especially if forecasted profit acceleration or higher silver prices do not occur.

- Persistent dilution makes it harder for earnings-per-share to keep up with headline growth, raising the bar for operational outperformance to deliver real value for shareholders.

Valuation: Premium to Industry, Discount to Peers

- First Majestic trades at a Price-to-Sales Ratio of 6.3x, above the Canadian metals and mining sector average but below direct peers. Its current share price of 15.05 is below both the analyst target (22.50) and DCF fair value (44.45).

- The analysts' consensus view suggests this pricing reflects a company with substantial growth upside balanced against real risk, and they expect only a modest 5.7% increase to reach their target:

- Consensus narrative notes that, while analyst models suggest undervaluation, the narrow gap between current price and the target indicates that many growth and margin improvements may already be accounted for by the market.

- Investors should sense-check whether assumptions about revenue reaching $1.2 billion and profits of $94 million by 2028 appear realistic given ongoing risks around costs, operational execution, and industry headwinds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Majestic Silver on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Take a few minutes to shape your own perspective and tell the story your way with Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

First Majestic’s progress is threatened by ongoing share dilution and insider selling, which could limit per-share gains even if headline growth targets are met.

If you prefer opportunities where growth translates consistently for shareholders, use our stable growth stocks screener (2082 results) to target companies delivering steady, reliable results regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives