- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG) Reports US$52 Million Net Income in Q2 2025

Reviewed by Simply Wall St

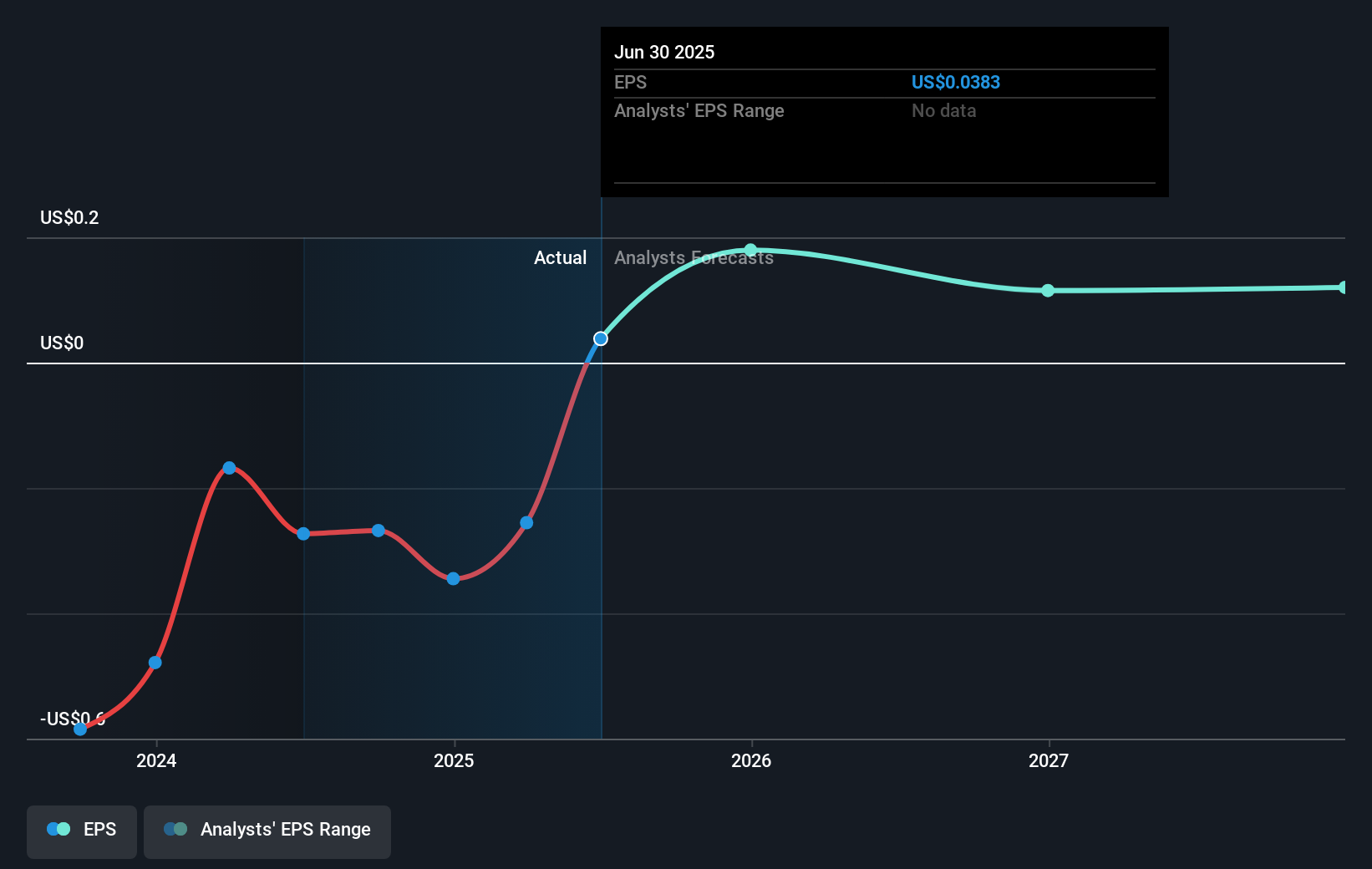

First Majestic Silver (TSX:AG) recently reported impressive Q2 2025 earnings results, with sales rising sharply to USD 264 million and net income swinging to USD 52 million from a previous net loss. This strong financial performance, coupled with the announcement of positive drilling results at their San Dimas Mine, likely supported the company’s 27% share price increase over the last quarter. The broader market trends, marked by technological sector growth and mixed performances in major indexes, may have also added weight to First Majestic’s upward trajectory, but the company’s solid performance stands out as a significant driver.

The recent impressive Q2 earnings report and robust drilling outcomes at the San Dimas Mine potentially strengthen First Majestic Silver's narrative of leveraging expanded exploration and operational efficiencies to boost silver production and capture rising demand. This aligns with the company's ongoing efforts to enhance its exploration and production capabilities at properties like Navidad and Santo Niño. If these initiatives lead to sustained revenue growth, they could bolster the company's strong balance sheet further by reinforcing its ability to generate internal cash, supporting future reinvestment without external reliance.

Over the past year, First Majestic Silver has achieved a total return of 83.40% when considering both share price appreciation and dividends, significantly outperforming the Canadian Metals and Mining industry, which returned 65.2% during the same period. In contrast, the company's share price is currently CA$14.37, which closely aligns with the consensus price target of CA$14.75, reflecting a limited discount. This suggests that the market largely values the company's future growth prospects, balancing potential risks related to higher operating and capital expenditures.

The impact of the recent earnings news on revenue and earnings forecasts may result in heightened expectations, with analysts projecting revenue growth of 12.2% per year over the next three years and potential earnings reaching US$94 million by 2028. However, forecasting remains cautious given industry-wide inflationary pressures and the strategic emphasis on sustainability, which could bring new capital investment opportunities while tightening production standards. Investors are encouraged to assess these forecasts carefully in light of current evaluations against broader market trends and expectations.

Evaluate First Majestic Silver's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives